- AAVE stock remained in an uptrend as of the time of publishing this report.

- The asset will see a golden cross if the symbol maintains its price trend.

Avi [AAVE] The Saudi stock market ended last week on a positive note, showing strong performance. However, it witnessed a decline during the last 24 hours.

Despite this recent decline, indicators suggest that its price may be poised for further upside in the coming week.

AAVE shows mixed signals

According to AMBCrypto, AAVE was trading at around $112.37, marking a daily increase of over 1.30%.

The long and short moving averages (blue and yellow lines) were providing support at around $99.86 and $97.67 respectively, indicating a solid base for its price.

The Relative Strength Index (RSI) is at 60.76, indicating that it is in bullish territory but not yet overbought. This leaves room for further upside before the RSI reaches overbought conditions (usually above 70).

The Moving Average Convergence Divergence (MACD) line is at 1.32, with the signal line at 1.60, both in the positive territory.

Source: TradingView

However, despite these bullish indicators, the data from Coin Market Cap It showed that it was among the losers in the past 24 hours, losing more than 1%.

This recent decline has seen it rank among the top losers, reflecting short-term volatility or profit-taking. Interestingly, AAVE still stands out as the second-highest gainer over the past seven days, up a notable 18%.

Approaching the golden cross

AAVE is set for positive price action at the time of publishing this report, with the moving averages indicating that a golden cross could form if the price continues to rise.

A golden cross, where the short-term moving average crosses above the long-term moving average, is typically seen as a strong bullish signal.

The next important resistance for AAVE is at the $120 level, a psychological barrier that has acted as resistance in the past.

If AAVE can successfully break this level, the next target could be around $130, which is the previous high. It also serves as the next logical resistance area.

While indicators are mostly bullish, with the RSI and MCD supporting the case for further upside, traders should be wary of potential pullbacks.

On a pullback, AAVE could find support around the long moving average at $99.86 and the short moving average at $97.67.

However, if the AAVE indicator breaks below these moving averages, it could indicate a return of bearish sentiment. The price could test the $90 level, where previous support was established.

Shareholders enjoy dividends

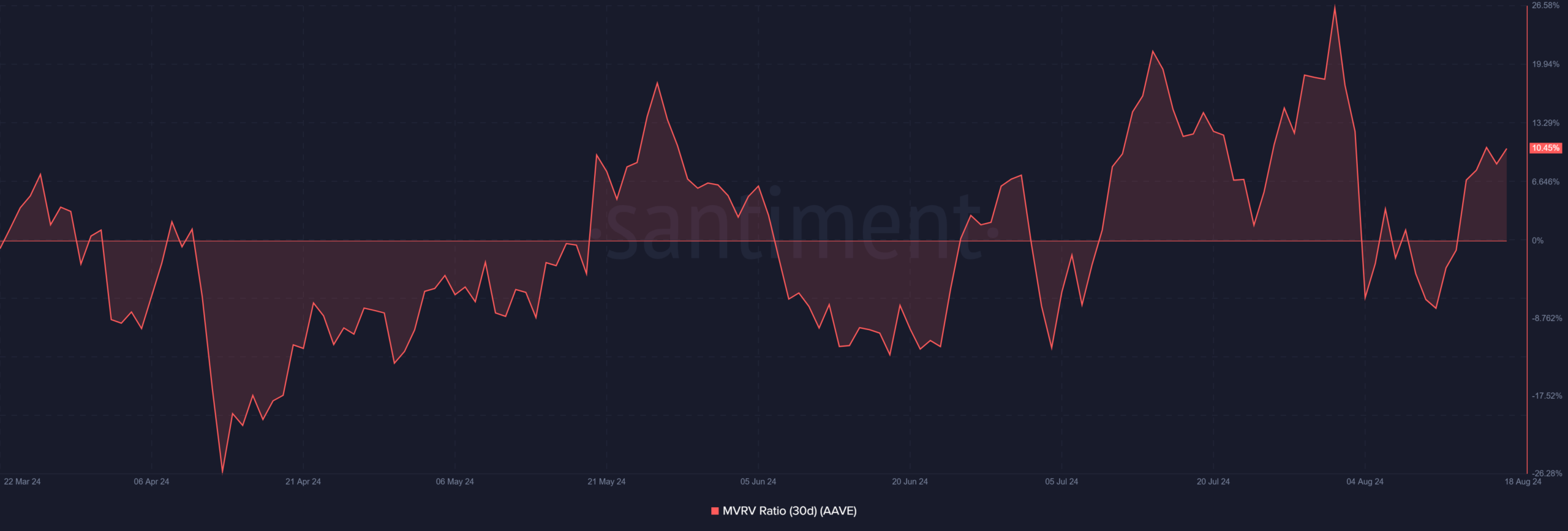

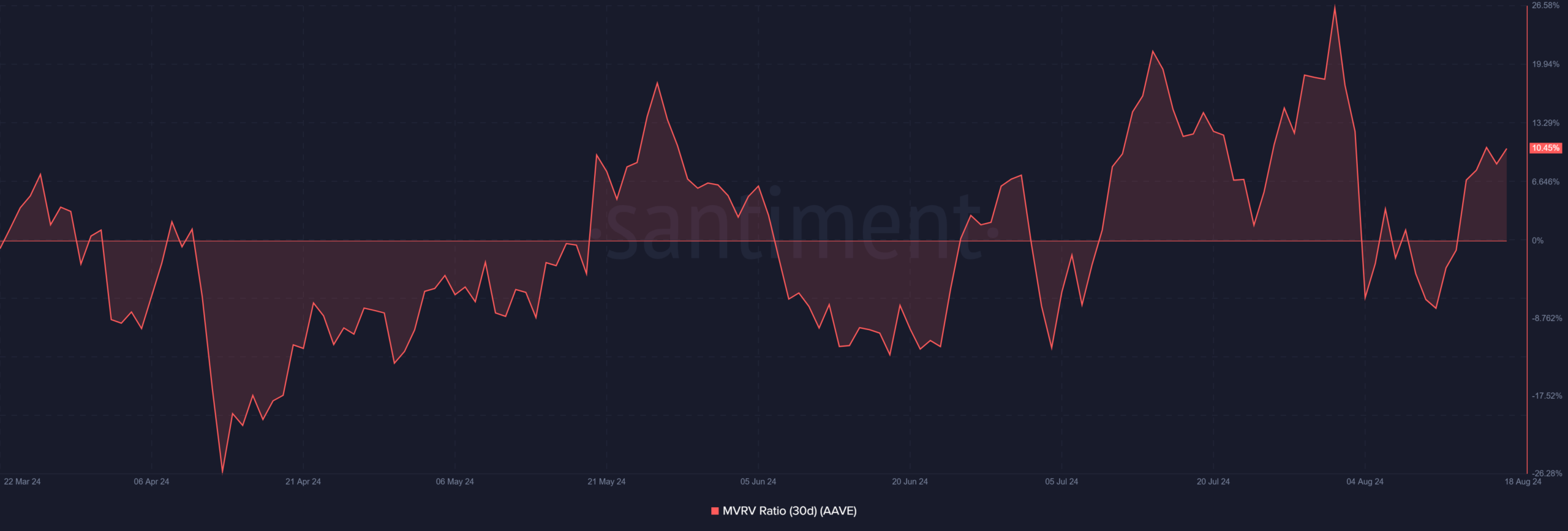

AAVE’s 30-day market cap to realized value (MVRV) ratio analysis reveals that shareholders are profitable at the time of publication.

The MVRV index rose above zero on August 13th and has remained in positive territory ever since. As of this writing, the MVRV index is at around 10.45%, Santiment Data.

Source: Santiment

Whether it’s realistic or not, here’s the market cap of AAVE in terms of BTC

This trend indicated that shareholders who bought AAVE in the last 30 days made an average gain of more than 10%.

A positive fair market value ratio typically reflects strong market sentiment. It indicates that current asset holders are not only making a profit, but are also confident in the value of the assets.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings