Coming every Saturday Hodler’s Digest It will help you keep track of every important news that happened this week. Best (and worst) quotes, top adoption and regulation, leading currencies, predictions and much more – a week on Cointelegraph in one link.

This week’s top news

“Bullying interest rate hike” – why cryptocurrency soared in the face of bad news

Despite the US Federal Reserve’s announcement of a 75 basis point interest rate hike on Wednesday, the cryptocurrency markets pumped heavily on the same day with momentum continuing through the week. Matty Greenspan, founder and CEO of Quantum Economics, jokingly called it a “bullish rate hike” and stated that investors were expecting much worse. Analysts, such as Swyftx’s Pav Hundal, suggested that the recent rally could be due to easing inflationary pressures around gas and commodities such as corn and wheat.

Ethereum dev confirms Goerli merger date, final update before the merger

On Thursday, Tim Peko, the lead developer of Ethereum, revealed that the final merger of the Goerli testnet before the long-awaited Ethereum merger and transition to Proof of Stake will take place between August 6-12. In a long and much delayed roadmap since late 2020, the Ethereum network is now in the final stages of completing its biggest upgrade to date. The official merger is scheduled for September 19, but could be further delayed if there are problems with Goerli’s testnet.

Zuckerberg wasn’t alarmed by a $2.8 billion loss in the metaverse division in the second quarter

Mark Zuckerberg, CEO of Meta, said he was unfazed by the company’s loss of $2.8 billion in its Metaverse division in the second quarter. He highlighted that Metaverse’s goals will take several years to roll out, but he sees a “tremendous opportunity” to earn hundreds of billions of dollars, or even trillions, over time as the sector matures. “I’m sure we’ll be glad we played such an important role in building this,” he said.

Cathy Wood sells Coinbase shares amid insider trading allegations

Cathy Wood’s Ark Investment Management, one of Coinbase’s largest (COIN) shareholders, reportedly disposed of 1.4 million shares of COIN stock on Tuesday. Three of Ark’s exchange-traded funds (ETFs) were taken out, and the sale was valued at approximately $75 million. The company reportedly owned nearly 9 million shares of COIN stock in late June and has continued to snap up shares since opening at nearly $350 last April. Since then, the price has dropped dramatically to stay just under $63, and the Ark probably should have cut it short when Jim Cramer called it “cheap” at $248 last August.

Tesla Records $64 Million Profit From Selling Bitcoin

Electric car maker Tesla led by Elon Musk posted a respectable profit of $64 million after that 75% of Bitcoin Holdings Sold in Q2. The gains are noticeable considering the company was sold off during the middle of a bear market; However, the most important and exciting thing is that musk finally appears Losing interest in cryptocurrency We won’t need to hear from him anymore. The company is said to still have 10,800 BTC on its books, which is worth about $255 million at the time of writing.

Winners and losers

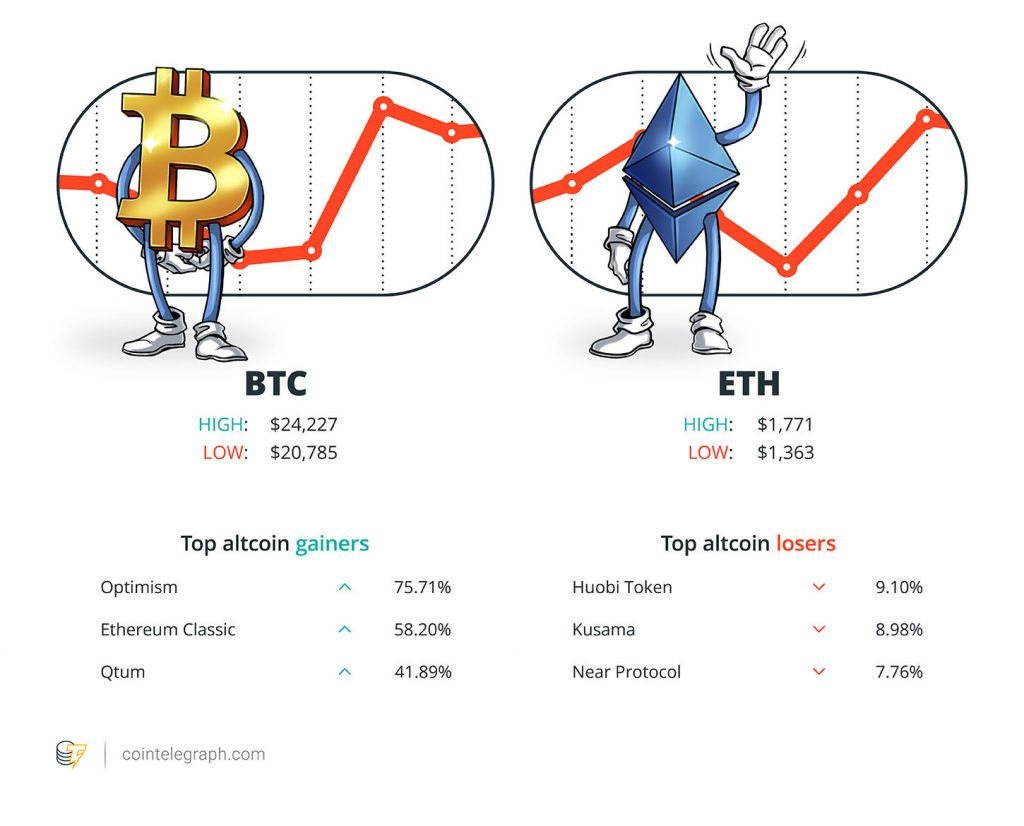

At the end of the week, Bitcoin (BTC) in $23559.86ether (ETH) in USD 1674.34 And the XRP in $0.36. Total market value at 1.08 trillion dollarsAnd the according to To CoinMarketCap.

Among the top 100 cryptocurrencies, optimists were the top three gainers for the week (OP) 75.71%, Ethereum Classic (etc) By 58.20% and cat (quantum) by 41.89%.

The three biggest altcoin losers for the week are Huobi Token (HT) By 9.10%, Kusama (KSM) 8.98% and NEAR . protocol (near) by 7.76%.

For more information on crypto prices, be sure to read Cointelegraph Market Analysis.

Most unforgettable quotes

“A lot of NFT projects are just speculation with no real concrete backbone, no real true story. Having a football club to root every week? This is the backbone that people attach themselves to.”

Preston JohnsonCo-owner of Crawley Town Club and co-founder of WAGMI United

“The industry shouldn’t be allowed to write the rules you want to play by.”

Sherrod BrownUS Senator and Chairman of the Senate Banking Committee

“We think it’s more appropriate for local projects to benefit the local economy, rather than just moving products to the United States to benefit merchants there, for example.”

lu yoHead of KuCoin Labs

“Powell is particularly skilled at delivering bad news. It’s clear that investors were expecting the worst.”

Matty GreenspanFounder and CEO of Quantum Economics

“The Metaverse is a huge opportunity for a number of reasons. I feel even more strongly now that developing these platforms will unlock hundreds of billions of dollars, if not trillions, over time.”

Mark ZuckerbergCEO of Meta

“I am concerned about things that are not directly related to the blockchain and the Metaverse. I am concerned about climate change and social fragmentation.”

Neil Stephensonauthor snow crash

Predicting the week

The GameFi Industry Will See A $2.8 Billion Valuation In Six Years

Absolute Reports published a report focused on GameFi this week estimating that the profitable NFT gaming industry will be worth $2.8 billion by 2028. To hit the target, GameFi will need a compound annual growth rate of 20.4% over six years as the public sector has been valued The past is about $776.9 million. However, the reasons for this lofty goal are confined behind the unpaid subscription ban.

FUD of the week

Solana-based stablecoin NIRV drops 85% after $3.5 million exploit

The algorithmic stablecoin peg from Solana Nirvana Finance’s adaptive yield protocol, NIRV, has been deprecated by 85% this week after the protocol was hacked worth $3.49 million from USDT. The incident was cited as a quick loan attack that led to the withdrawal of funds from Nirvana’s treasury. Its original token, ANA, has also fallen by 85% as a result of the hack.

Phishing risk escalates with confirmation of the degree of leakage of customer emails

On Tuesday, embattled and bankrupt crypto lender Celsius sent an email to its customers, informing them that a list of their emails had been leaked by an employee of a business data and messaging management vendor, Customer.io. The company downplayed the incident, stating that it “presents no significant risks.” [its] customers,” adding that they just wanted users to be “informed” — although Celsius also said similar things regarding user assets after it paused withdrawals several weeks ago.

TikTok data policy disaster: Is user encryption at risk?

Popular social media app TikTok is facing a backlash over far-reaching data collection policies that can extract large amounts of sensitive information from a user’s smartphone or computer. As such, crypto users are now concerned about whether TikTok is able to scrap important data such as private wallet keys. “TikTok isn’t just another video app. This is sheep’s clothing. It harvests swathes of sensitive data that new reports show is being accessed in Beijing,” said US Federal Communications Commissioner Brendan Carr.

Cointelegraph’s Best Features

Researcher Says Merger Is An Opportunity For Ethereum To Acquire Bitcoin

Ethereum’s impending move to a proof-of-stake consensus mechanism will change its monetary policy, potentially making ETH even scarcer than Bitcoin.

Tokenomics not Ponzi-nomics: influence on behavior, earn money

Economics is the study of human behavior that involves scarce resources—and the effects of those behaviors on those resources, as Roderick McKinley explains.

When worlds collide: Joining Web3 and coding from Web2

A friend of mine who is an experienced Web2 CEO joined Web3 in June. An operator asked, to speak with all 16 employees before deciding to join the company.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings