CNBC’s Jim Cramer on Thursday provided investors with a list of stocks he thinks might be worthwhile additions to investors’ portfolios.

All of his picks are listed on the Nasdaq Composite. While the index is full of tech stocks that took a beating last year, there are still names that could perform well even in a recessionary environment, according to Kramer.

“In an index that’s been folded, spun, and mutilated, I still feel good about a few of these stocks,” he said.

Here are his choices:

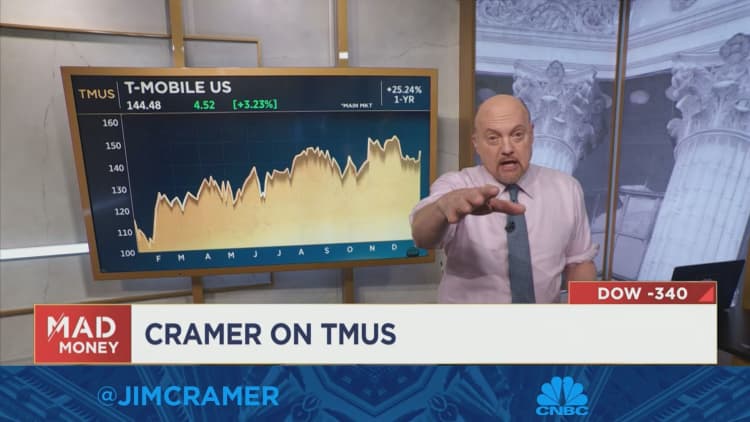

T-Mobile

- Kramer said he expects the company to continue to take market share from competitors.

Regeneron Pharmaceuticals

- “Regeneron has an extensive pipeline with ridiculously cheap inventory. I think it’s a really excellent situation, especially if you’re anticipating a severe recession,” he said.

PepsiCo

- He said rival beverage giant Procter & Gamble is the best consumer packaged goods company in the US when it comes to it, though he acknowledges the stock’s valuation is a bit higher than he’d like.

American Electric Power

- Kramer said he likes the stock because the company is well-managed, and utility stocks tend to do well during an economic downturn.

dollar tree

- While he likes the stock compared to other Nasdaq-listed retailers, Kramer said he still prefers it TJX Companies.

Disclaimer: Cramer’s Charitable Trust owns shares in TJX companies.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings