We want to hear from our readers who have stories to share about the effects of rising costs and a changing economy. If you would like to share your experience, write to [email protected]. Please write your name and the best way to reach you. A reporter may be in touch.

High-income families feel the inflation crisis.

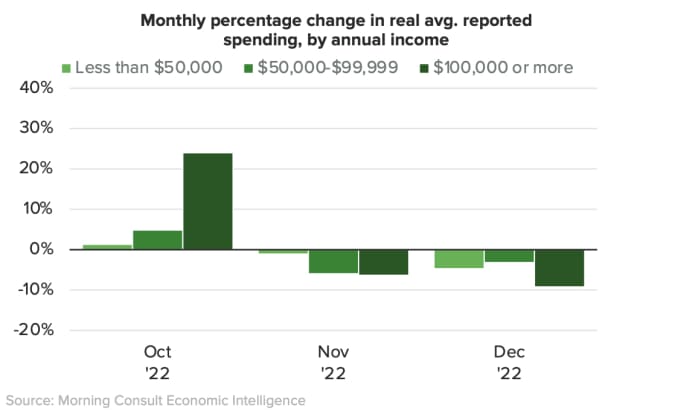

Consumer spending slowed and household finances weakened across all income levels last month. But households earning $100,000 a year or more reported cutting back on spending more than less affluent households did. According to a report It was released this week by Morning Consult, a decision-making intelligence company.

The report also found that real monthly spending among US adults fell 4.3% from November to December. However, 21.3% of US adults said their monthly expenses exceeded their monthly income in December, up from 19.2% in November.

On average, households earning $100,000 a year or more said they spent about 10% less in real terms in December than in the previous month. Meanwhile, households with incomes from $50,000 to $99,999 and those making less than $50,000 per year reported that they cut their monthly spending bills by no more than 5%, on average.

The report found that overall, households cut back on entertainment, alcohol, vehicle insurance and other services in December, while spending more on hotels, gas and planes.

One theory about spending cuts: Higher earners usually have more discretionary income, and it’s possible they decided to exercise more fiscal caution after seven interest rate increases by the Federal Reserve last year. (On Wednesday, St. Louis Federal Reserve Bank President James Bullard told the Wall Street Journal in a Live interview that the Fed should not “procrastinate” in raising benchmark interest rates until they exceed 5%).

The Morning Consult report pointed to inflationary pressures. “Increased pressures on the budget caused by continued high inflation are forcing trade-offs for consumers, leading to redistribution across categories,” she said. “For example, as the cost of food has increased over the past year, American households have absorbed an increase in grocery purchases by spending less at restaurants.”

Earlier last year, higher-income households led consumer spending in the face of rising prices, said Kayla Brun, an economic analyst with Morning Consult and co-author of the report. But household income, even for those making six-figure incomes, hasn’t grown fast enough to keep up with inflation, she said.

They may be starting to realize, ‘Hey, I can’t keep buying the same basket of goods every month and expect to keep adding to my savings,’ Brun told MarketWatch.

Meanwhile, Brune said recent layoffs in the high-income tech and financial sectors may have also affected sentiment among wealthier households.

She added that the technology and financial sectors felt the impact of higher interest rates and economic headwinds. Goldman Sachs

p,

And Black stone

BLK,

They said earlier this month that they would cut their jobs. Microsoft Corp. MSFT,

Plans confirmed on Wednesday to lay off about 10,000 workerswhich equates to about 5% of the company’s global workforce.

Before Microsoft announced, data Compiled by the layoffs.fyi website, it has been estimated that more than 25,000 global employees were laid off in the tech sector in the first few weeks of 2023. Last year, nearly 60,000 people were laid off in the tech industry, according to Challenger, Gray & Christmas.

However, there was some good news: Inflation eased in December for the sixth straight month: The annual rate of inflation fell to 6.5% from 7.1% in November after hitting a four-decade high of 9.1% last summer.

Also read:

Microsoft will lay off 10,000 workers. If you get fired from your tech job, what’s your next step?

Inflation hit rural people, Hispanics, and blacks the hardest for one main reason

Soaring medical costs made more Americans postpone care last year

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings