- On-chain data showed that sentiment around cryptocurrencies was bearish.

- Development activity improved and other indicators predicted a rise in Aptos’ price.

Days after confirming its cooperation with a specific project, Aptos [APT] He shows signs of life again. At the time of writing, the price of Aptos Crypto has risen by 2.10% in the past 24 hours.

This move ensures that the value of the token will be $8.41. Like the price, trading volume jumped, indicating growing interest in Aptos.

However, the increase was not without reason and can be traced back to the disclosure issued on June 6th. On the above-mentioned date, IONET, an AI-powered decentralized computing platform, was launched open It has partnered with Aptos.

Not everyone is excited

According to the project, the decision was because it found Aptos to be the ideal layer-one blockchain network to provide a transparent ledger of AI assets. As a result, IONET deployed its generative AI product on the Aptos cryptocurrency blockchain.

Furthermore, IONET’s founder and CEO, Ahmed Shadid, mentioned that Aptos’ high speed and scalability was one of the reasons it chose blockchain technology.

Currently, Aptos can process 25,000 transactions per second, making it one of the few blockchains with this capability.

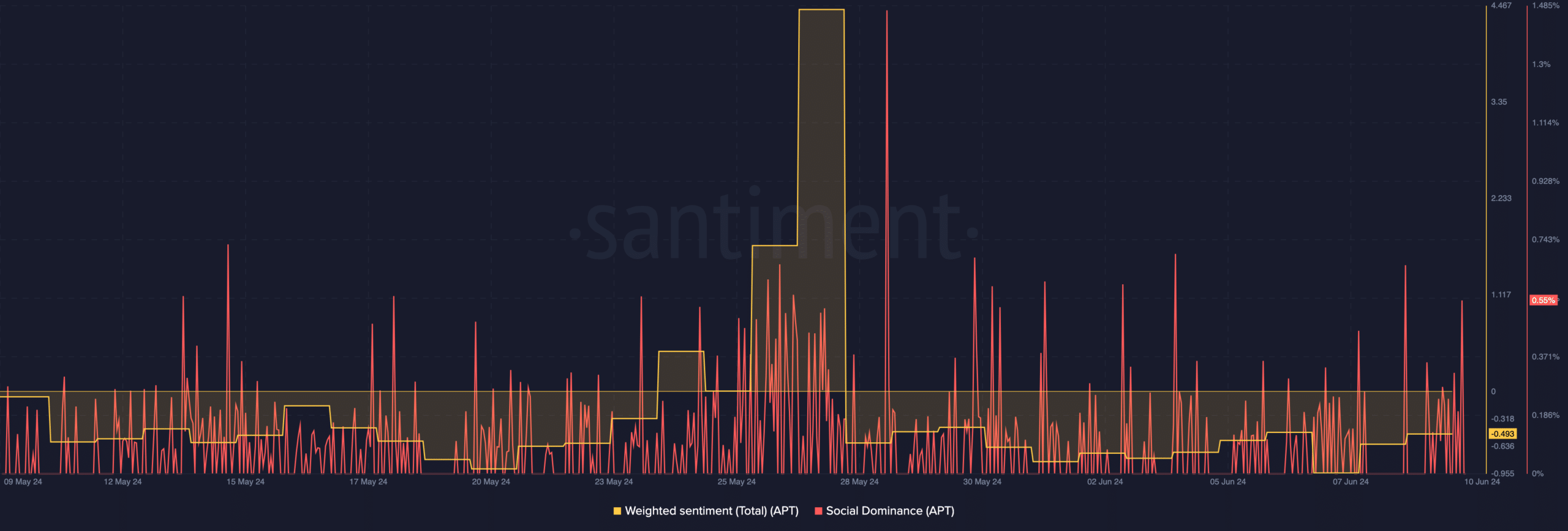

Despite the development, sentiment around Aptos has declined. At the time of writing, AMBCrypto’s analysis of Santiment showed that the scale was -0.493, indicating that most comments about APT were negative.

If this remains the case, demand for the token may decline. The recent price increase can also be neutralized. However, social dominance around the Aptos cryptocurrency has jumped.

this Shown That discussion about it has improved compared to other assets on the Top 100 list. But the improvement is not evidence of a potential upside, and our findings show that it can be linked to IONET again.

Source: Santiment

TVL rises but that’s not all

Aside from its partnership with Aptos, IONET’s cryptocurrency will be launched on June 11. As Binance’s listing approaches, it appears that market participants have been including Aptos cryptocurrencies in growing conversations due to their connection.

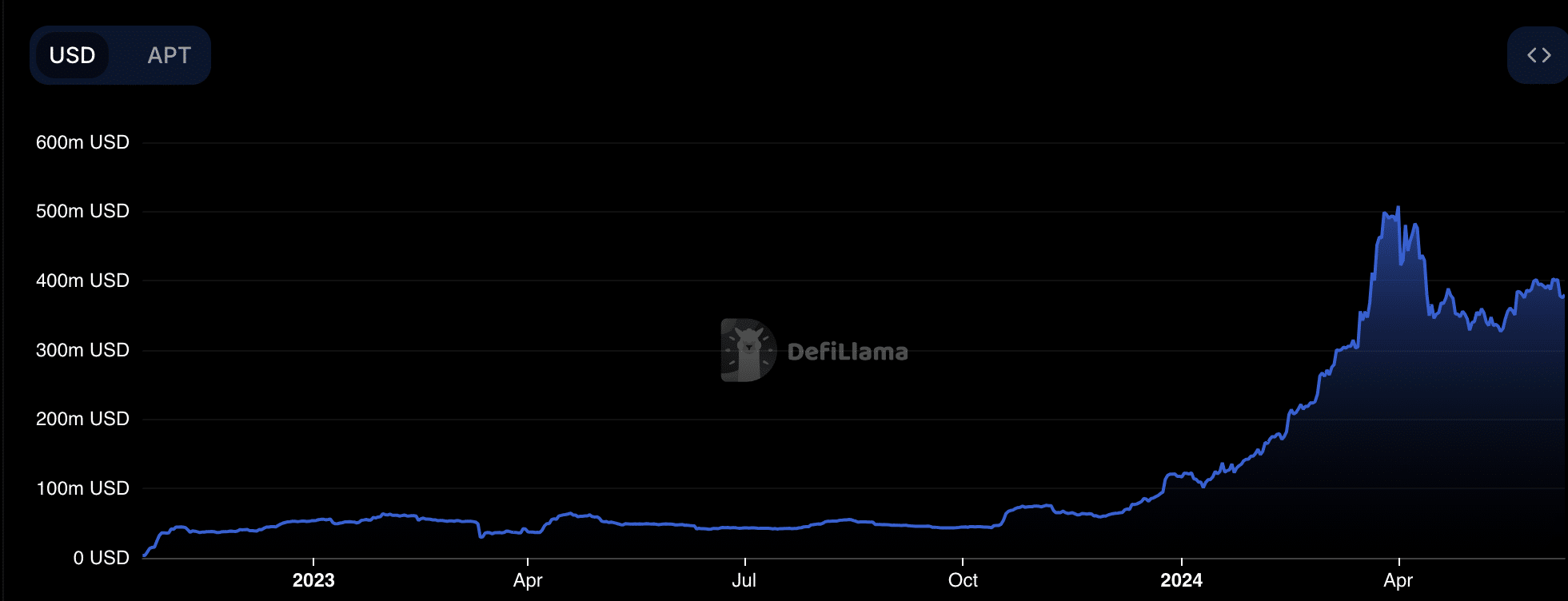

Another metric examined by AMBCrypto is the Total Value Locked (TVL). On May 14, Aptos TVL dropped to $326.99 million, according to data from DeFiLlama.

However, data at press time showed that the metric had recovered, standing at $379.91 million. The increase can be attributed To the high level of assets locked or staked in on-chain protocols.

If this problem persists, the value of Aptos’ locked assets could rise to $450 million as it was in April. But if perceived trust decreases, the scale may drop again.

Source: Devilama

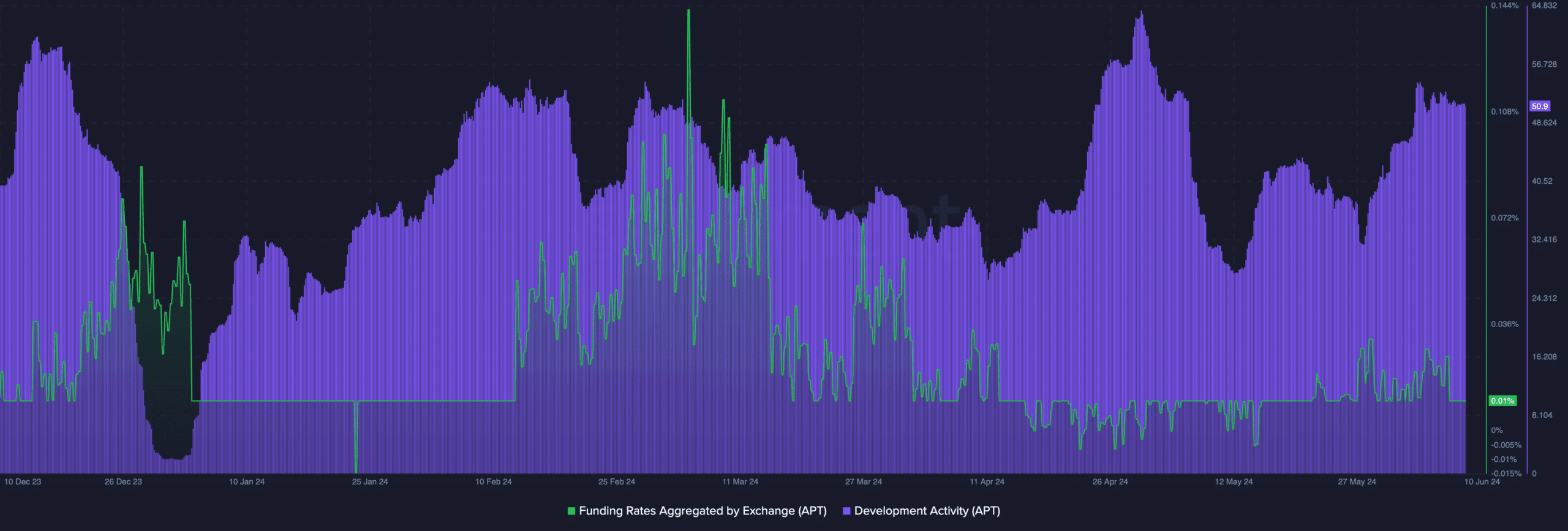

At the same time, development activity on the Aptos blockchain is increasing. As of this writing, on-chain data showed the reading to be 50.90.

This metric is important for any project. This is because it indicates the rate at which new features are being shipped while helping to drive growth and user adoption.

Will APT go to $9?

For the Aptos cryptocurrency, this could be a bullish signal. But the data revealed that the measure did not have a strong relationship with the APT price. Therefore, there is no confirmation of a further price increase.

Meanwhile, Aptos’ funding rate stood at 0.01%. Although positive, the rate was lower than it was a few days ago.

The financing rate is the cost of holding an open contract in the market. If the reading is positive, it means that the trading price is trading at a level beloved Compared to the spot value.

Source: Santiment

On the other hand, a negative reading means that the perp price is at a discount compared to the spot price. However, since the price of perp fell as the price of APT rose, it means that perp traders are not convinced by the price increase.

Realistic or not, here’s APT’s market cap in terms of SOL

A reasonable inference is that spot traders are becoming more aggressive. Hence, this could be bullish for Aptos crypto price.

By the looks of things, APT could reach $9 in the short term. However, this will only be the case if selling pressure is not triggered.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings