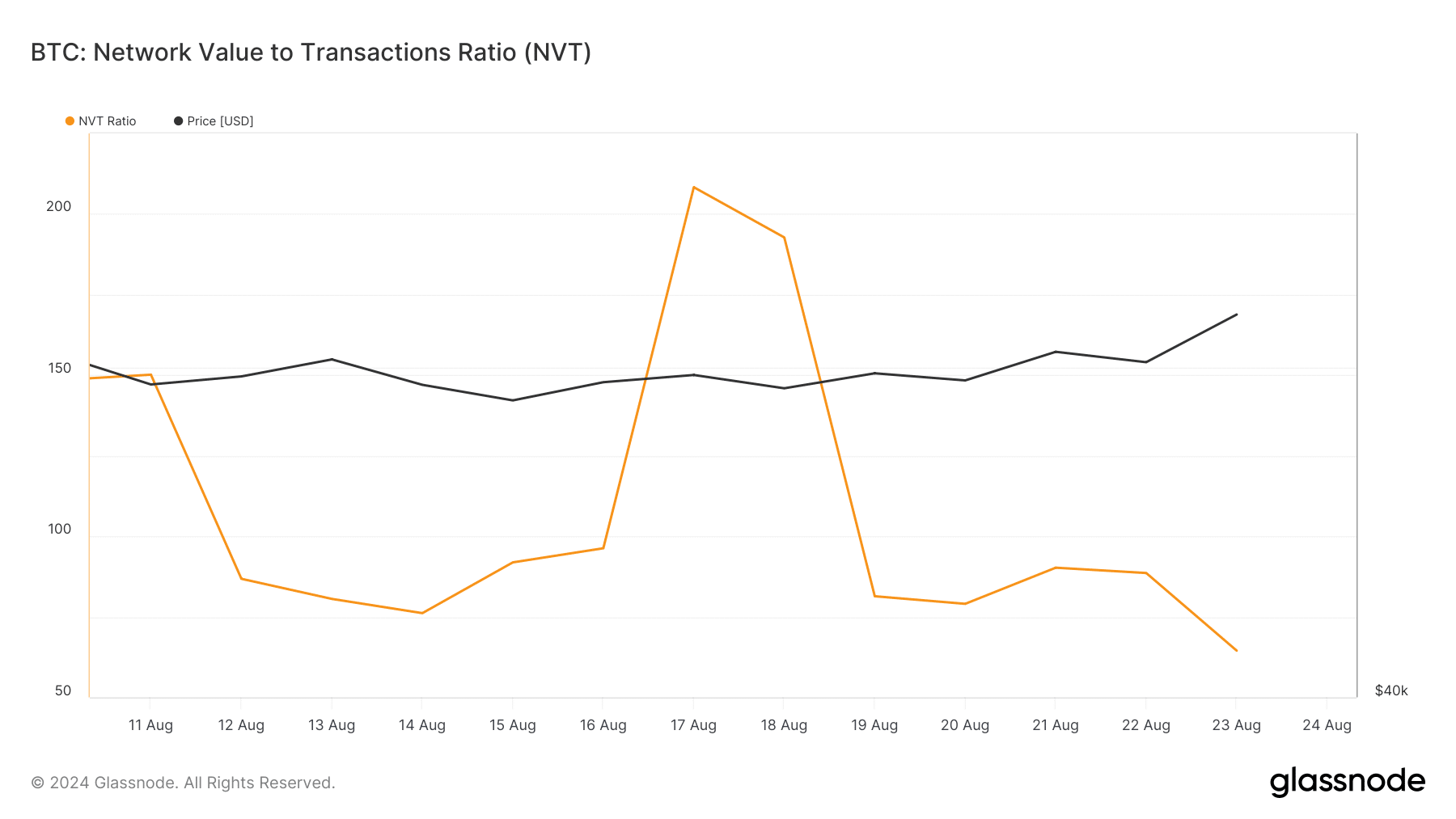

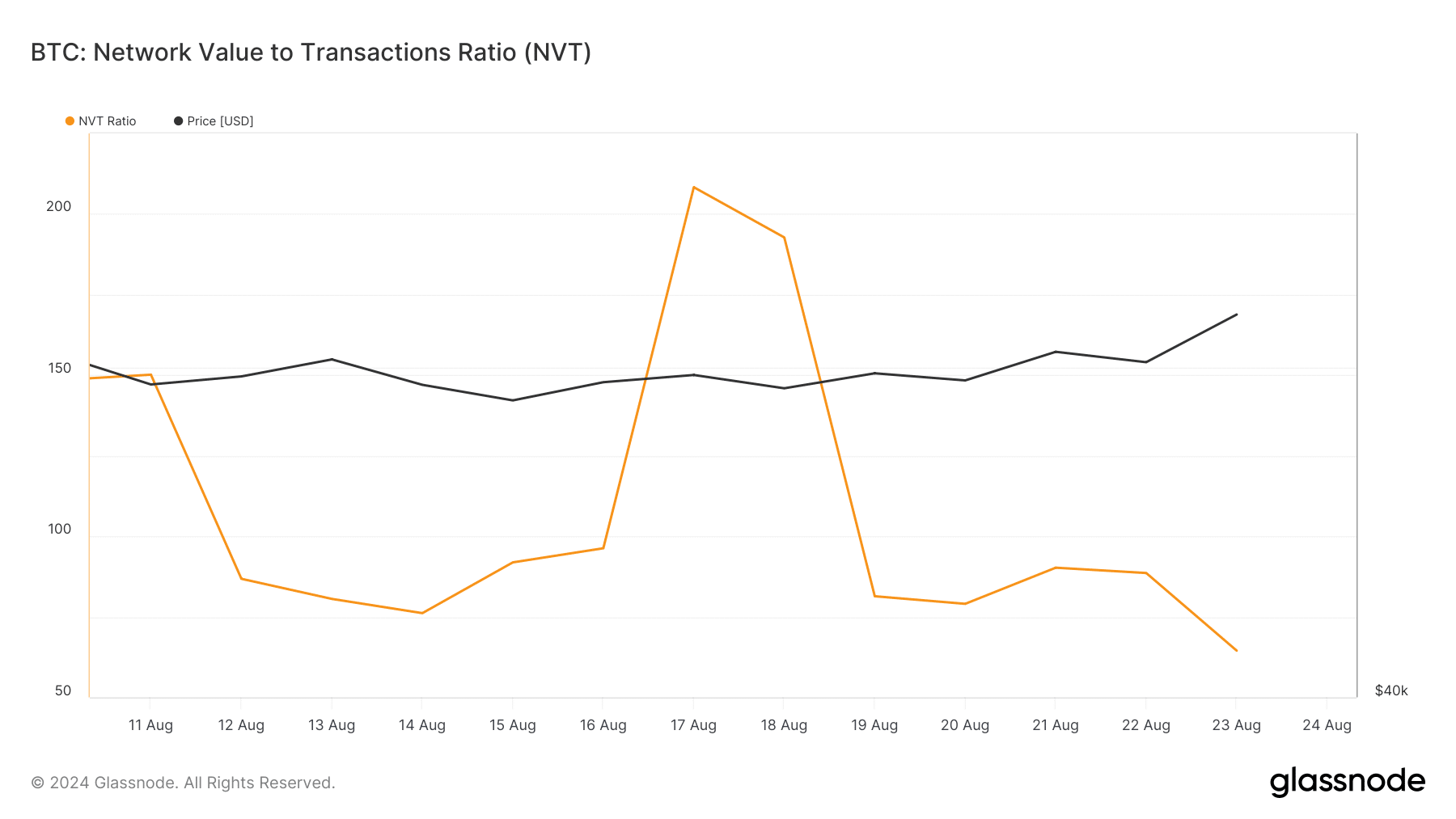

- Bitcoin’s net worth ratio indicates that it is undervalued on the charts.

- Some metrics were bearish, suggesting a drop towards $57,000.

Bitcoin [BTC] At the time of writing, investors are enjoying themselves as the price action of the king of cryptocurrencies has once again turned bullish. Bitcoin’s recent price surge has also pushed a major indicator into bullish territory. Therefore, it is worth taking a closer look at the current state of the cryptocurrency to see how long the bulls can sustain this fresh uptrend.

Bitcoin Turns Bullish Again

Bitcoin crossed the $61,000 level on August 23, and since then, sentiment around the currency has been bullish. In fact, the cryptocurrency has been rapidly approaching $65,000. According to Coin Market CapFor example, its price has increased by more than 5% in the last 24 hours.

At the time of writing, Bitcoin was trading at $64,276.61 with a market cap of over $1.26 trillion. With this price surge, nearly 86% of Bitcoin investors have made a profit.

Source: IntoTheBlock

But that’s not all.

Ali, a well-known cryptocurrency analyst, recently shared tweet Revealed bullish development. According to the same source, since early August, the BTC bull market index has been fluctuating between bearish and bullish. Now, it has returned to bullish again.

This means that the recent rise in Bitcoin may continue further.

Source:X

BTC’s Upcoming Targets

Since the above indicator has become bullish, AMBCrypto has examined other data sets to see how likely the royal coin is to remain bullish.

Our analysis of Glassnode data reveals that Bitcoin’s (BTC) net worth ratio has fallen sharply. A decline in this metric means that the asset is undervalued, suggesting a price increase in the future.

Source: Glassnode

Additionally, according to CryptoQuant, DataNet BTC deposits to exchanges were down compared to the average of the past seven days, indicating a decrease in selling pressure. Apart from this, AMBCrypto Reported previously The Nasdaq has formed a bearish divergence pattern. This means that renewed selling pressure could lead to an influx of liquidity from stocks into Bitcoin.

However, some metrics turned bearish. For example, the ASORP indicator was in the red, which means that more investors were selling to make a profit. In the midst of a bull market, this can indicate a market top.

NULP also noted that investors are in a belief phase as they are currently in a state of high unrealized gains.

Source: CryptoQuant

Therefore, AMBCrypto examined the daily chart of Bitcoin to better understand whether it is able to maintain the upward momentum. The technical indicator MACD showed a bullish crossover. The Chaikin Money Flow (CMF) indicator also registered an increase.

Reads Bitcoin [BTC] Price prediction 2024-25

If the rally continues, Bitcoin price could soon surpass the $65.2k resistance level and approach $68k after that. However, in case of a bearish takeover, Bitcoin price could drop to $57k again.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings