Bitcoin (BTC) headed towards a retest of $40,000 on Feb 12 as BTC price action met analyst expectations.

Trader hopes to avoid ‘ugly’ weekly close

information from Cointelegraph Markets Pro And TradingView BTC/USD showed it reached a local low of $41,741 on Saturday with Bitstamp before rebounding over $42,000.

It was a turn in turn I finish The pair advanced after the arrival of the US CPI data, and soon there were calls for a return to $40K or even lower to see how strong the bulls’ resolve could be.

For Cointelegraph contributor Michael van de Poppe, the results were still inconclusive, but it was definitely necessary to be careful going forward with short time frame trades.

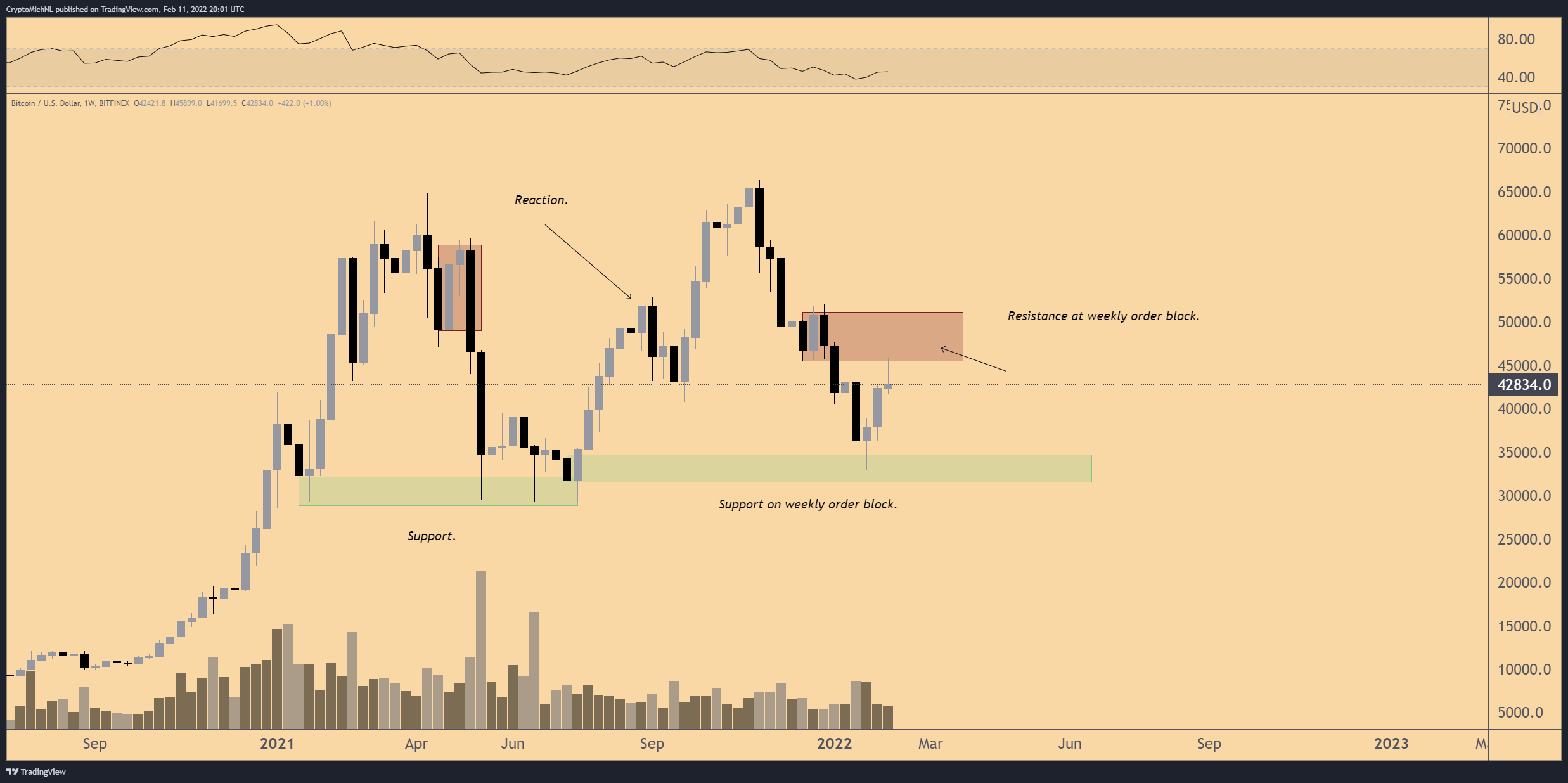

“Bitcoin is still looking at the same resistance,” he said Summarization Along with a chart showing potential support and resistance targets.

“Weekly demand block rejected in a ruthless manner. Weekly candle starts to look ugly + several levels of fear across the market for the coming weeks. Stays flat at this point.”

Meanwhile, others are calling time for the potential range of Bitcoin’s long-term downside.

Popular commentator Credible Crypto advised on Twitter, “For those waiting for less than 30,000 bitcoins, maybe the crypto avatars are with you because the odds are not.”

For those who are waiting for 30 thousand subs BTC dollarsMay the crypto gods be with you because the odds are not. https://t.co/LJPDoa4KCx

– CredibleCrypto February 12 2022

Even at current levels, Bitcoin’s weekly close is set to be virtually identical to the latter, thus preserving the majority of the previous gains that took it out of the $30,000 region.

Return directly to “Fear”

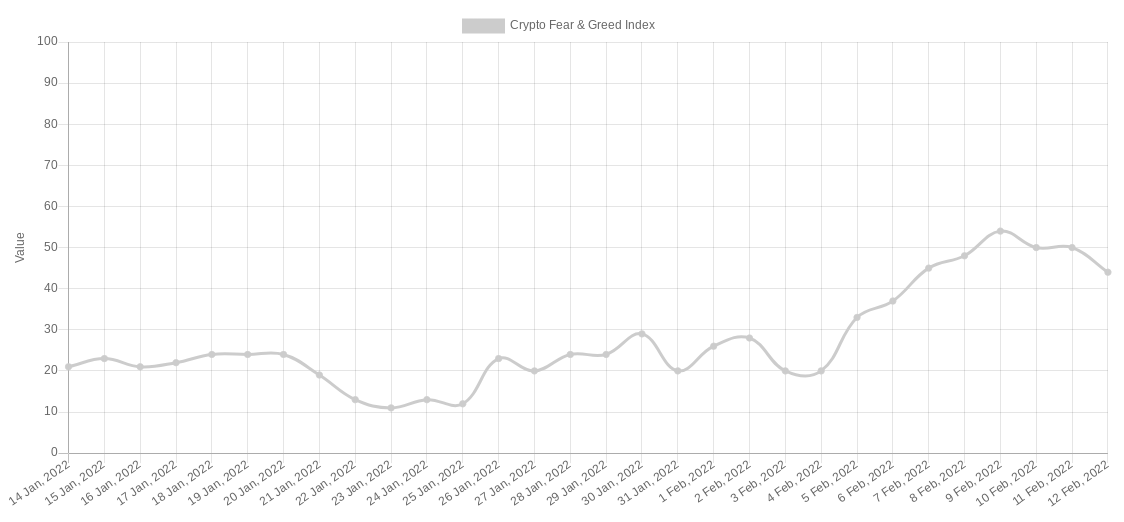

However, this week’s late pullback was more than convincing enough to take the crypto market sentiment a fresh blow.

Related: Bitcoin stuck in a tight range as BTC price moving averages are a major bullish cross

according to Cryptographic Fear and Greed Indexthree days of the “neutral” area was enough before the return of “fear” as the main force playing among the merchants.

On Saturday, the index measured 44/100, after hitting 54/100 on Wednesday.

Discussing January’s weeks-long journey into lower “extreme fear” territory, trading group Decentrader argued that a reset of sentiment likely already came based on historical patterns.

Analysts wrote in Market Update Released on Friday.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings