Wall Street hit records in the first half of the year, none of which were very good.

economy on cusp of recessionbeing beaten high inflation And the high interest ratesThis affects their salaries, weakens consumer confidence and leads to cutbacks in corporate spending. As it swung, the markets fell.

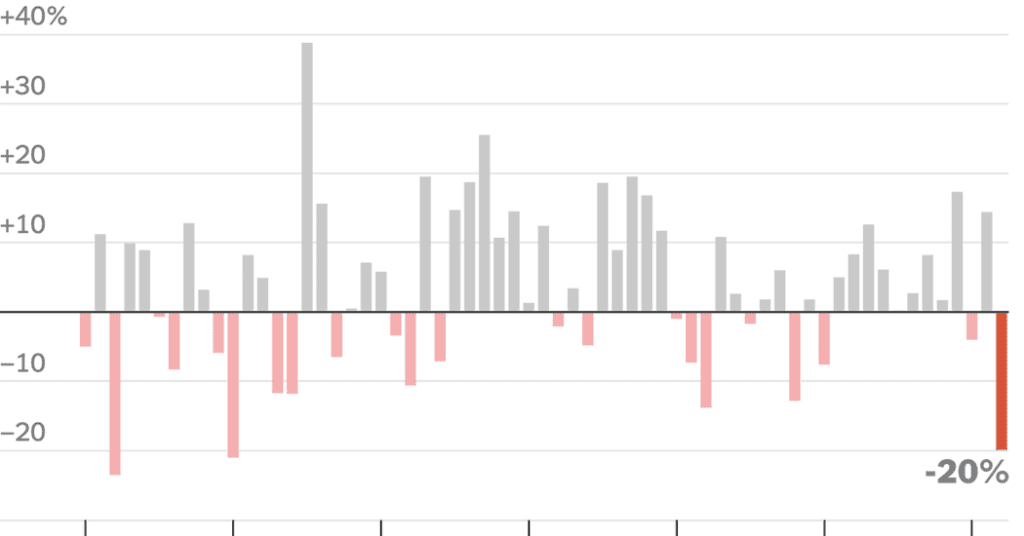

The stock market is on its way to its worst six months of the year since at least 1970. The S&P 500, a cornerstone of many stock portfolios and retirement accounts, peaked in early January and has fallen 19.9 percent over the past six months.

Sales were remarkably broad, with every sector Except for the energy drop this year. Bellwethers including Apple, Disney, JPMorgan Chase and Target have fallen more than the market as a whole.

And that’s only part of the horror story for investors and companies this year.

The bonds, which are seen as providing lower but more stable returns to investors, have also been through six months. Since bonds are particularly sensitive to economic conditions, reflecting shifts in inflation and interest rates more directly than stocks, this could be a more worrying sign about the state of the economy.

An index that tracks 10-year Treasuries, a benchmark for borrowing costs on mortgages, business loans and many other types of debt, fell about 10 percent in price. Analysts at Deutsche Bank had to go back to the late 18th century to find a worse performance in the first half of the year for equivalent bonds.

“Make no mistake, this first half has been tough,” said Jim Reed, head of credit strategy and thematic research at Deutsche Bank.

To the average investor with a diversified portfolio of stocks and bonds, it may seem like “nothing is working,” according to Victoria Green, chief investment officer at G Squared Private Wealth. This is especially true for investors who bought in at the beginning of the year, when the markets were in a more prosperous mood. “The venerable 60-40 portfolio just didn’t hold up at all,” Green said, referring to the mix of 60 percent stocks and 40 percent bonds that financial advisors traditionally suggest to investors to protect them from overdrafts.

Since the beginning of the year, the inflation rate has risen stubbornly, and is now running at the fastest pace in the More than 40 years It was made worse by rising food and energy prices due to the war in Ukraine, eroding corporate profit margins. This comes on top of an ongoing supply chain that has made it difficult for companies to meet customer demands and manage inventories.

As investors reassess the outlook for companies and sell their shares, a few weeks ago the S&P 500 Fell in a bear market, a rare and bleak sign of pessimism, which Wall Street sees as a 20 percent drop from its recent peak. The index has fallen in 10 of the past 12 weeks, with occasional gains fading quickly as a new wave of market fears spread.

The Fed’s determination to tame inflation by raising interest rates is a major factor in market turmoil. High borrowing costs cool the economy by reduce demandWhich in turn reduces pressure on prices. Sharply high bond yields, which move in the opposite direction as prices, weigh on it Portfolios of bond investors with losses.

And if the Fed’s fight against inflation requires rates to go up that far, the economy is so fast Recession tipsThat would limit companies’ ability to hire new employees, spend on new projects, and pay off their debts, which is ominous for both stocks and bonds.

Assets that were thought to have been unaffected by these trends offered little recourse. BitcoinThe largest cryptocurrency, it has fallen more than 50 percent this year.

When studying the financial wreck, the question arises: how bad can it become?

In the next few weeks, companies will begin reporting their second-quarter earnings, with investors updated on the performance of their financials. These reports will be scrutinized for signs that the shaky economy may turn for the worse, which will influence buying and selling decisions.

Just as important as what companies reveal about the last quarter of the year is what they say about how things will shape in the coming quarters, according to Steve Sosnick, chief strategist at Interactive Brokers.

“Overall, expectations remain very high,” he said. This is either a sign that conditions may not be as bad as some fear, or they are about to disappoint. Analysts’ forecasts for earnings at companies like Apple and JPMorgan Chase have remained relatively stable over the past month.

Andy Sieg, president of Merrill Lynch Wealth Management, said he had not seen a significant increase in trading activity among clients, which would be expected during a period of turmoil. However, there has been a spike in clients seeking talks about financial planning over the past year, which he described as a “constructive” approach to dealing with the economic downturn.

“When the markets are more volatile, sentiment escalates,” Sieg said. “This is just a normal human reaction to the kind of environment we live in.”

Even if the news about corporate earnings or the economy isn’t as bad as some fear, it may take time for the gloomy mood to change, and what many believe to be another false dawn marks a crucial turning point. “Usually a bear market turns when the world is still feeling bad,” said Green of J Square Private Wealth.

“There is only one true bottom,” said Sosnik of Interactive Brokers. “This is really the last tipping point. And so to me, it’s not clear if we’ve seen conditions that point to one of those yet.”

For Mr Reid of Deutsche Bank, “a lot depends on the timing of the recession,” he said. According to his research, the decline in stocks thus far would be very anomalous if not accompanied by a recession.

Economists have been Raise the possibility That the US economy is about to enter a recession, and that the shrinking economy is more in line with the magnitude of the market downturn that Mr. Reid is predicting. He thinks it is “reasonable” that the stock market is down 35 to 40 percent from its January peak, meaning the current downturn is only over halfway.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings