The Dow fell despite rushing to close, with nike (NKE) And the apple (AAPL) make some of the best gains. Tesla (TSLA) despite the disappointing delivery data. Warren Buffett’s stock is down even with his appearance Berkshire Hathaway (BRKB) raised its share.

Three of the stocks made upward movements amid the mixed movement. MGP components (MGPI) I tested a point of purchase while dollar tree (DLTR) And the Funko (FNKO) showed their strength as they continued to build bullish bases.

X

Volume was lower on both the Nasdaq and New York, according to early data.

The yield on the benchmark 10-year Treasury fell eight basis points to 2.83%. West Texas Intermediate crude fell 8% to trade at less than $100 a barrel.

Nasdaq profits with the flexibility of tech stocks

The Nasdaq outperformed the other major indexes, rising 1.8%. Video Call Zoom (ZM) was among the best performers, up 8.5%.

The S&P 500 managed to carve its way out of negative territory, up 0.2%. e-commerce inventory Etsy (ETSY) was among the best performers here, coming in at 10.6%.

S&P 500 . Index Sectors were mostly negative. Technology, consumer appreciation, and communication services were the only areas in positive territory. Energy was the worst, as utilities followed closely.

Smaller micro-caps also resisted the bears, with the Russell 2000 gaining 0.7%.

Growth stocks also jumped again, although the Innovator IBD 50 ETF (fifty), which is the leader in developing stocks, closed partially negative.

Dow Jones Today: Nike, Apple’s stock leader

The Dow Jones Industrial Average was far from today’s lows, but it’s still struggling. It remained down about 0.7%.

Nike was the best performing stock in the index. It finished the day 3.1% higher but remained about 9% lower than the 50-day moving average, MarketSmith analysis shows.

Other stocks doing well on Dow Jones today include Apple, Microsoft (MSFT). AAPL stock is up 1.9% while MSFT is up 1.3%.

Both are trading without 50 day moving averages.

chevron (CVX) was the worst, down 2.6%. However, it’s still up about 20% for the year.

Tesla stock rises despite delivery data

Tesla stock was able to reverse higher despite disappointing new delivery data.

Tesla has managed to recover despite reports Delivery of 254,695 electric cars in the second quarter. This was also lower than analysts had expected. It is also down nearly 18% against the first-quarter record of 310,048 but is up 26.5% from the previous year.

Tesla produced 258,580 cars in Q2 versus 305,407 in Q1, and nearly all Model 3 sedans and Model Y crossovers.

Tesla Shanghai was closed for most of April and only resumed full production in early June. Tesla’s recently opened Berlin and Austin plants produce relatively few vehicles, in part due to supply chain issues. The EV giant said June was a record month for production.

Tesla stock closed at its highest levels for the day, up 2.6%. However, it is still down about 42% since the start of 2022.

Ex-leaderboard stock is still stuck well below its price 50 day moving average. It’s near the lowest levels of A Reinforcement model with entry 1,208.10.

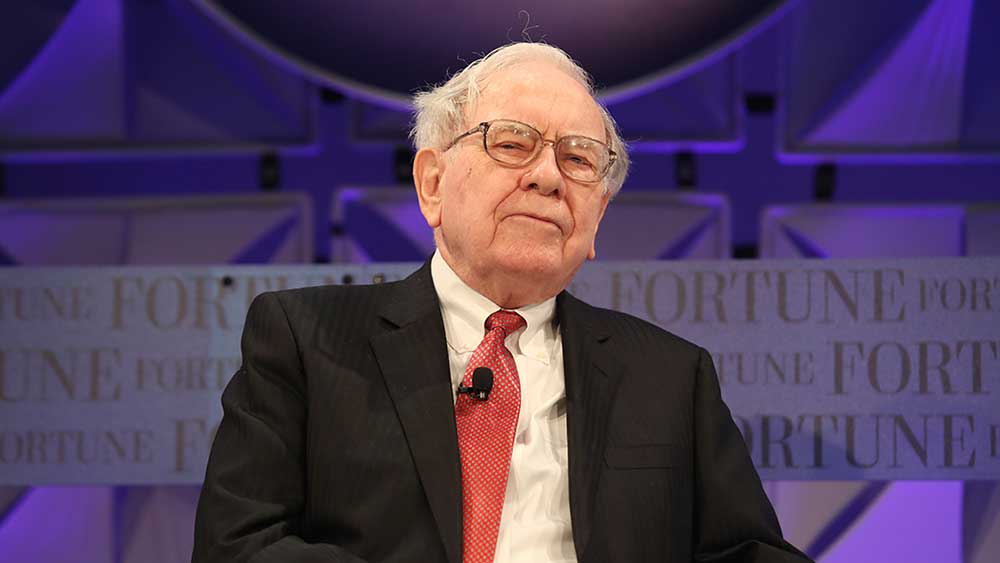

Warren Buffett relegates Stock after BRKB buys More

Warren Buffett stock Occidental Petroleum (OXY) fell in open trading after the market moved higher on news of Berkshire Hathaway raising its stake in the oil company.

With the energy sector the worst performing today, Occidental stock fell 2.2%. However, OXY stock is still up 90% so far in 2022. It has lost ground on the major 50 day moving average, MarketSmith analysis shows.

Buffett’s Berkshire Hathaway acquired an additional 9.9 million shares, according to a Securities and Exchange Commission filing. She now owns over 163 million shares, or over 17% of the company.

Berkshire Hathaway stock is down more than 1% during the session.

Among other oil stocks, gallon petroleum (CPE) 8.6% while Diamondback Energy (fang) decreased by 5.8%. apache parent APA (APA) fell 7.4%.

Vanguard Energy Index Fund ETF (VDE) increased by 4.2%, but remained up by 20.5% since the beginning of the year. Although it is far from the recent highs.

technical lead market recovery; The end of the Fed rate hike?

Outside the Dow: These 3 stocks are making bullish moves

MGP components closed below their buying zone after briefly surpassing the entry of a flat base at 104.10. Its relative strength line has just reached a new high, a bullish signal.

Earnings are the main force, while they are in the top 2% of stocks in terms of price performance over the past 12 months.

The company produces distilled spirits including gin, vodka, and whiskey.

Two of the names also saw their RS lines reach new heights as they tried to reach their purchase points.

The US dollar is approaching the point of buying a cup with a handle at 165.45. The overall performance at the premium retailer is excellent, which is reflected in the composite IBD rating of 96.

Big Money recently bought shares, MarketSmith data appears.

Funko also made a cup base with a handle, this time with a purchase point of 25.18. This is the early second stage pattern. The stock carries the best possible composite rating. In all, 93% of the shares are currently owned by funds.

Please follow Michael Larkin on Twitter at Tweet embed For further analysis of growth stocks.

You may also like:

MarketSmith: Research, charts, data, and training in one place

These are the 5 best stocks you can buy and watch right now

This is Warren Buffett’s ultimate stock, but should you buy it?

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings