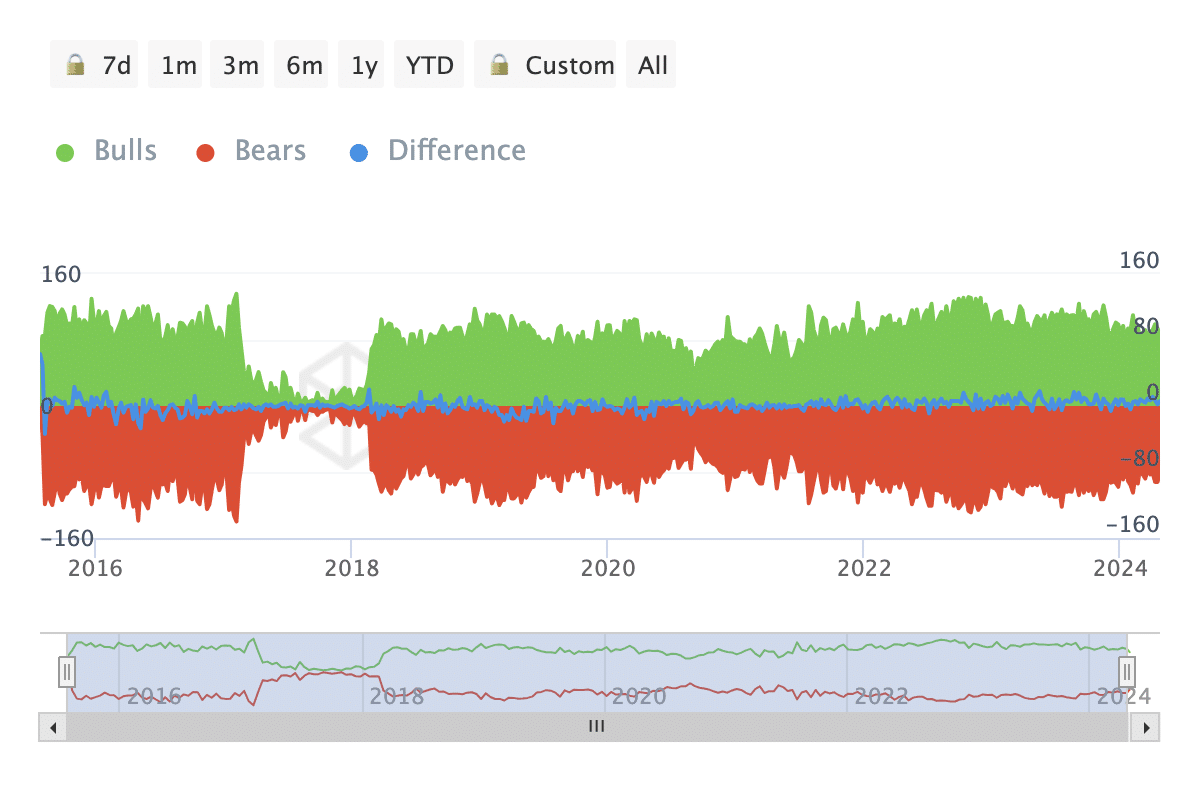

- A positive reading on the bulls and bears indicator indicates that the price may rise.

- The Ethereum network was overvalued and could hinder a potential rally.

Ethereum price [ETH] It may have fallen by 7.30% in the last 24 hours, but the assessment of the leading indicator suggests that the decline may end soon.

The indicator talked about here is the Bulls And Bears metric provided by IntoTheBlock. This indicator can be measured in titles or volume.

However, the focus is usually on large buyers or sellers, as they have a significant impact on price movements.

1% want to keep the faith

A net negative result for the bulls and bears indicator indicates that there are more large sell orders than buy orders. In this case, the price of the asset in question may fall.

But for Ethereum, data show up The reading was positive, which indicates bullish confidence in the price direction. If this metric maintains its position over the coming days, ETH may be able to rise towards $3,100.

Source: IntoTheBlock

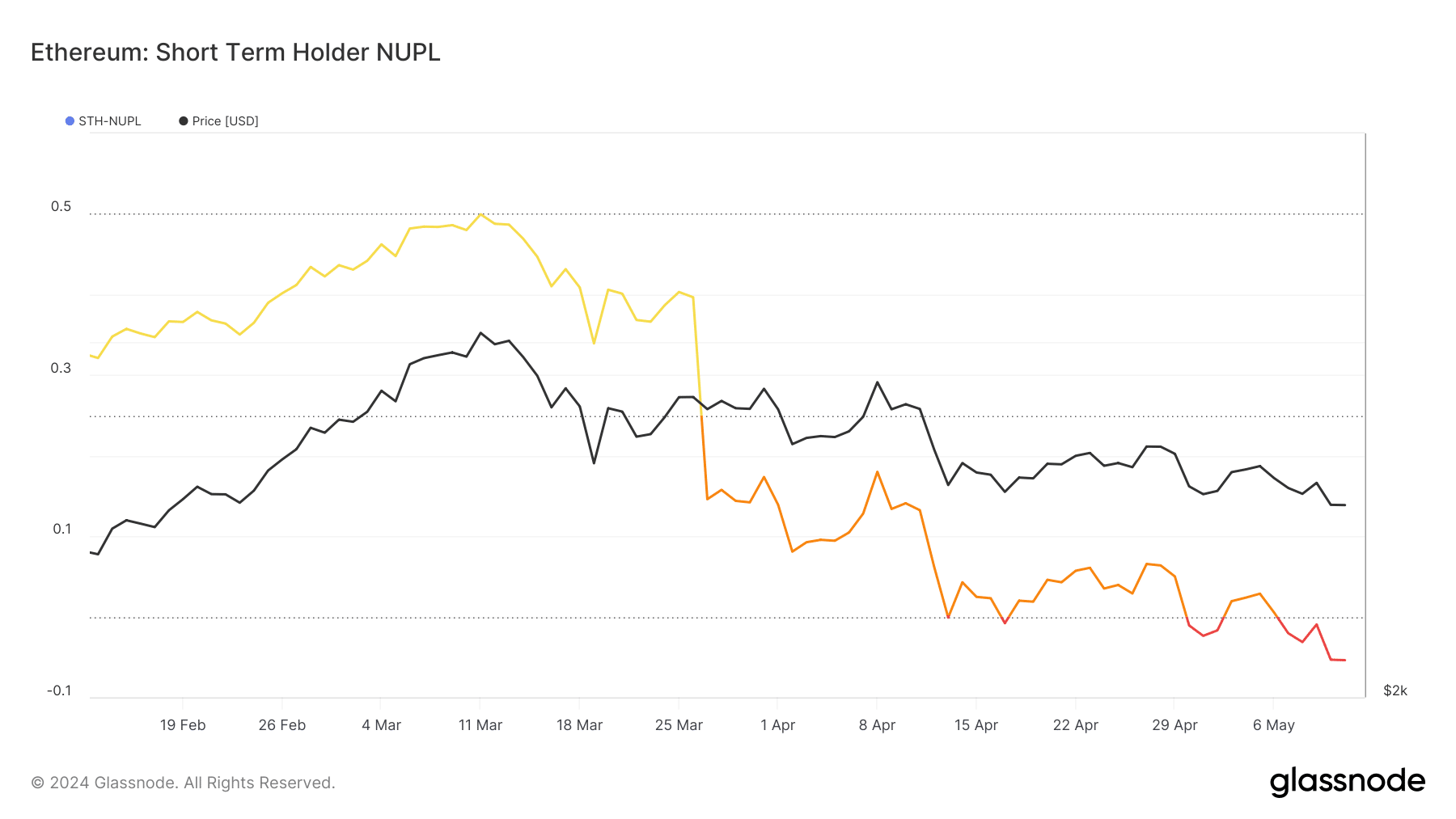

However, failure to maintain or improve the status quo could see the altcoin price drop below $2,800. When AMBCrypto looked at Ethereum’s STH-NUPL, we noticed that market participants were not completely confident in the cryptocurrency.

STH-NUPL stands for Short-Term Holder – Net Unrealized Gain/Loss. Using this metric, one can have an idea about the behavior of investors in the short term.

Investors are panicking, but ETH may come to their aid

From our analysis, ETH’s disappointing price action has changed investor sentiment towards the coin. In March, the gauge was in the optimism zone (yellow).

At that point, holders were confident about ETH’s price movement. But as of this writing, that reading It has reached the surrender zone (red), which indicates that market participants are in a state of fear.

Source: Glassnode

However, fear can serve as fuel for rebound. If STH-NUPL continues to decline, the price of ETH may decline as well.

Going forward, a shift may occur as extreme fear could lead to a more difficult rally if buying pressure increases.

In this case, Ethereum may target a rise towards $3,500. Along with this metric, AMBCrypto found another indicator that suggests ETH could be recovering soon.

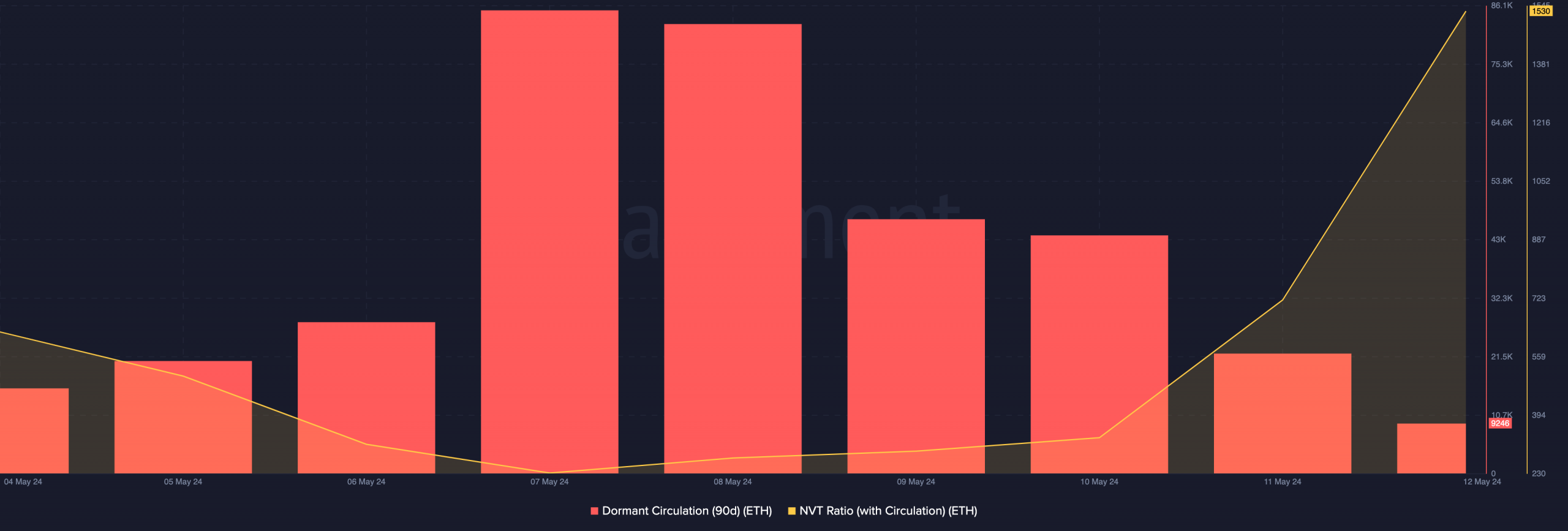

This time, we looked at inactive circulation. according to Data on the string From Santiment, 90-day passive trading fell to 9,246.

If the scale increases, it means that coins that have not moved for a long time are starting to change wallets. Sometimes, this means old hands are selling.

Source: Santiment

Thus, the recent decline implies that long-term Ethereum investors are not selling as much as they did around May 7th and 8th.

Read about Ethereum [ETH] Price forecasts 2024-25

However, the network value to transaction (NVT) ratio suggests that ETH may still be overvalued. Low values of NVT indicate that it is undervalued.

But for Ethereum, the metric has risen, indicating that the network is overvalued compared to transactions.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings