- Both long and short trades have had a turbulent time following the rise and fall in the price of ETH

- Realized profits have risen, indicating that the value may drop below $3,400

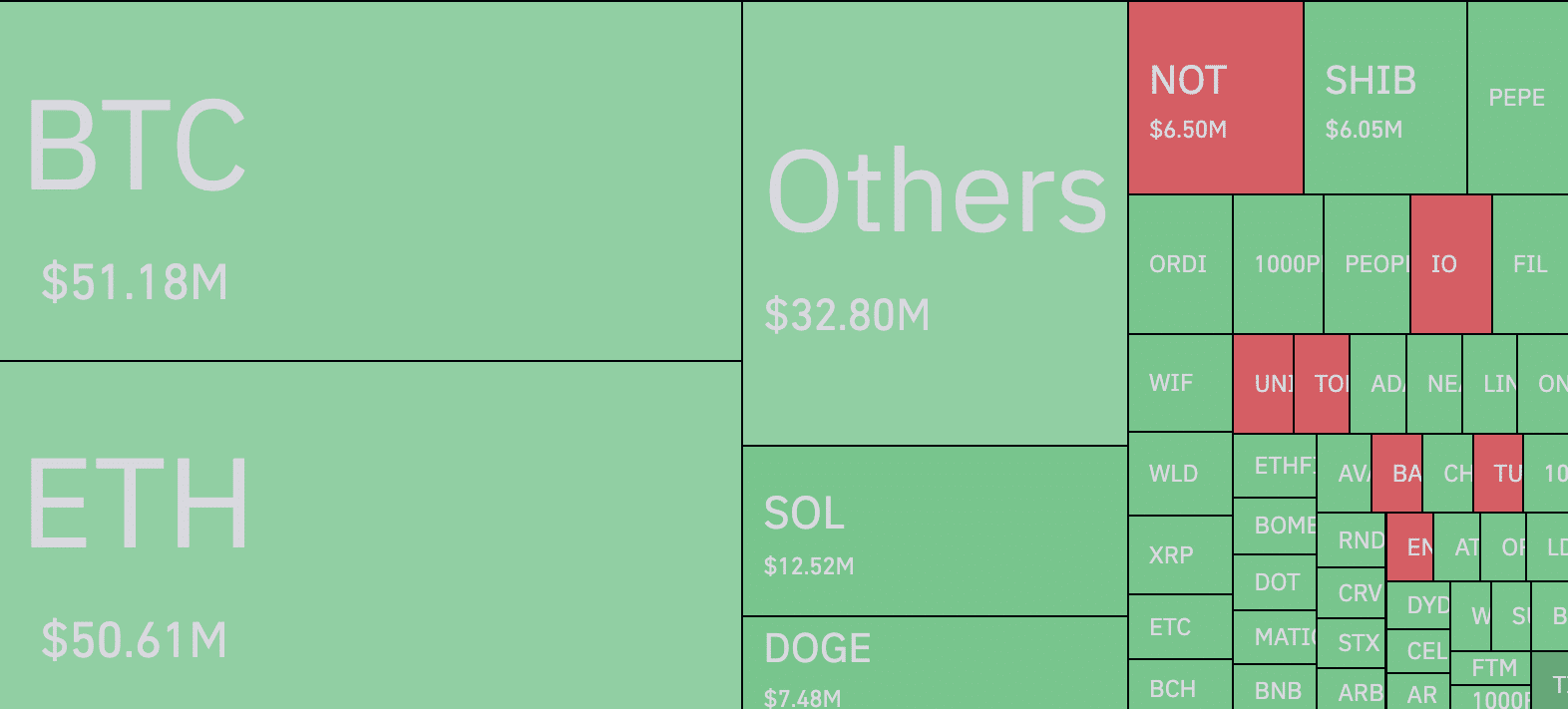

High market volatility caused market liquidations to reach $215 million. To get out of this, Ethereum [ETH] The contracts were worth $50.61 million, according to Coinglass data.

Liquidations occur when a trader does not have enough margin balance to keep the position open. Forced closure is necessary to avoid further losses.

Stormy season for the market

For ETH, the rise Liquidation It can be linked to the price of the cryptocurrency. A look at the price action revealed that it fell to $3,368 sometime on June 14. Later, the value rose to $3,512, before settling above $3,500 at press time.

As a result of these price fluctuations, both buy and sell trades were not saved. Long trades refer to traders who bet that the price of an asset will rise. Shorts, on the other hand, are traders who have stakes in falling prices.

Source: Coinglas

However, traders seem to be anticipating lower prices. This is, due to the call/sell ratio before options expiration on Friday. According to derivatives exchange Deribit, Ethereum’s buy/sell ratio was 0.37.

Since the ratio was less than 0.50, it means that the forecast was bearish. However, participants did not seem to expect the high level of volatility.

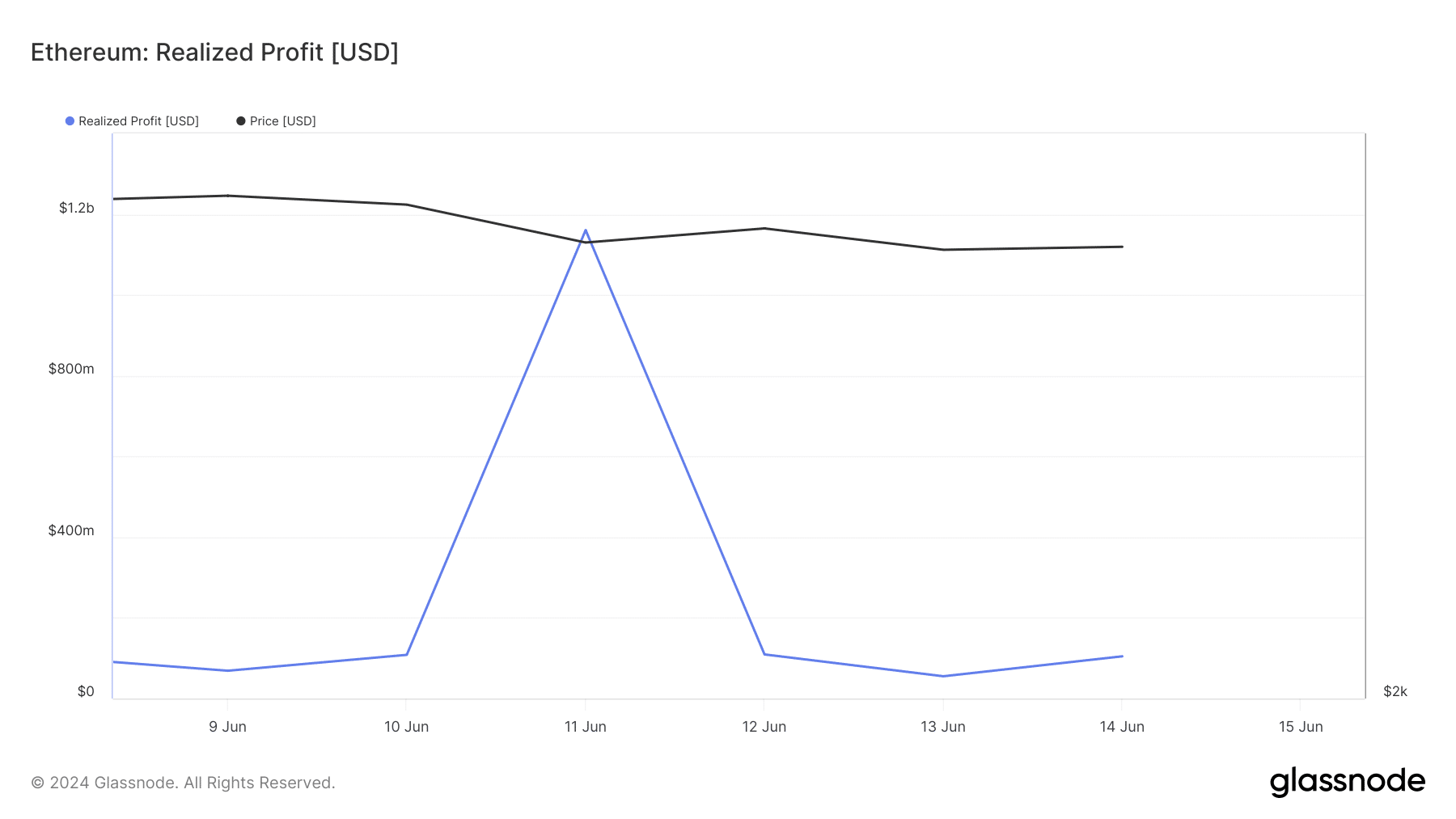

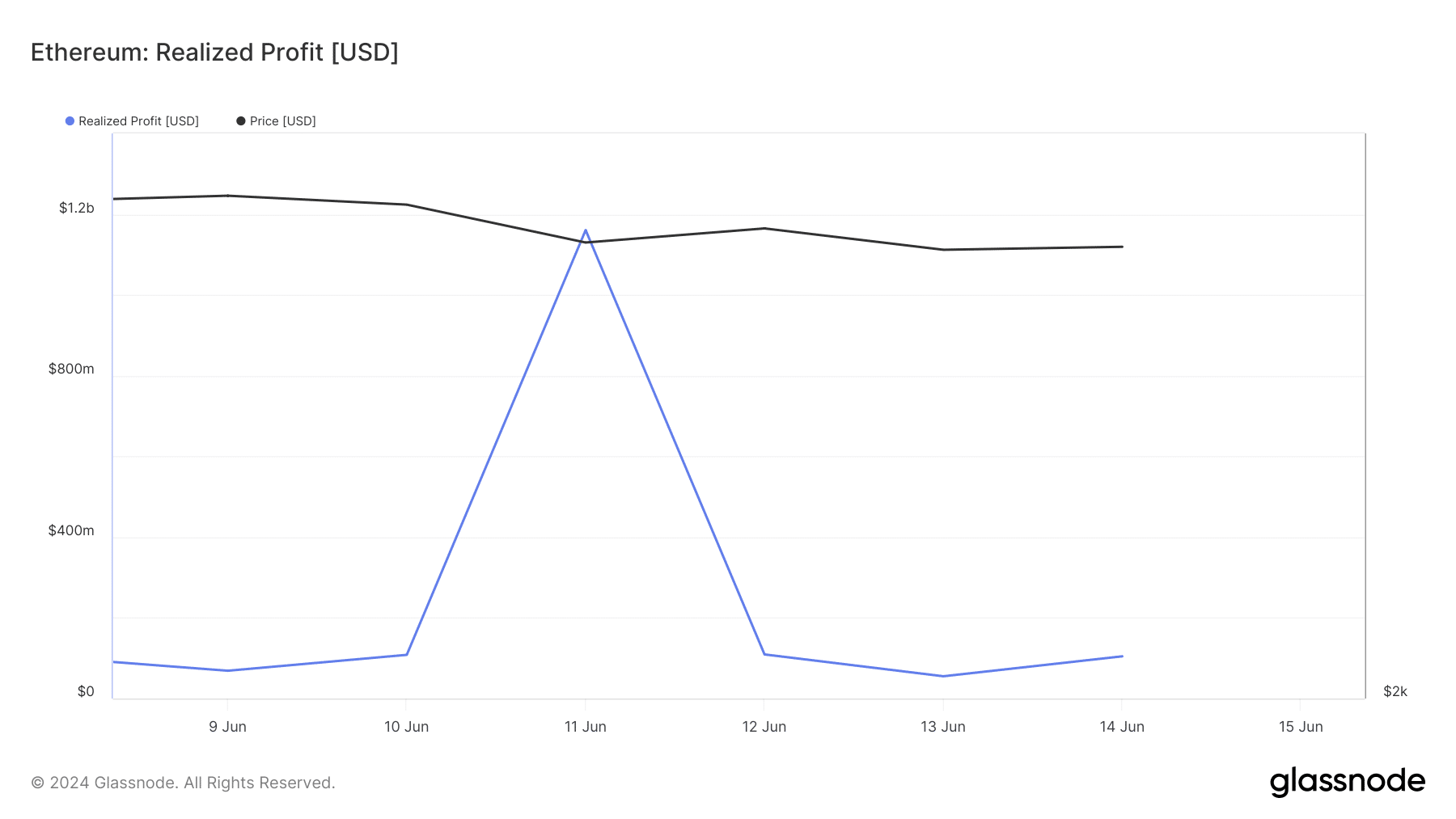

Regarding the price, AMBCrypto looked at the profit made as well. As the name suggests, this refers to the total of all transferred currencies whose last price was lower than their value at the time of publication.

ETH plans to fluctuate between $3,400 and $3,600

On June 12, ETH was released Profit achieved It was $55.18 million. By June 14, the value had risen to $104. 58 million. An increase in this measure indicates that stockholders are booking profits, and this may cause prices on the charts to fall.

However, if the measure itself stabilizes, selling pressure decreases throughout the market. For Ethereum, the profit achieved seems to have stabilized around the value mentioned above. Therefore, altcoins may be likely to trade between $3,400 and $3,600 over the next few days.

Source: Glassnode

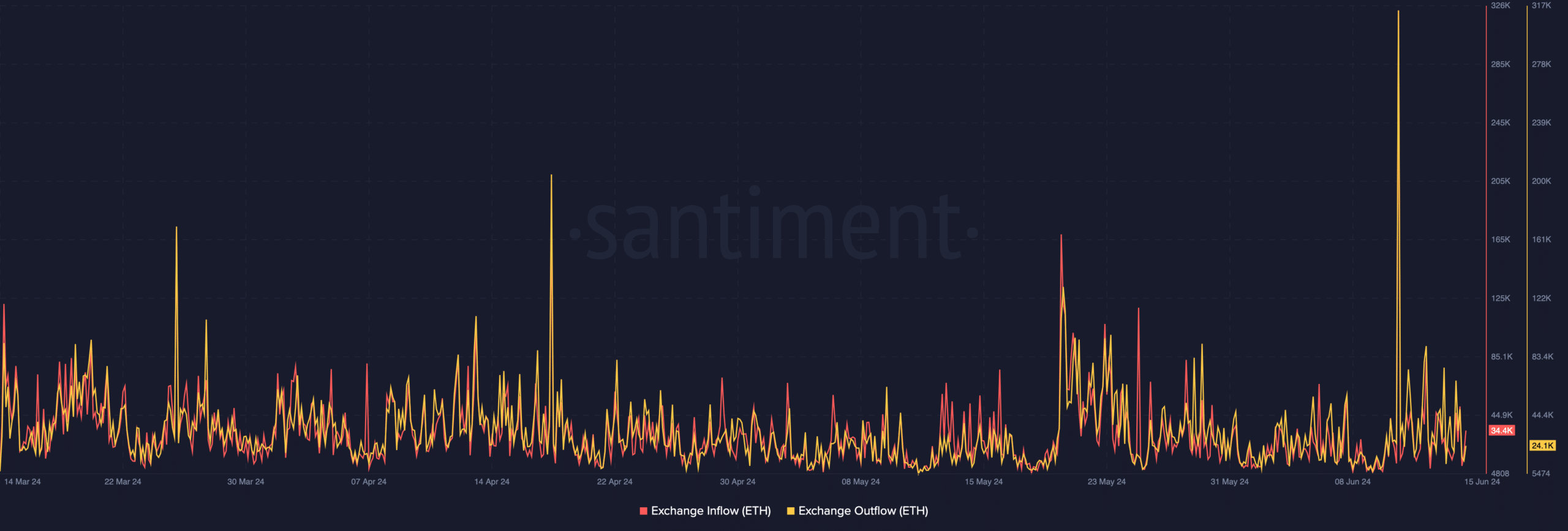

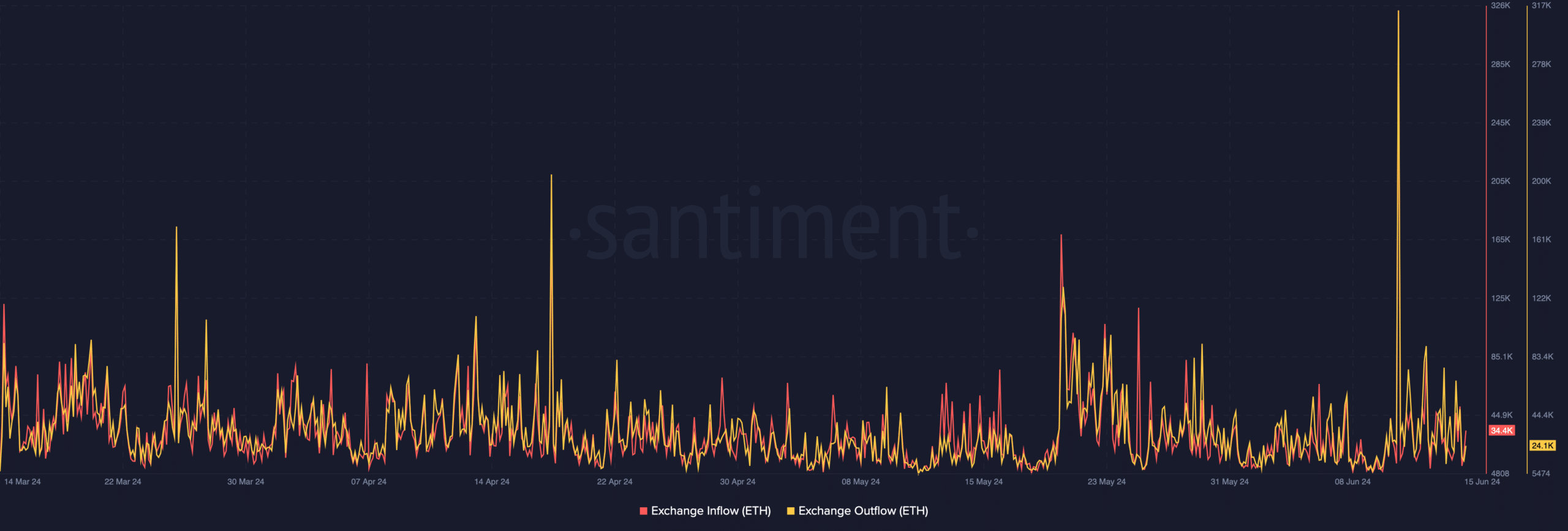

AMBCrypto too Analyzed Exchange inflows and outflows to evaluate the next movement of ETH. Exchange flows track the number of currencies sent on exchanges.

If this increases, it means that stockholders are planning to sell. When this happens, the price of the cryptocurrency usually declines. On the other hand, exchange outflows measure the number of currencies sent from exchanges.

At press time, inflows to the Ethereum exchange amounted to $34,400 while outflows to the altcoin amounted to $24,100. The difference in flows indicates that there are more Ethereum for sale than those retired into cold wallets.

Source: Santiment

Read about Ethereum [ETH] Price forecasts 2024-2025

If this continues, the price of the cryptocurrency may fall below $3,400 as it happened on June 14. On the other hand, a decrease in selling pressure may halt this decline and ETH may continue to consolidate on the charts.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings