Paul Morigi

According to another company filingBerkshire Hathaway, Warren Buffett (New York Stock Exchange: BRK.A) (New York Stock Exchange: BRK.B), is to sell exposure to publicly listed shares. During the period from January to the end of March, the US giant sold $13.3 billion worth of products of shares, with just $2.9 billion added to existing exposure, generating over $10 billion in sales. Buffett set aside nearly $4.4 billion to participate in buybacks, while the company’s cash holdings jumped to $130.6 billion, the highest level since late 2021, when the stock market began to plunge aggressively.

During Berkshire’s annual gala Shareholders meeting in 2023Buffett made it clear that he expects “the majority of holdings will likely report lower profits this year than last year,” arguing that the economic backdrop is under pressure due to “a very different climate than it was 6 months ago.” As an example of why his rating is negative, share the note that says, “We We started making sales where we didn’t need sales before.”

Berkshire reports strong results in the first quarter of 2023

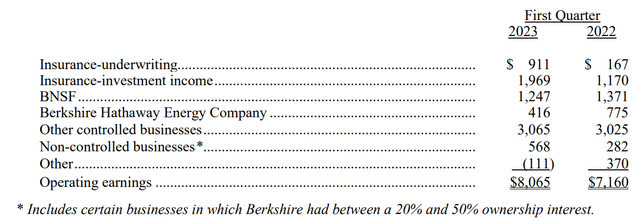

Interestingly, Buffett’s comment about the economy is somewhat at odds with the Berkshire conglomerate’s earnings results, as operating profit for the first quarter of 2023 increased by 13% year-on-year versus the relevant period in 2022, despite the unfavorable economic backdrop. From January to the end of March, the giant Berkshire amassed $8.07 billion in operating profit, aided by its reinsurance insurance business.

Geico, after posting six straight quarters of quarterly losses, turned around with a profit of $703 million. This positive result is attributed to higher average premiums earned, combined with lower advertising expenses and frequency of claims. With this frame of reference, Buffett has commented that he expects the insurance sector to perform strongly, due to its relatively low correlation to economic business activity.

However, Berkshire Hathaway’s rail and utility subsidiary BNSF reported a decline in profit compared to the first quarter of 2022. BNSF’s operating income fell to $1.25 billion, from $1.37 billion previously, in part due to a slowdown in imports at its ports. West Coast. While the utility division’s profits fell from $775 million to $416 million.

Saving BRK.B files Q1

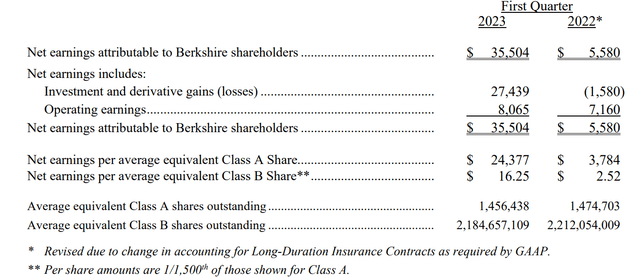

I would also point to Berkshire’s massive investment gain in the first quarter of 2023, which amounted to $27.4 billion, versus a loss of about $1.6 billion for the same period one year earlier. However, these earnings are only “paper earnings” and may fluctuate wildly over time. Accordingly, Buffett advised giving these numbers no meaning:

The amount of investment gains (losses) in any given quarter is usually meaningless and gives figures on net earnings per share that can be very misleading to investors with little or no knowledge of accounting rules.

Saving BRK.B files Q1

Juicy Yield in Treasury Bonds

One of the main reasons why Buffett has shifted somewhat away from stocks is the rich yield that Treasury bonds offer. Particularly in a stressed macro environment, it may not necessarily be wise to risk capital for an equity yield of 10%, when the risky Treasury yield is close to 5%.

In this context, Buffett commented that Berkshire’s $125 billion cash pile invested in short-term fixed-income securities is yielding attractive returns compared to what it was a year or two ago. In fact, Buffett estimates that Berkshire’s investment income from “cash and cash equivalents, including marketable securities” is expected to top $5 billion this year.

Another takeaway from the shareholder meeting

apple

Buffett continues to like Apple (AAPL), even at 30 P/E. The Oracle of Omaha says Apple is unlike any Berkshire has, adding that Apple is also the “best” company. In this context, Buffett argued that if the choice is made, consumers will abandon their second car before the iPhone, which costs less than a tenth of a car.

Apple is in a situation with consumers, where they pay maybe $1,500, or whatever that may be, for a phone…the same people pay $35,000 to own a second car, and when they have to give up their second car or give up their iPhone, they’ll give up their car the second …

… I mean, it’s an extraordinary product. We don’t have anything like that we own 100%, but we’re very, very happy to have 5.6%, or whatever that may be, and we’re happy about every tenth of a percent that goes up.

Taiwan Semiconductor

Buffett surprised the markets when he bought a large position in TSMC (TSM) in late 2022, only to sell 86% of the shares a few months later. Now, while Buffett continues to like TSMC’s value proposition, the company’s geographic presence simply doesn’t fit into his portfolio/convenience circle.

Taiwan Semiconductor is one of the world’s best managed and important companies… [just]I don’t like its location and re-evaluate it,… [but] Nobody in the chip industry is really in their league, at least in my view…

… great people and a great competitive location, but I’d rather find it in the States

banking crisis

Of course, Buffett also received questions regarding the recent banking stress: Munger and Buffett criticized the executives responsible for failing banks, emphasizing the importance of holding them accountable for mistakes that were clearly visible. The duo also highlighted flawed incentives in banking regulations and expressed dissatisfaction with ineffective communication between regulators, politicians and the press.

She was doing it in plain sight and ignored by the world until she exploded

Buffett stressed the importance of the government’s decision to protect all SVB deposits, commenting that the consequences would have been catastrophic for the United States if such a guarantee had not been made.

Occidental Petroleum

Buffett said he/Berkshire had no plans to bid for full control of Occidental Petroleum (OXY), easing speculation that Berkshire was aiming for a takeover. However, Berkshire did not rule out the possibility of buying additional OXY shares, praising CEO Vicki Hollub.

There is speculation about us buying control, we’re not going to buy control…we won’t know what to do with it.

…but we like the stock we have… [and] We may or may not own more in the future, but we certainly have warrants on what we got in the original deal on a very large amount of shares of about $59 a share, warranties last a long time, and I’m glad we own them.

last words

Buffett sees an “incredible period” for the US economy coming to an end and, accordingly, is tactically reducing some exposure to stocks. However, Buffett also argued that “nothing is ever certain,” and advised against paying attention to predictions about how the macro backdrop will develop or move markets, including the Oracle of Omaha.

For reference, shares of Berkshire Hathaway have underperformed slightly since the start of the year, with shares up just 4.51%, compared to a gain of about 8% for the S&P 500 (SP500).

Search for alpha

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings