Effective cash tax rates

One of the most profitable companies since 2019

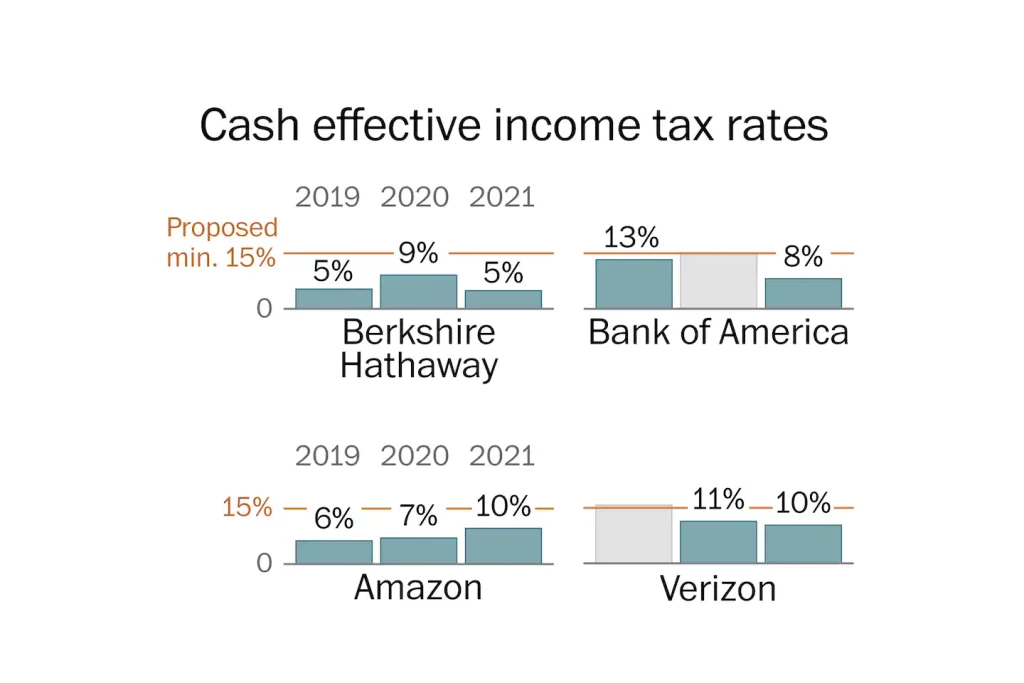

Berkshire Hathaway, Amazon and Intel have paid less than 15 percent in taxes globally in each of the past three years.

Technology companies including Alphabet

Reduce their tax bills by reporting income

In countries with low rates

Source: Washington Post analysis

From Calcbench Data

Effective cash tax rates

One of the most profitable companies since 2019

Berkshire Hathaway, Amazon and Intel have paid less than 15 percent in taxes globally in each of the past three years.

Tech companies, including Alphabet, cut their tax bills by reporting income in countries with lower rates.

Source: Washington Post Calcbench data analysis

Effective cash tax rates

One of the most profitable companies since 2019

Berkshire Hathaway, Amazon and Intel paid less than

15% of taxes worldwide in each of the last three years

Tech companies, including Alphabet, cut their tax bills by reporting income in countries with lower rates.

Source: Washington Post Calcbench data analysis

Effective cash tax rates

One of the most profitable companies since 2019

Berkshire Hathaway, Amazon and Intel have paid less than 15 percent in taxes globally in each of the past three years.

Tech companies, including Alphabet, cut their tax bills by reporting income in countries with lower rates.

Source: Washington Post Calcbench data analysis

Tax credits and deductions are purposefully designed as tools to incentivize certain behaviors. But because it reduces corporate tax bills, it will eliminate the effectiveness of minimum taxes. Companies can still use the deductions for research and development, investment expenses, and more to lower their tax bills. Democrats Marquee climate proposal It comes in the form of tax credits – which are also exempt from the minimum corporate tax rate.

Because of these exemptions, it will still be possible for profitable companies to achieve a tax rate of less than 15 percent, Daniel Boone, executive vice president of the Tax Foundation, said in an email.

The proposed minimum tax would raise $220 billion over 10 years, according to To the Joint Committee on Taxation, a nonpartisan parliamentary body that analyzes tax bills. The minimum tax rate applies to companies that have reported an annual average of $1 billion in annual profits to shareholders over a three-year period.

More than 250 companies in the S&P 500 have averaged pre-tax income of more than $1 billion over the past three years, according to a Washington Post analysis of Calcbench data. Of those, 83 paid less than 15 percent in income tax globally. The list includes technology companies such as Amazon and Intel, banks such as Bank of America and US Bancorp, telecom giants Verizon and AT&T, and other familiar names such as General Motors and UPS.

The rate is calculated according to global income, which means that a company can, in theory, “have an effective domestic tax rate of less than 15 percent as long as its foreign earnings are above tax,” said Kyle Pomerleau, senior fellow at the American Enterprise Institute. , he said in an email.

President Biden often notes that 55 companies are profitable Pay any federal income tax in 2020, according to an analysis by the Institute for Tax and Economic Policy, a liberal think tank.

It avoids the talking point that companies often pay different amounts in taxes from year to year. But it points to a truism Democrats are aiming to fix: In the long run, many businesses pay less than the current 21 percent corporate tax rate.

Some companies avoid federal income taxes by redirecting revenue to the countries in which they operate at low tax rates. Until the end of 2019, Alphabet, the parent company of Google, licensed its intellectual property rights from Bermuda – an offshore tax haven. Alphabet reports that the global effective tax rate in 2018 and 2019 was cut by billions because “all” of its foreign income was earned through its Irish subsidiary, according to Securities Deposit.

Businesses also reduce their taxes through deductions and credits. Amazon cut $3 billion from its tax bills from 2019 to 2021 through its use of stock-based compensation and another $2.2 billion for other tax credits including one for research and development, according to Securities Deposits. The company reported $4.1 billion in federal tax expense for those years on $69.4 billion in U.S. pre-tax earnings — an effective federal rate of less than 6 percent. (Jeff Bezos, founder of Amazon, owns The Post.)

to me Get support Senator Kirsten Senema (D-Arizona), Democrats amended their minimum rate proposal to exclude deductions for certain investments and exemptions Companies owned by private equity. These last-minute changes will help some ultra-profitable companies pay less than the minimum rate.

This analysis was based on data from Calcbench, which was pulled from the company’s filings with the Securities and Exchange Commission. The graph displays cash-effective tax rates (tax expenses divided by pre-tax income). The chart includes the 20 most profitable companies in recent years that revealed enough numbers to do the math.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings