The first quarter was bad with initial public offerings crashing, investment banking taking a hit, mortgage activity faltering, and other things happening.

by Wolf Richter to Wolf Street.

Of the five largest US banks and bank holding companies by total assets — JP Morgan, Bank of America, Wells Fargo, Citigroup and Goldman Sachs Group — four have reported first-quarter earnings so far, and Bank of America will do so next week. These earnings reports were marked by a sharp decline in revenue and net income, with all sorts of complications in between. As a group, its shares continued their intermittent decline that began in November of last year.

The WOLF STREET Market Capitalization Index of the Big Five has fallen 23.5% since its last peak in October 2021 (data via YCharts):

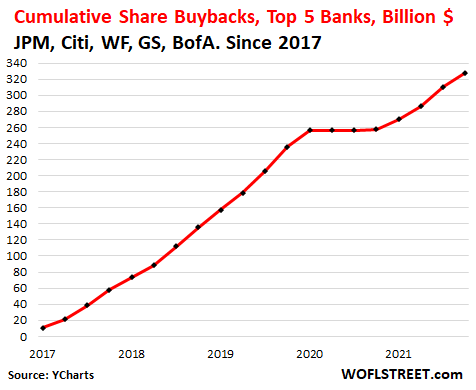

This disaster occurred amid massive share buybacks. These banks have regularly appeared among the largest stock buybacks in the United States, except during the pandemic, when the practice was discontinued for three quarters.

In the five years from 2017 to 2021, the five banks burned, squandered and destroyed $328 billion in cash when buying back their shares to bolster their stock, and now their stocks have nothing to show (data via YCharts):

The first quarter was bad with initial public offerings crashing, mortgage activity faltering, and other things happening.

c. B. Morgan Chase [JPM] The quarterly banking presentation kicked off Wednesday morning when it reported that its net income fell 42% to $8.3 billion in the first quarter compared to the first quarter of last year. Revenue fell 5% to $30.7 billion, driven by a 35% drop in revenue in the investment banking division.

In the two trading days since the earnings release Wednesday morning, JP Morgan shares are down 4.1% and down 25% from their 52-week high in January.

In preparation for the financial pressure caused by raising interest rates on borrowers, it has set aside $902 million for loan loss reserves, compared to a benefit of $5.2 billion a year before the loan loss reserves it created during the pandemic were launched. It booked $582 million in net discounts, bringing total credit costs to $1.5 billion.

Its corporate and investment bank earnings were hit by a $524 million loss, “driven by an expansion of financing margin as well as credit valuation adjustments related to both increases in exposure to commodities and reductions in derivatives receivable from Russia-linked counterparties.” earnings release.

During the earnings call, CEO Jamie Dimon said the bank sees “significant geopolitical and economic challenges ahead due to high inflation, supply chain issues, and the war in Ukraine.”

Goldman Sachs [GS] It reported that revenue fell 27% in the first quarter, to $12.9 billion, and net income fell 42% to $3.9 billion.

Goldman Sachs’ share slipped slightly on Thursday, down 24.5% from a 52-week high in early November.

Investment banking revenue fell 36% to $2.4 billion. It set aside $561 million for credit losses, compared to a benefit of $70 million a year earlier. Asset management revenue collapsed 88% to $546 million, “primarily reflecting net losses in equity investments and significantly lower net revenue in debt and lending investments.”

But in the Consumer and Wealth Management division, revenue grew 21% to $2.10 billion. Global market revenue increased 4% to $7.87 billion. And yes, due to the turmoil in the commodity, currency and bond markets, revenue in FICC (fixed income, currency and commodities) jumped 21% to $4.71 billion.

“The rapidly evolving market environment had a significant impact on client activity as risk brokerage emerged and the issuance of shares was completely halted,” earnings release She said.

Initial public offerings were bad all over.

With equity issuance “completely halted”, Goldman is talking about IPOs and SPACs, many of which have exploded spectacularly over the past 12 months. I am now tracking some of them, including those where Goldman Sachs was the lead guarantor, in the WOLF STREET category. exploding stocks.

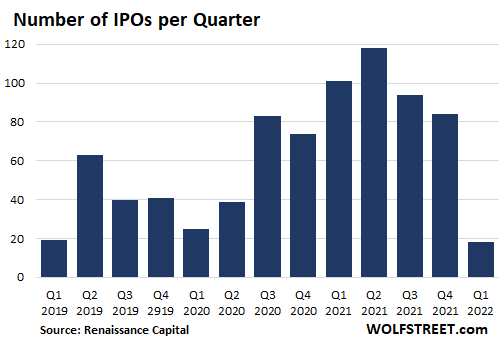

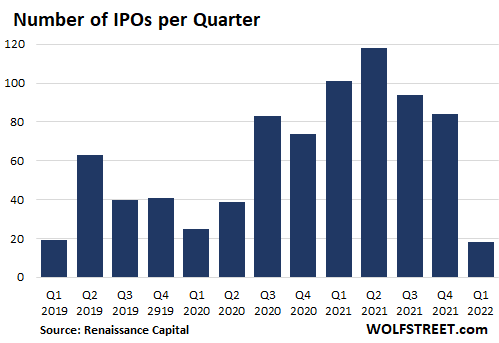

Initial public offerings are huge fee generators for investment banks. But the collapse of these newly listed stocks has now essentially wiped out the appetite for new IPOs, which is only fun in the relentless hype and panic market. In the first quarter, according to Renaissance Capital, there were just 18 IPOs, including just two in March, down from 118 IPOs in the second quarter of last year:

City Group [C] It reported that revenue fell 2.5% to $19.2 billion. Net income decreased 46% to $4.3 billion, as a result of higher operating expenses (+15%) and credit losses of $755 million, compared to interest of $2.05 billion a year earlier.

The problem is not US consumers. Citibank said in its report: They are fine earnings release: “We continue to see the health and resilience of the American consumer through the cost of credit and repayment rates. We’ve had good involvement in key drivers such as card loan growth and strong buyout sales growth, so we like where this business is headed.”

The biggest culprit was investment banking, including IPOs: “The current macro background has affected investment banking as we’ve seen a contraction in capital market activity. This remains a key investment area for us, Citigroup said.

Its shares rose 1.6 percent on Thursday, but are down 36 percent from a 52-week high in June.

Wells Fargo [WFC] It reported that revenue fell 5% to $17.6 billion. Net income fell 21% to $3.67 billion.

One culprit was mortgage lending activity, which fell 33% in the quarter due to higher mortgage rates. Wells Fargo said in a newspaper earnings release.

Shares are down 4.5% Thursday and are down 23% in two months from a 52-week high in early February.

American bank [BAC] Earnings will be reported on Monday. It forecast its shares would fall 3.2% on Thursday and shed 25% from a 52-week high in February.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings