- Ethereum saw a record number of active addresses daily.

- ETH support continues to hold.

Ethereum [ETH] The recent rise in the key on-chain metric is noteworthy, especially given recent price trends and its struggle to maintain levels above the critical support line.

However, it is interesting to note that despite this spike, other metrics on the series have displayed typical patterns.

Ethereum is seeing more active addresses

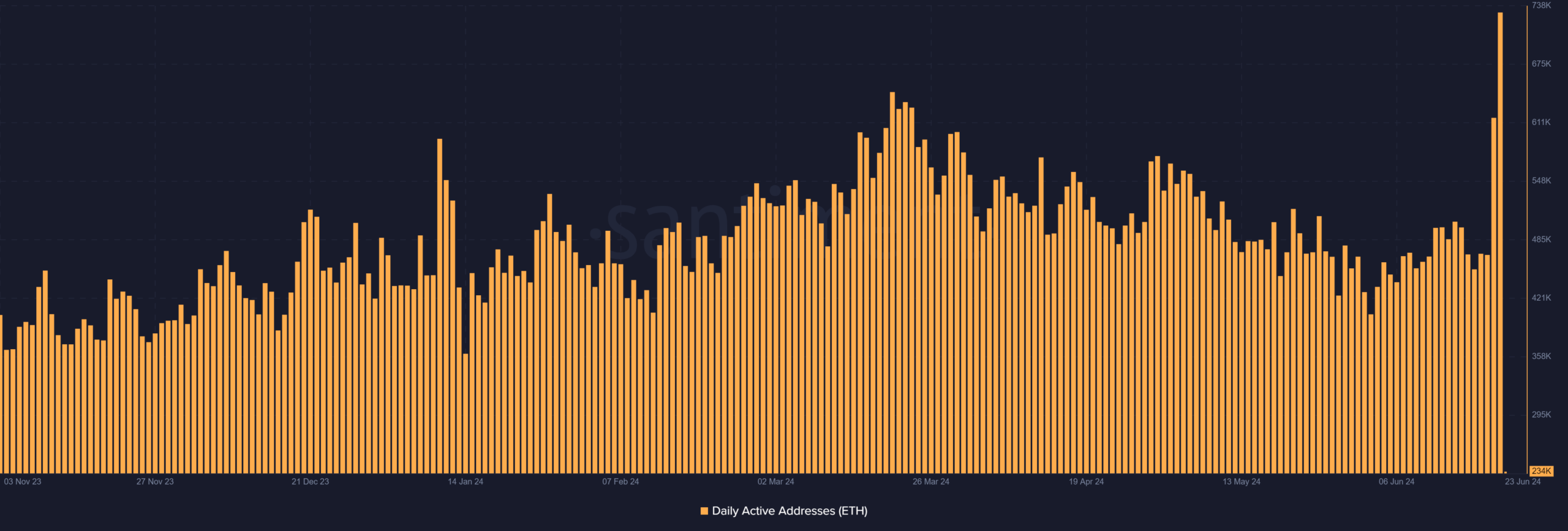

AMBCrypto’s analysis of Ethereum’s daily active addresses metric from Santiment It revealed recent consecutive spikes, indicating a significant increase in network activity.

On June 21, the number of daily active addresses reached more than 617,000, the highest level since March 23.

However, this record was surpassed the next day, June 22, marking another high point.

Source: Santiment

Ethereum active addresses indicated that by the end of trading on June 22, the number of daily active addresses exceeded 731,000.

AMBCrypto then took a deeper look at the historical data, which revealed that the last occurrence of such high activity was about ten months ago.

In September 2023, the number of active addresses rose to more than one million, the highest level recorded up to that point.

These spikes indicate a high level of participation on the Ethereum network, which can be driven by various factors such as market movements, new developments in the ecosystem, or increased adoption.

However, these elevations did not affect the size.

What about the volume of Ethereum?

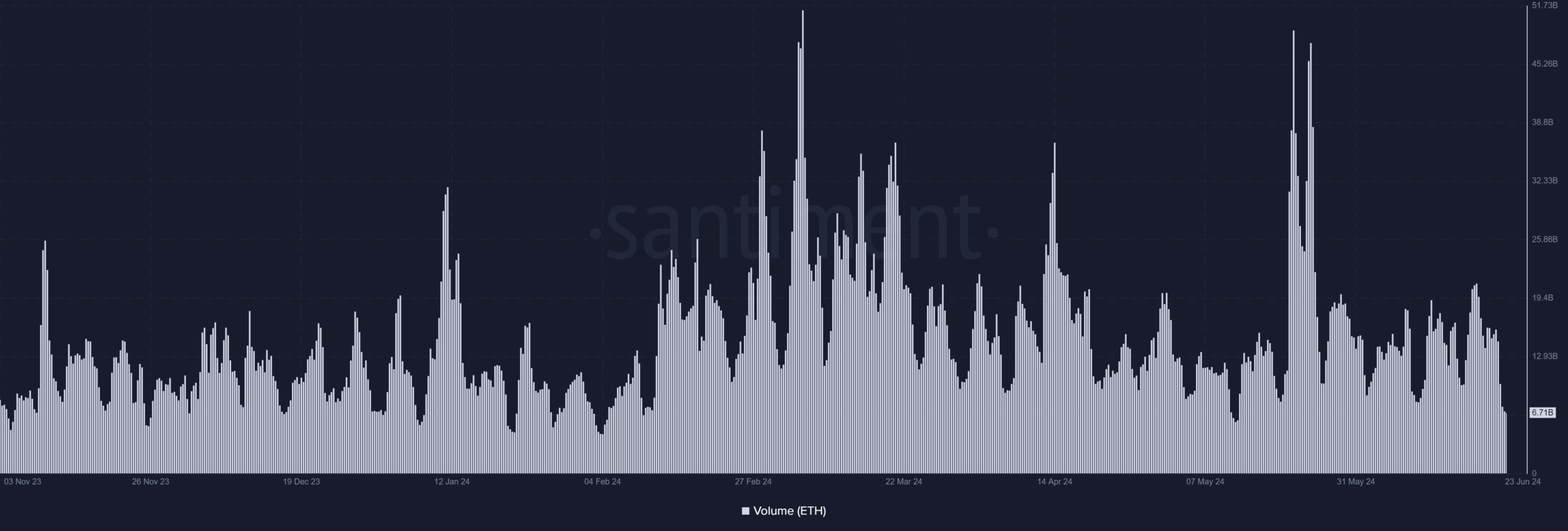

AMBCrypto’s analysis of Ethereum’s trading volume reveals an interesting contrast with spikes in daily active addresses. Despite the increase in active addresses, trading volume decreased.

By the end of trading on June 22, trading volume reached about $9 billion, which may seem large at first.

However, compared to the $15 billion recorded in the previous trading session, this represents a significant decline.

Source: Santiment

The discrepancy indicates that although there are more active addresses, which may indicate increased user interactions or transactions on the network, this has not translated into higher trading volumes.

This suggests that smaller, less value-intensive transactions may be dominating activity during this period.

ETH’s downtrend is weakening

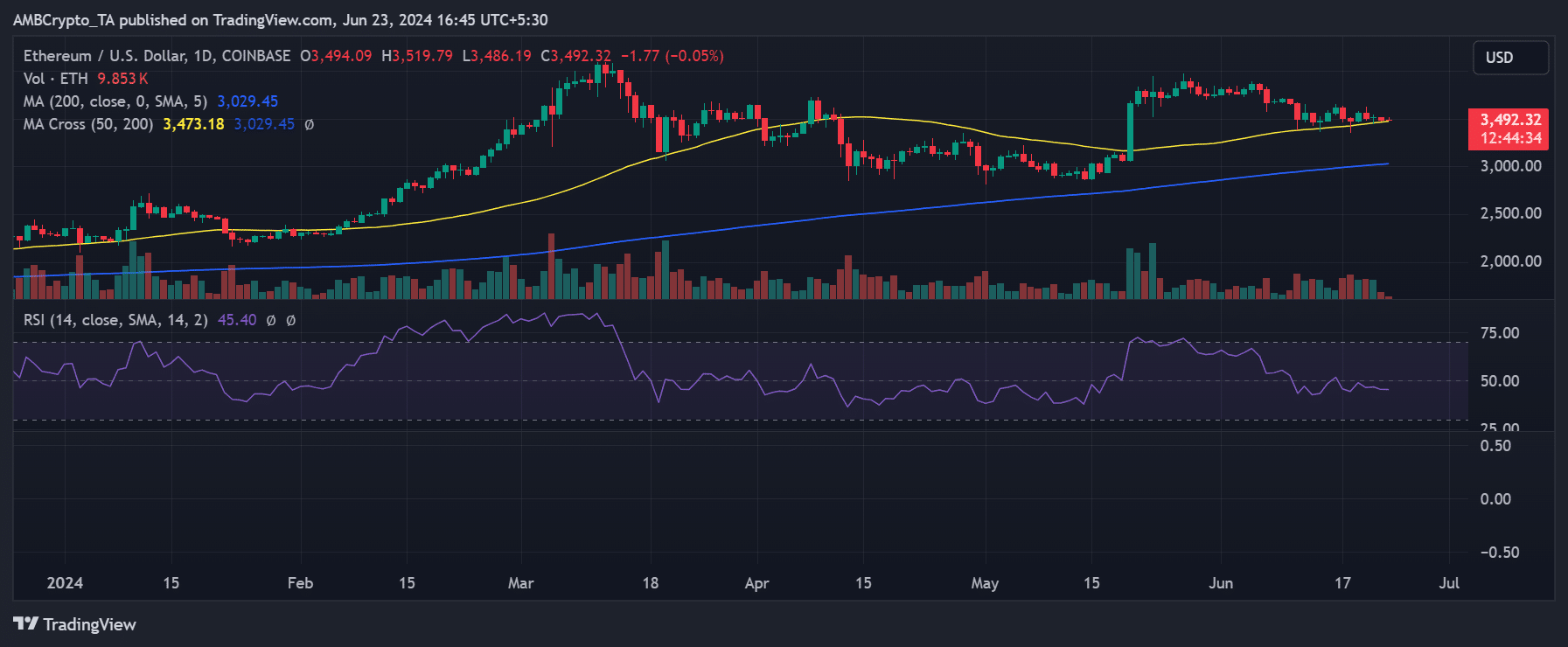

The Ethereum price chart has indicated that it is currently seeking to maintain its support level.

AMBCrypto’s review of the daily time frame chart showed that despite the decline in its price over the past few days, the support level actually remained at around $3,400.

As of the latest data, Ethereum was trading at approximately $3,490, and has seen a slight decline.

This indicates initial stability, as it managed to stay above the crucial support level of $3,400, which could be pivotal in determining the price path in the short term.

Source: Trading View

Is your wallet green? Check out our ETH profit calculator

Ethereum’s Moving Average Convergence Divergence (MACD) analysis indicated that it was in a downtrend at the time of publication.

However, the behavior of the MACD lines indicates that this downtrend is weakening. If the price rises, this may diminish further, which could indicate a reversal or at least a slowdown in the downward momentum.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings