- Both BTC and ETH appear to have a bearish outlook based on technical analysis.

- On-chain metrics have shown a more consistent accumulation of ETH than BTC recently.

Bitcoin [BTC] and Ethereum [ETH] Both stocks were trading below key resistance levels at $60K and $2.6K respectively at the time of writing. Their market structures on the 3-day and weekly time frames were also bearish.

The flash sell-off in early August sparked panic, but it also gave market participants the conviction to buy into this leading crypto asset. AMBCrypto examined these trends to understand market sentiment. And we found that Ethereum has the advantage.

Price action and technical indicators showed the seller’s superiority.

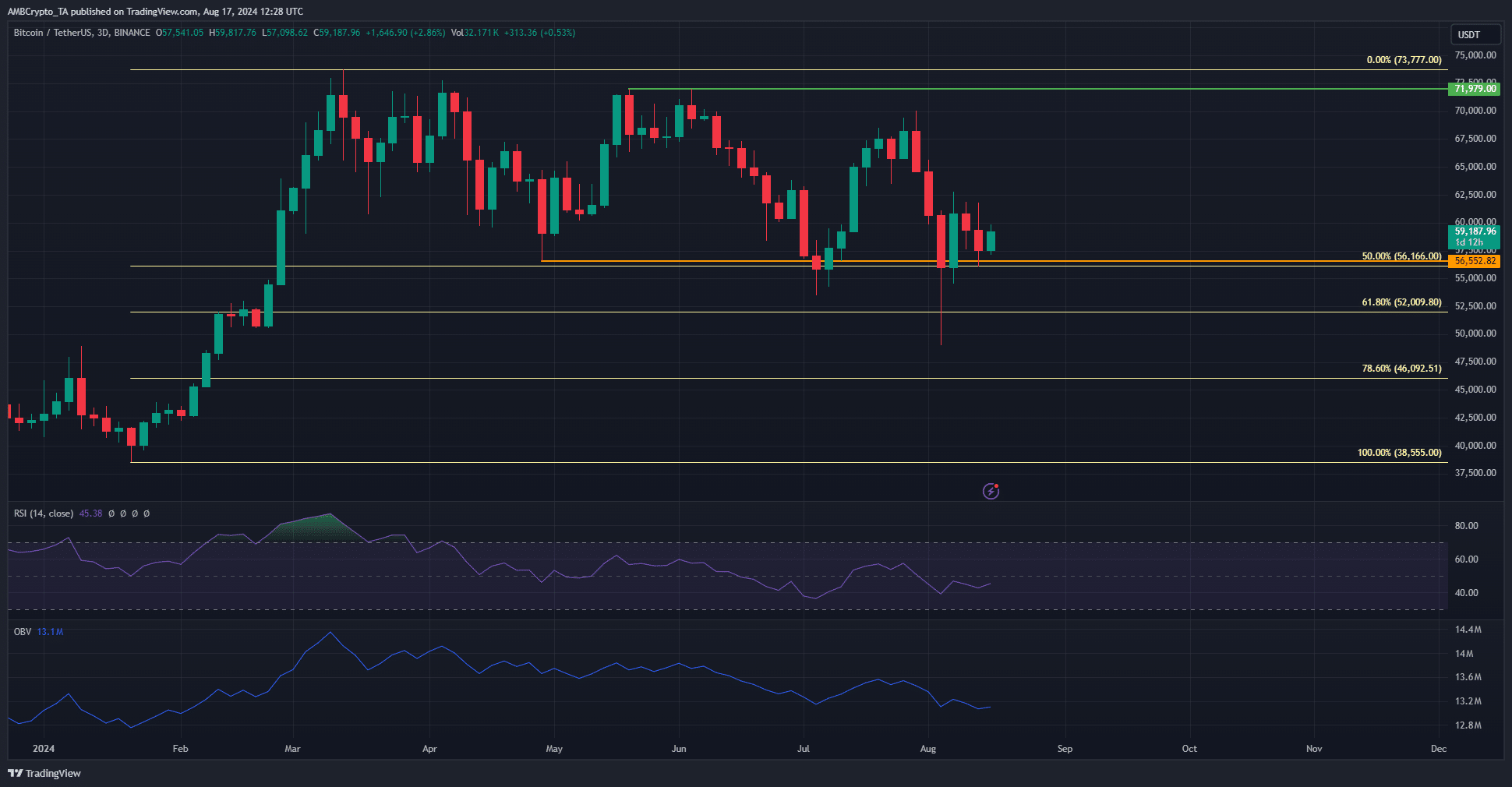

Source: BTC/USDT on TradingView

On the chart, the orange color indicates a break of the bearish structure, while the major low at $72k remains unbeaten. Combined with the bearish RSI on the D3 chart and the bearish OBV, sellers are likely to force Bitcoin below $56.1k again.

The first sign of a recovery would be a continued push beyond $60,000. However, at the time of writing, the demand for such a reversal is not there.

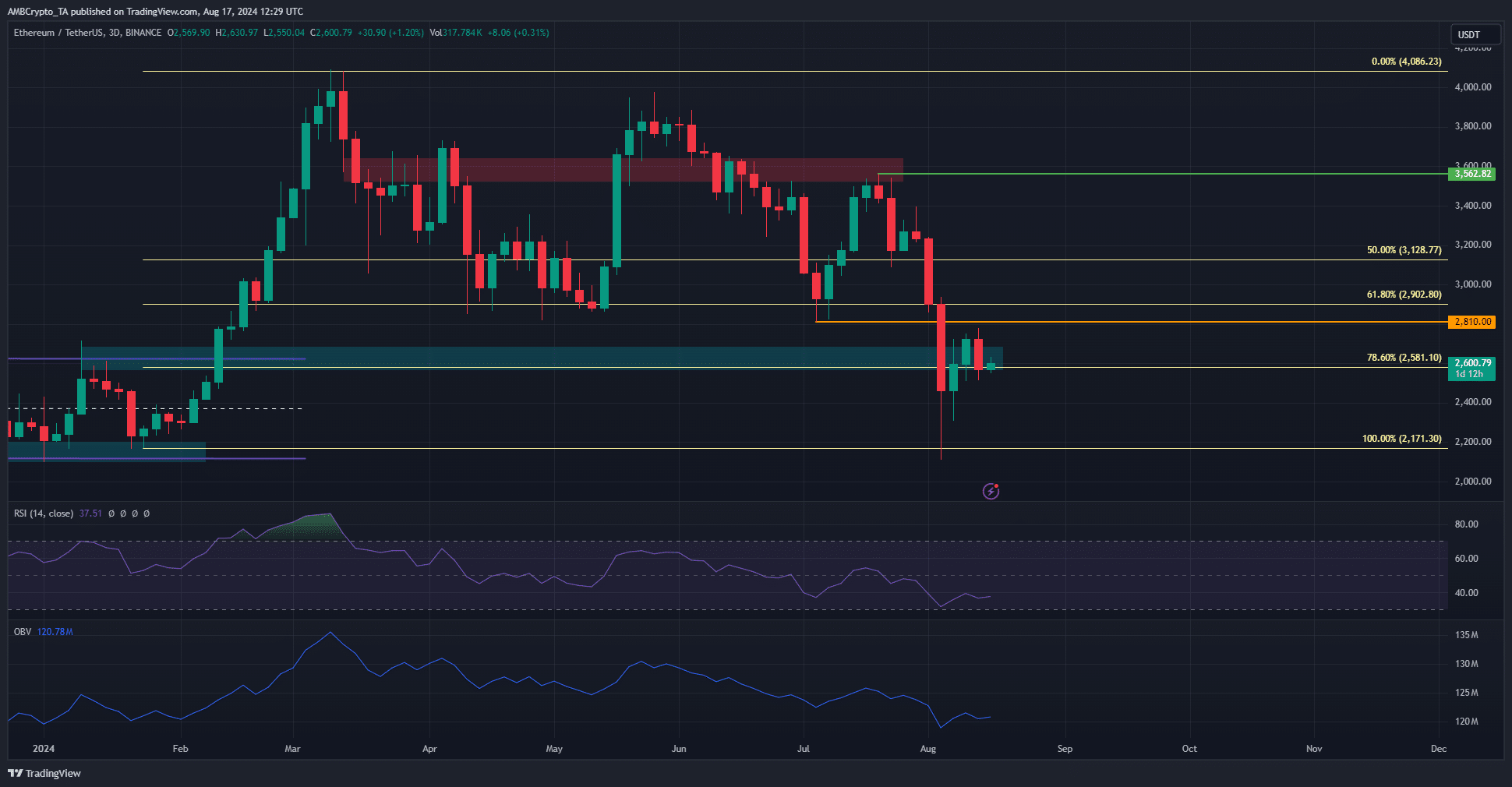

Source: ETH/USDT on TradingView

The technical outlook for Ethereum is more pessimistic. The fair value is around $2.8K, with the Fibonacci level exceeding $2.9K. This means big trouble for Ethereum investors.

The RSI and OBV are indicating that bearish pressure is expected. This could pave the way for a move towards the $2.2k level.

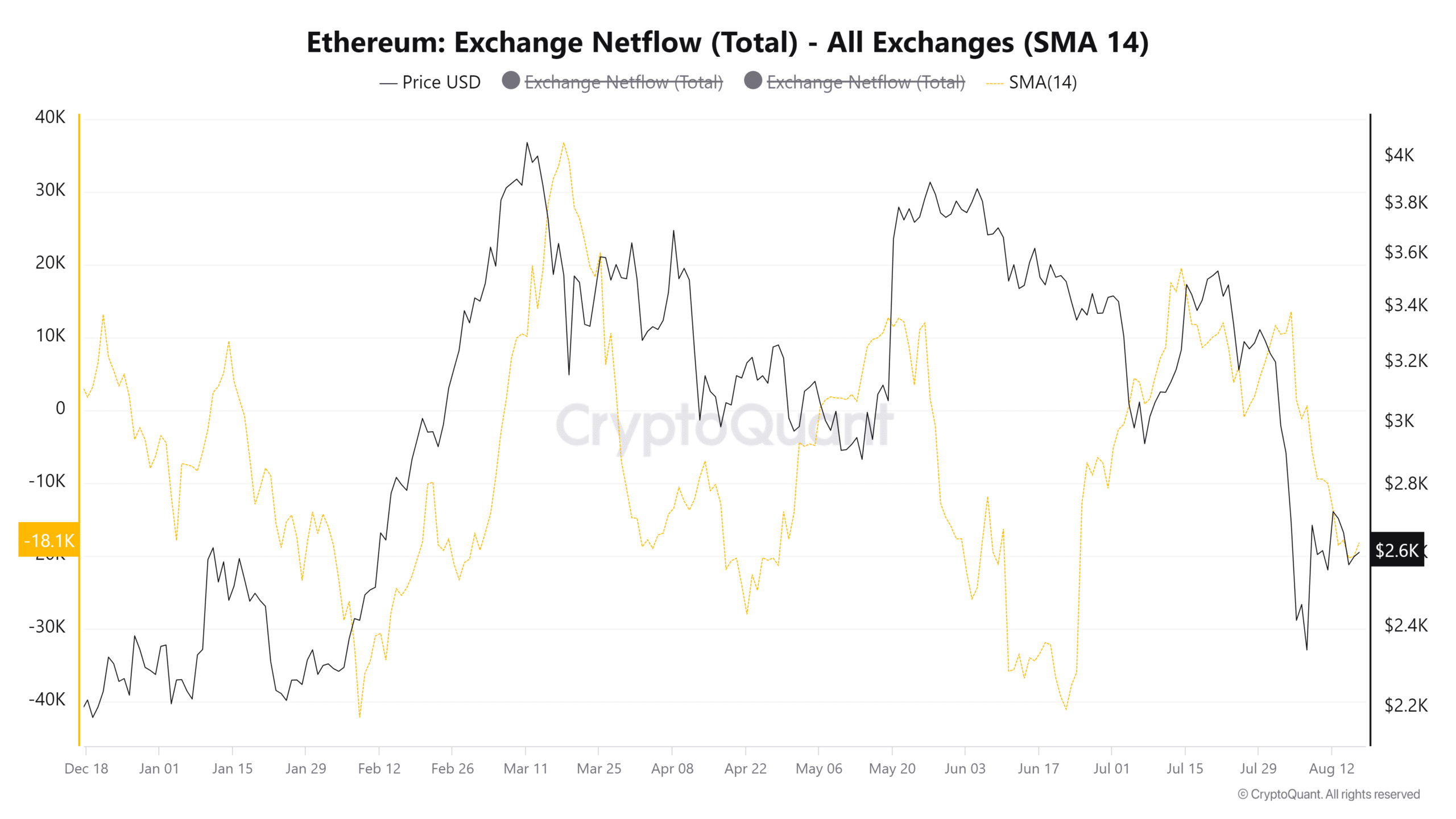

Net flows reveal more consistent cumulative trends for Ethereum

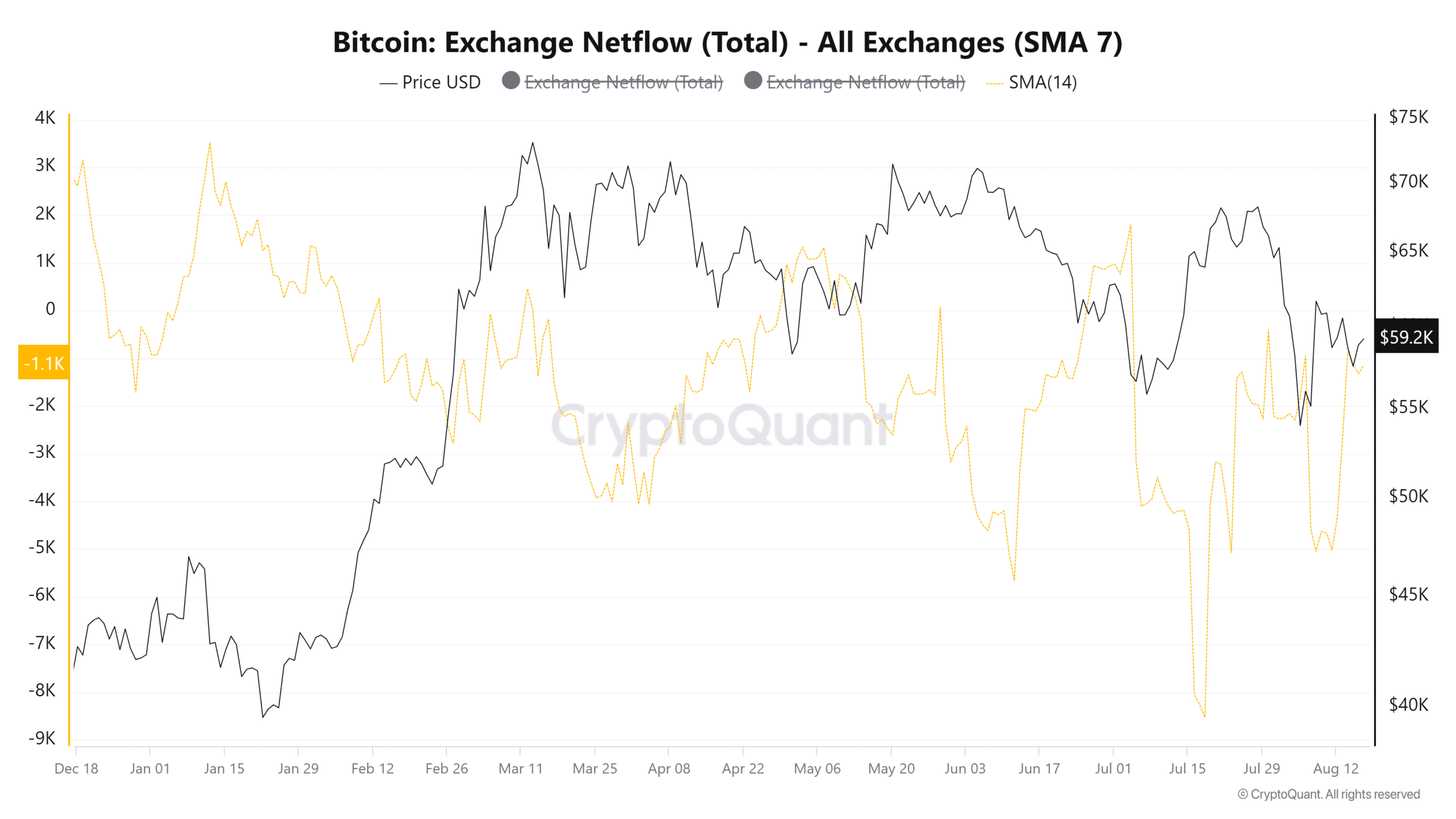

The increase in stablecoin reserves, as previously reported, highlighted the growing purchasing power in the cryptocurrency market. After the massive price drop on August 5, net inflows into Bitcoin were negative.

This showed coins leaving the exchanges – a sign of accumulation.

Ethereum has also been accumulating since late July, and its net flow metric has been more consistent in its downward trend than Bitcoin’s.

This is a sign that Ethereum accumulation continued at a rapid pace while Bitcoin holders were more hesitant. Unfortunately, this is not a definitive guarantee that Ethereum was more bullish.

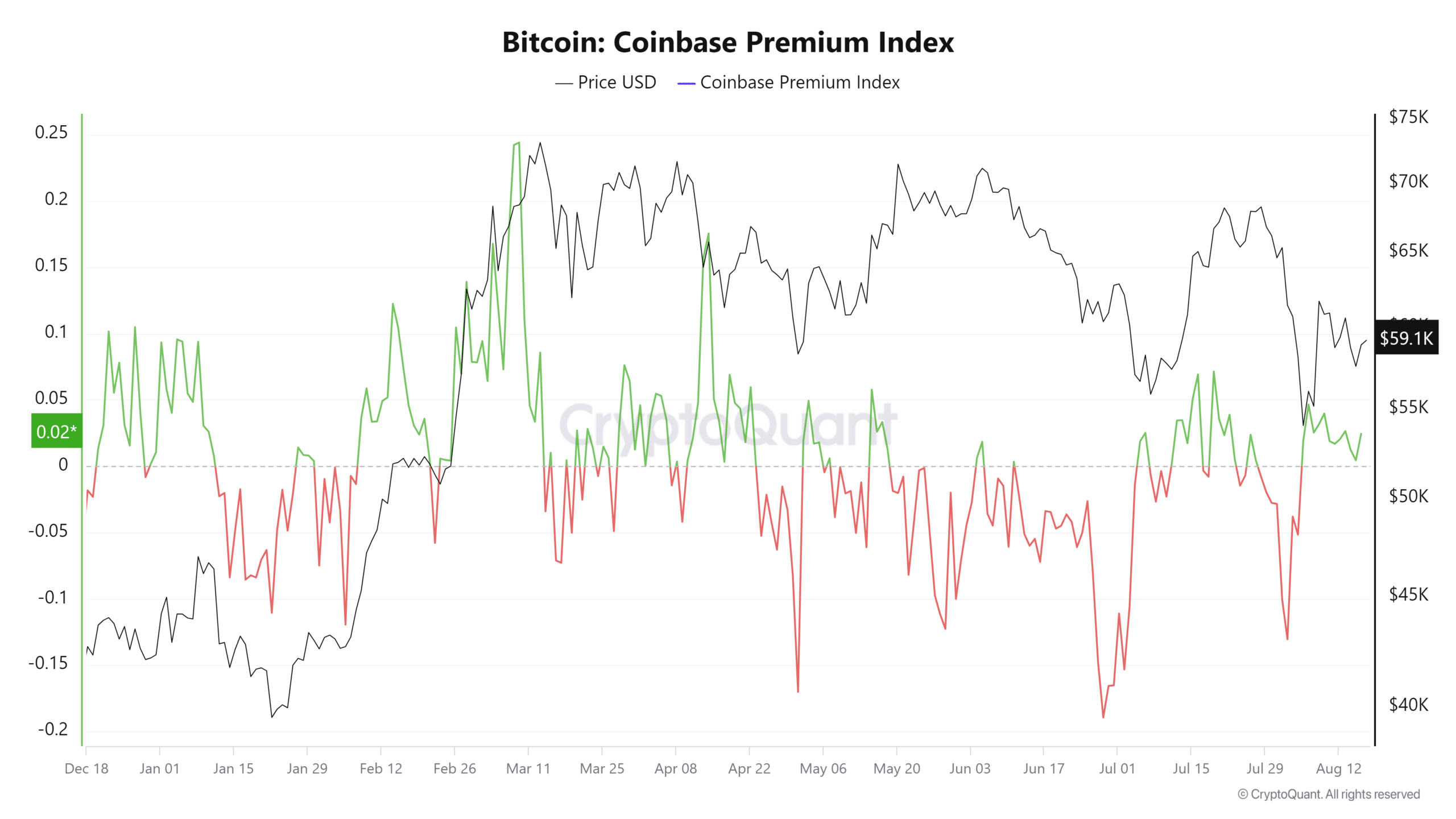

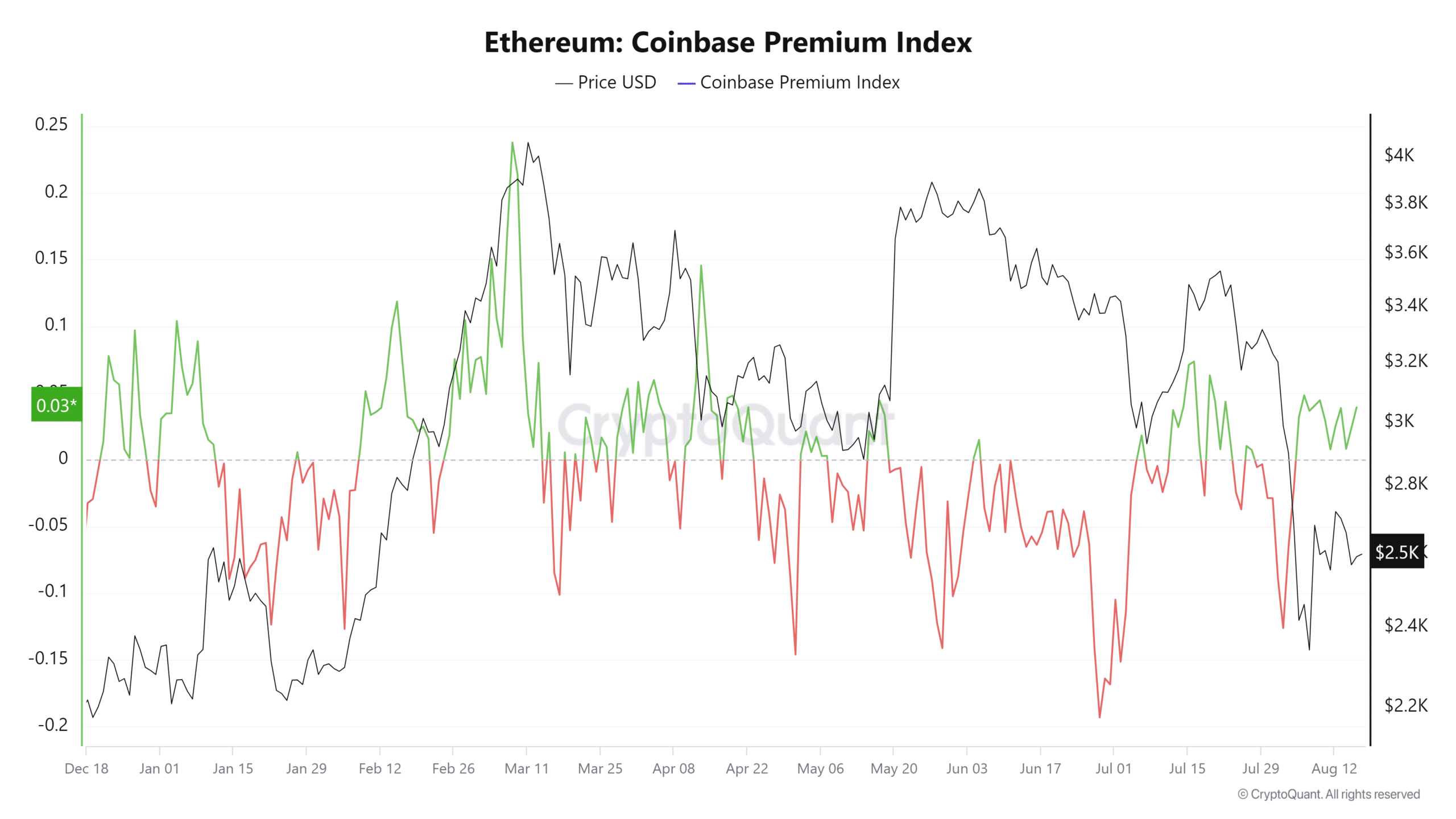

Finally, Coinbase’s premium for Bitcoin and Ethereum was positive, confirming the growing demand from US-based investors.

However, the value of Bitcoin has declined over the past two weeks.

Meanwhile, the Ethereum Coinbase Premium price was slightly more positive, another sign that demand for ETH has been higher over the past 10 days compared to BTC.

Read about Bitcoin [BTC] Price forecast 2024-2025

Overall, the metrics showed that Ethereum had an edge over Bitcoin. The price action advantage was in Bitcoin’s favor, although both assets were bearish on the given time frames.

A move above the major resistances at $60K and $2.6K could instill confidence in the crypto markets.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings