Vineeta Agarwala is general partner of Andreessen Horowitz

Andreessen Horowitz’s move to join Elon Musk’s bid to buy Twitter threatens to cause conflict between company founder Mark Andreessen, who sits on the board of Meta Platforms Inc. Competition on social networks.

Andreessen Horowitz has agreed to invest $400 million in the Twitter acquisition deal, part of the $7.1 billion in new funding commitments announced Thursday. That put one of Facebook’s biggest early backers, who changed his name to Meta last year, into the new owner of Twitter.

The company’s co-founder Ben Horowitz said in a tweet that Musk was probably the only person in the world with the “courage, intelligence and skills” to fix Twitter’s problems and “build the public arena we all hoped and deserved.”

Andreessen Horowitz’s post raised questions about the VC firm’s ties to Meta, where Marc Andreessen has served as a board member since 2008. Although it’s not uncommon for Silicon Valley investors to have a hand in competing startups, potential conflicts could be more Get serious with business traded firms, said John Coates, a professor at Harvard Law School.

“It’s safe to say that Silicon Valley standards on disputes – where they are often tolerated or even encouraged, in a culture aligned with the phrase ‘all this gets thrown in the wash’ – are dangerous to convey to the corporate world.”

A representative for Andreessen Horowitz said he intends to seek legal advice to ensure compliance with any rules about sharing Twitter information with the company.

Andreessen, 50, is under scrutiny for past potential Meta disputes, such as investing in companies — including Oculus VR — that he ended up buying on Facebook. At one point, he was sued by investors for advising Meta CEO Mark Zuckerberg on how to protect his control of majority voting even if he sold his shares.

On Twitter, Andreessen has been publicly supportive of Musk, and has criticized the content moderation policies of social media companies. Musk said he plans to relax the rules if he takes charge of Twitter.

Since the investor is not on Twitter’s board of directors, his relationship with meta may not be an issue, said David Larker, a professor at Stanford University. “Although I don’t know any way to tell from public data, I do believe that many CEOs and board members trade in their competitors’ stock,” he said.

Twitter, while much smaller than Facebook, is a dead competitor, vying for digital advertising dollars and user posts. When the Twitter board was assessing whether to take Musk’s bid, they considered the recent drop in Meta’s valuation as part of their deliberations, according to a person familiar with the matter. In the end, they concluded that the billionaire’s offer was fair.

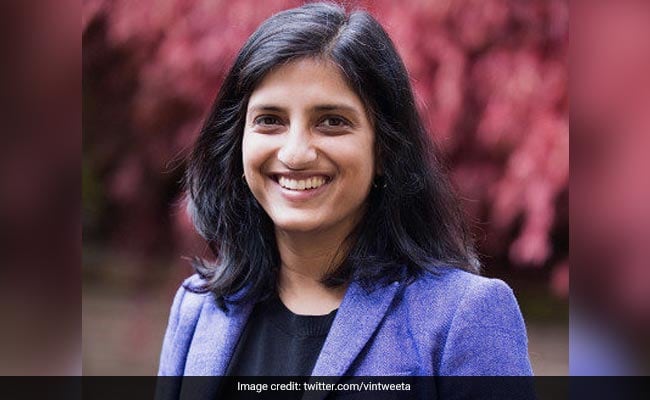

Andreessen isn’t the only partner in his venture company whose current relationships may become more complicated after the Musk deal is completed. Vineeta Agarwala, general partner at Andreessen Horowitz that invests in biotech and medical companies, is married to Twitter CEO Parag Agrawal. It is unclear whether Agrawal will remain as CEO under Twitter once Musk takes over, but Musk previously said he made his bid to acquire Twitter in part because he did not trust the company’s current leadership.

On Thursday, CNBC reported that Musk plans to take over as CEO for a short period after the deal closes.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings