Bitcoin (BTC) gave up some of its recent gains, but on-chain data supplier Ecoinometrics said so whales pile up Because they think the price is attractive from a long-term perspective.

On the downside, analyst Willy Wu believes $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto, citing data from PlanC, said that The odds of Bitcoin dropping below $30,000 are slim.

Chris Kieber, Head of Research at Fidelity Digital Assets, thinks so Bitcoin downside risks may be minimal When compared to other digital assets, it can go up significantly if you can replace gold as a store of value.

Can Bitcoin and Altcoins Recover After the Recent Pullback? Let’s study the charts of the top 5 cryptocurrencies that might catch the attention of investors in the short term.

BTC / USDT

Bitcoin turned lower from the upper resistance at $45,456 but the small positive is that the bulls did not allow the price to break below the 20-day exponential moving average ($41,383).

If the price rebounds from the current level, the bulls will try to push the BTC/USDT pair above $45,456. Closing above this level will complete the bullish reversal head and shoulders pattern.

The pair could then rise to $52,088 as the bears are likely to pose a strong challenge. If the bulls push the price above this level, the pair could start its northward march towards the pattern target at $56904.

This positive outlook will be nullified if the price breaks and continues below $39,600. Such a move could open the door to a possible drop to $36,250.

The pair fell from $45,456 and broke below the moving averages. The bulls are currently trying to defend minor support at $4,168.88 but are facing heavy resistance at the moving averages.

If the price breaks below the current level and breaks below $4,168.88, the pair could drop to $39,600. If the price bounces away from this level, the pair may stay in a range between $39,600 and $45,456 for a few days.

On the upside, a breakout and a close above the moving averages would be the first indication that the bulls have a slight advantage. The pair could then rise to $43,920 and later to $45,456.

XRP / USDT

ripple (XRP) was breached and closed above the moving averages on February 7, indicating that the downtrend may be coming to an end. The bears attempted to pull the price below the breakout level at $0.75 but the bulls thwarted their attempt.

The price bounced off $0.75 and the bulls are trying to push the XRP/USDT pair towards the general resistance at $1. A breakout and a close above this resistance could open the door for a potential rally to $1.41.

The moving averages are about to cross bullish and the Relative Strength Index (RSI) is in positive territory, indicating that the buyers have the upper hand. This positive outlook will be nullified upon the breakout and the close below $0.75. Such a move would indicate that the bears continue to sell on rallies.

The 4 hour chart shows that the bulls and bears are battling near the $0.82 mark. The bulls pushed the price above this level but the bears stopped the rally at $0.85 and pulled the pair below $0.82.

The simple positive is that the bulls are buying dips to the 50-SMA. If the price bounces off this support, the bulls will try to push the pair above $0.85 and challenge the resistance at $0.91. On the contrary, a breakout and a close below the 50-SMA could pull the pair down to $0.75. A breakout and a close below this support could signal the start of a deeper correction.

CRO / USDT

Crypto.com’s native coin (CRO) broke above the 50-day simple moving average ($0.47) on February 7, indicating that the corrective phase may be over. The price rose to $0.54 on February 10 as the bears build a strong defense.

The moving averages are about to cross bullish and the RSI is in positive territory, indicating that the buyers have a slight advantage. If the current bounce off the moving averages continues, this will indicate that the bulls are buying on the dips. The bulls will then attempt to push the price above $0.54 and resume the upward trend.

If they can pull it off, CRO/USDT could rise to $0.60 and then $0.68. Contrary to this assumption, if the price declines and breaks below the 20-day EMA, the pair could drop to $0.39.

The 4 hour chart is showing that the pair is rising within a bullish channel formation. The bulls tried to push the price above the channel but the bears had other plans. They pulled the price back into the channel, trapping the aggressive bulls.

Buyers are trying to defend the 50-SMA. If the price continues above the 20-EMA, the bulls will once again try to push the pair above the channel resistance line. This positive outlook will be invalidated if the price falls and falls below the channel’s support line.

Related: Could XRP Reach $1 After Gaining 25% In One Week? Watch this key support level

FTT / USDT

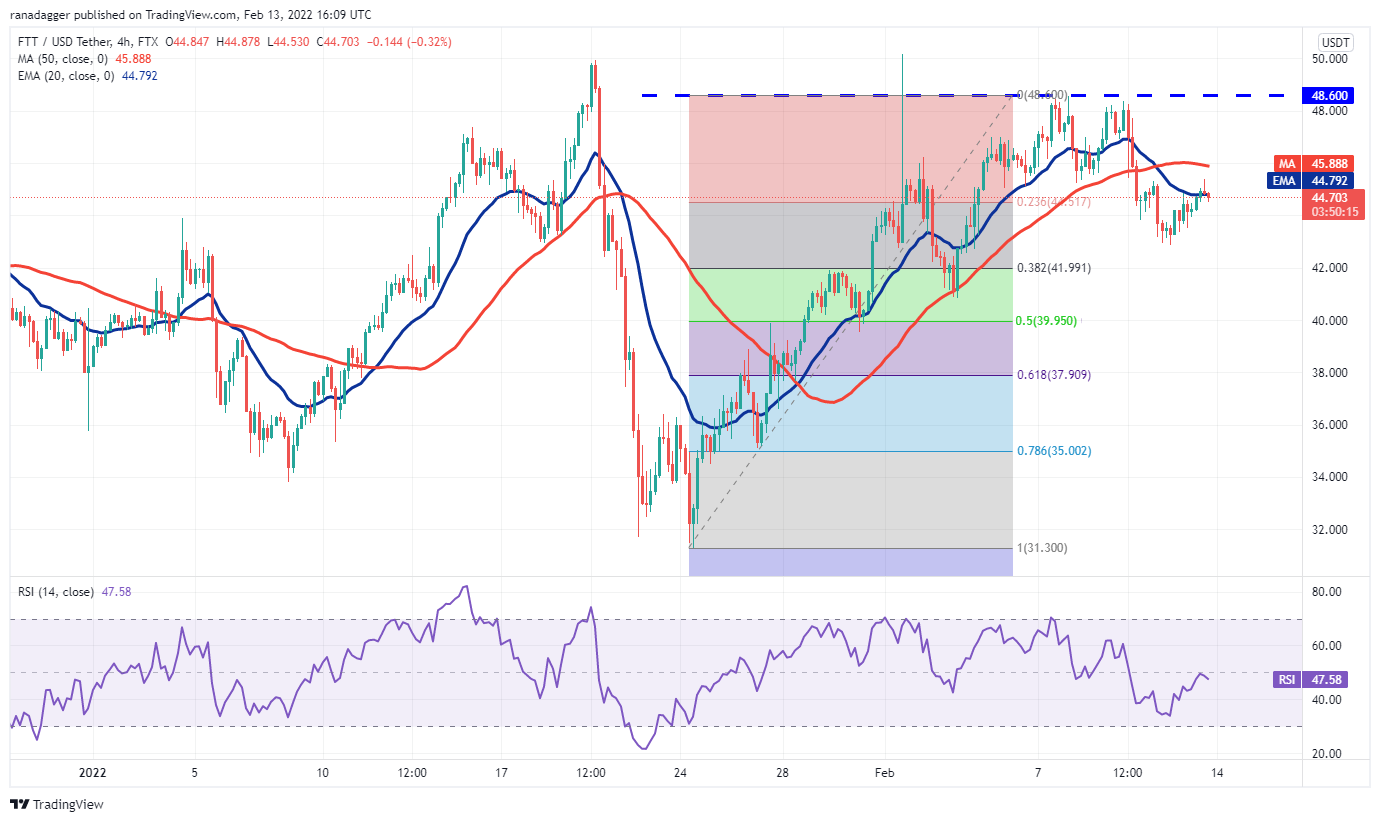

The FTX Token (FTT) was choppy within an expanding formation. The failure of buyers to push the price above the resistance line indicates that the bears are selling rallies to this level.

However, the slight positive thing is that the bulls are buying dips in the area between the 20-day moving average ($43.85) and the 50-day simple moving average ($41.50). If the price rebounds from the current level, the buyers will make another attempt to remove the upper barrier.

If they manage to do so, FTT/USDT may start a new uptrend. The pair may then rise to $53.50 where the bears may pose a strong challenge again but if this resistance is breached, the rally could extend to $65.

This uptrend will be nullified if the price breaks down and falls below the 50 day simple moving average. This will indicate that this pair may extend its stay inside the expanding pattern for a few more days.

The failure of the bulls to push the price above the upper resistance zone from $48 to $50 may have attracted profit taking from short-term traders. The pair broke below the two moving averages and could decline to the 38.2% Fibonacci retracement levels at $41.99.

If the price rises above the current level or $41.99, this will indicate that buyers are accumulating on dips. The bulls will once again try to push the price above the 50-SMA. If they succeed, the pair may challenge the upper resistance.

On the downside, a breakout and a close below $41.99 could signal the start of a deeper correction to the 50% retracement level at $39.95.

Theta / USDT

The Theta Network broke out and closed above the downtrend line on February 10, indicating that the downtrend may be coming to an end. In general, the rise above the extreme resistance tends to go back and retest the breakout level.

If the bulls succeed in turning the breakout level into support, this indicates a change in sentiment from selling on rallies to buying on dips. The 20-day EMA ($3.49) has started to rise and the RSI is in positive territory, indicating an advantage for buyers.

If the price bounces off the downtrend line, the bulls will try to start a new uptrend. A breakout and a close above $4.39 could attract more buying and THETA/USDT could rise towards $6.

This uptrend will be invalidated if the price falls below the current level and falls below the downtrend line. Such a move would suggest that a break above the downtrend line could be a bull trap.

The pair was rising inside an ascending channel pattern. The bulls tried to push the price above the channel’s resistance line but the bears were unrelenting. This may have resulted in profit taking by the short-term speculators, pulling the price towards the support line.

The price bounced off the support line on three previous occasions, thus, the bulls will try to defend it again. If the price bounces off the level and rises above the downtrend line, this will signal the resumption of the uptrend.

Alternatively, a breakout and a close below the channel’s support line could point to a deeper correction to $3.20.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risks, you should do your own research when making a decision.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings