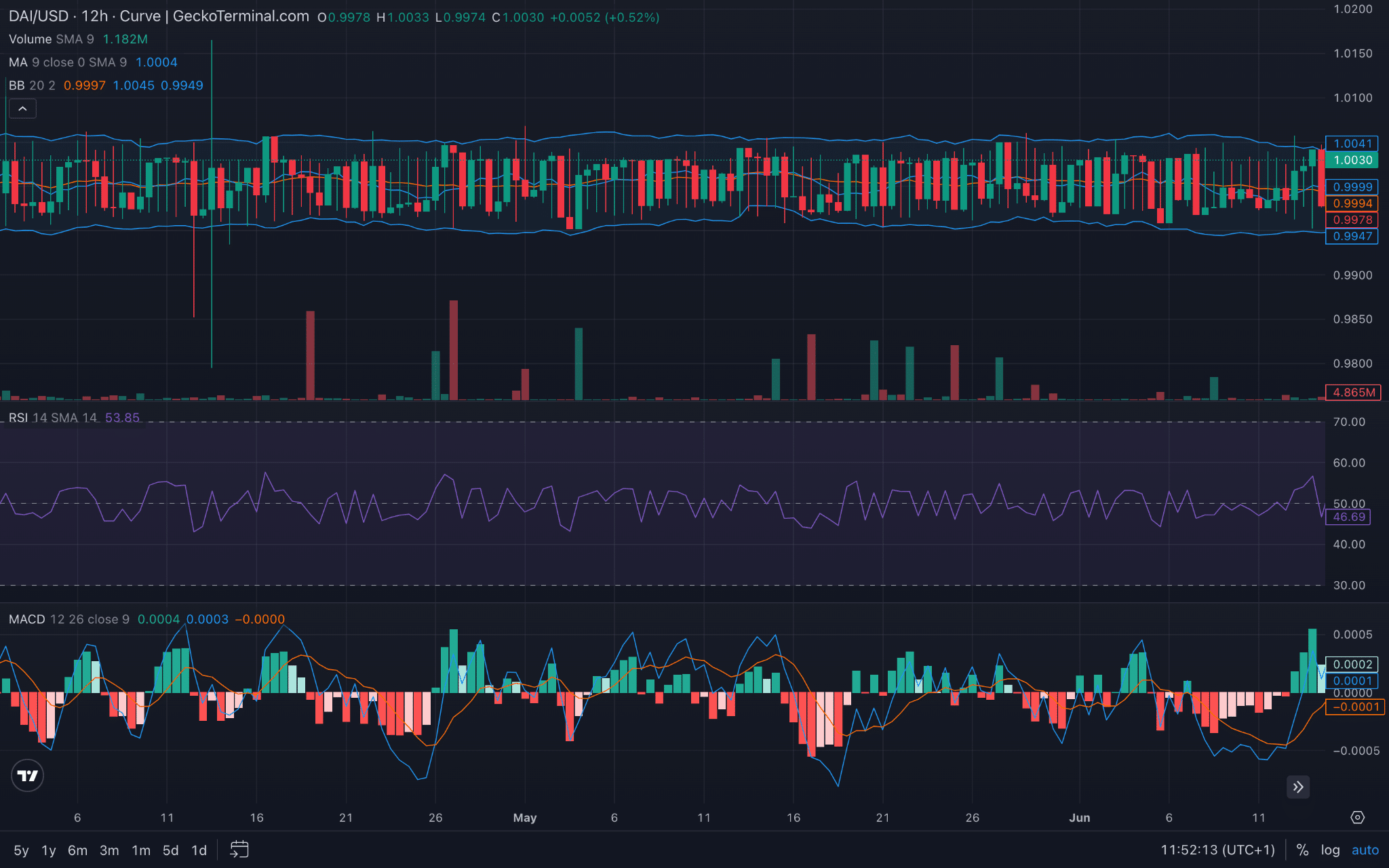

- DAI has struggled to maintain its peg to the dollar, with trading limited to a narrow range of Bollinger Bands.

- Mixed indicators point to ongoing struggles for stability, with no strong trends away from the peg.

Over the past month, DAI has been struggling to maintain its peg to the dollar, and is facing major challenges in holding steady at $1.00.

Recent volatility has seen the price of DAI drift between highs of $1.001 and lows of $0.98.

Despite the volatility, DAI price action has been largely contained within Bollinger bands, indicating relatively stable volatility levels.

Candles that stayed near the upper and middle range indicated an attempt to maintain the correlation at $1.00.

Source: Trading View

Evaluating the future of DAI

Volume was variable but not excessively high, suggesting that there was no massive buying or selling, which could destabilize the peg further.

The RSI was around 53.85 at press time, indicating a balance between buying and selling pressures.

This level of the RSI indicates that although the asset is not overbought or oversold, it is fairly stable around its intended peg.

The MACD line was near zero, and the signal line is showing small fluctuations around the zero mark.

This is in line with the struggle to settle once and for all at $1.00, showing slight fluctuations but no strong trend away from the peg.

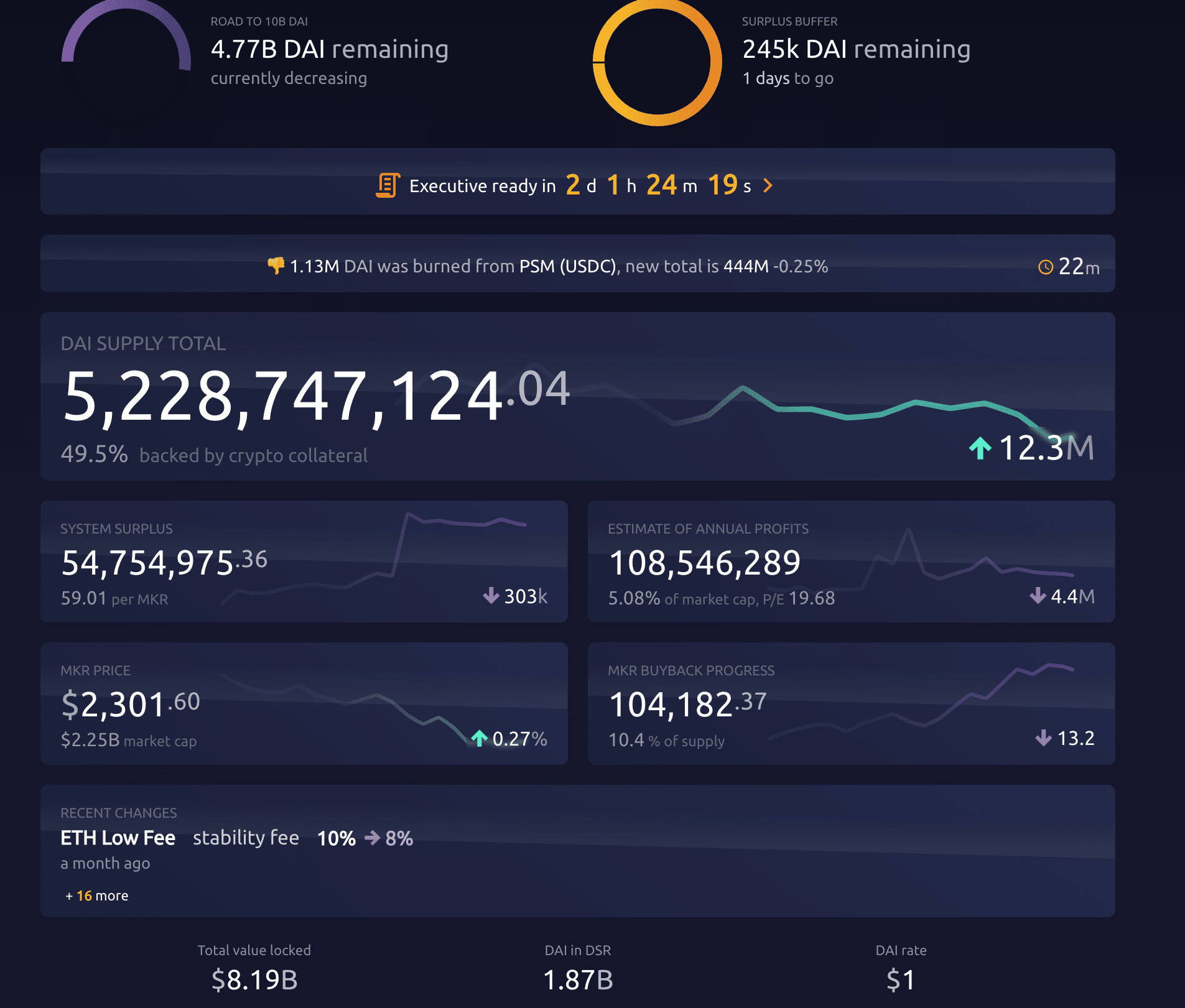

Source: Burn Maker

49.5% of total DAI Supply Backed by cryptocurrency collateral.

This indicates that approximately half of the DAI issued is locked in other cryptocurrencies. It could affect its stability and credibility as a stablecoin if its prices decline, which is currently happening.

67% of DAI holders were out of money at press time, indicating that most DAI holders acquired DAI at rates varying from its current level.

Source: IntoTheBlock

Realistic or not, this is the market cap of MKR in terms of BTC

With 56% of DAI owned by large holders, there is a significant concentration of control. Therefore, liquidity and price stability are strongly affected by the actions of a small number of stockholders.

Exchange inflows and outflows show that $18.97 million enters the exchanges and $21.03 million exits. This net outflow could slightly ease the selling pressure on DAI, helping it get closer to its price peg.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings