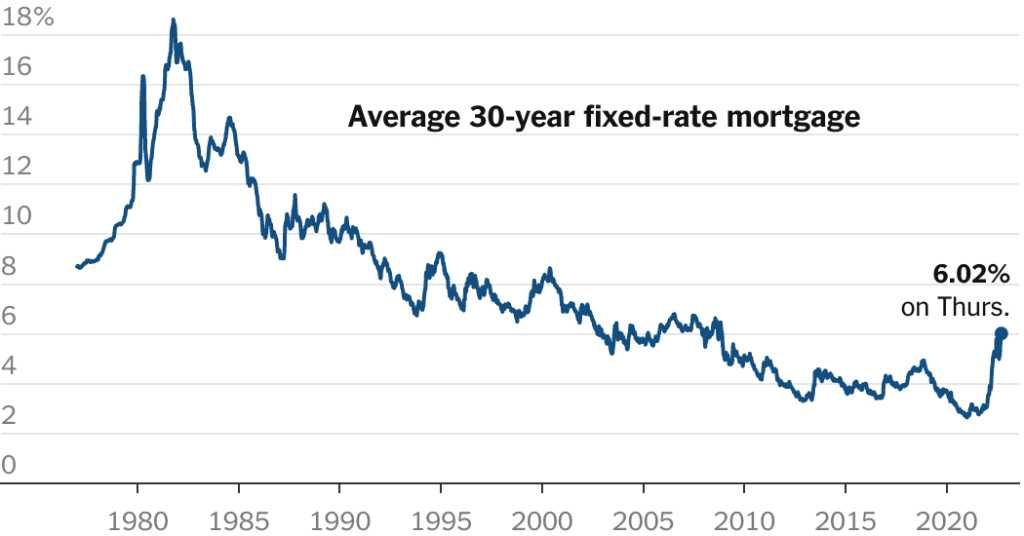

As inflation worries persist, mortgage rates soared to more than 6 percent this week, their highest point since late 2008 and more than double their level a year ago, adding to pressure on potential homebuyers’ budgets and easing the hot housing situation. . Market.

Mortgage rates have been on the rise since the beginning of the year as the Federal Reserve reiterated its commitment to raise its key interest rate to tame high consumer prices. With inflation remaining stubbornly high In August, the Fed is expected to raise the federal funds rate again when it meets next week. she has Rates already increased 2.25 percentage points in four measures since May.

Mortgage rates do not directly follow the Federal Reserve’s key interest rate, as credit cards do, but are influenced by it. Instead, they tend to track the yield on 10-year Treasuries, which are driven by inflation expectations and expectations about Fed action.

“The housing market is the most sensitive to Fed policy,” said Lawrence Yun, chief economist at the National Association of Realtors. “High inflation requires the Fed to be more aggressive than previously assumed, so the broad bond market — including the mortgage market — has responded.”

The average 30-year mortgage rate, the most popular mortgage loan, was 6.02 percent as of Thursday, I mentioned Freddy Mac, up from 5.89 percent in the previous week. The similar loan rate averaged 2.86% in the same week of 2021.

Inflation FAQ

What is inflation? Inflation is a Loss of purchasing power over time, which means your dollar won’t go away tomorrow the way it did today. It is usually expressed as the annual change in the prices of everyday goods and services such as food, furniture, clothing, transportation, and toys.

The price increase will help cool the housing market, but the number of homes for sale is still not enough to meet demand, Sam Khater, chief economist at Freddie Mac, said in a statement.

“This indicates that while house price declines are likely to continue, they should not be significant,” he said.

The 30-year fixed rate mortgage rate may feel particularly high given its recent history; It was 3.72 percent at the start of 2020 and has spent most of the past two years less than 3 percent. However, from a longer perspective, rates have averaged about 7.8 percent over the past half century, according to Freddie Mac, who began tracking borrowing costs in 1971. In the early 1980s, rates stretched to double digits, well above 18 percent In 1981. .

But the combination of high mortgage rates and inflated home prices has greatly limited what potential home buyers can afford, driving many of them out of the market.

With 10% down payment on average house The price is listed In the database on Realtor.com, typical monthly mortgage payments are now about $2,352, up 66 percent from $1,416 last year, taking into account rising home prices and interest rates.

And that doesn’t take into account other expenses — such as potentially high closing costs, along with property taxes, home and mortgage insurance, which are often required with down payments of less than 20 percent.

Glen Kellman, CEO of Redfin Real Estate Broker, said: announced in June It will cut about 8 per cent of its workforce due to reduced demand. “It’s just a really under-traffic market. It’s hard to put deals together.”

Higher rates were certainly a driving factor, but the uncertain economic outlook also played a role. “Some people decided: I can’t buy a house,” Mr. Kellman said. “Others are appalled: ‘I’m worried about the stock market.’” I worry about my job and the broader economy. “

Understand inflation and how it affects you

Demand fell quickly. Mortgage applications were largely flat in the week ending September 9, up 0.2 percent from the previous week, according to a report. Data from the Mortgage Bankers Association. But orders are down about 29 percent from the previous year.

Demand for refinancing is also down: Home loan refinancing requests are down about 4 percent from last week, but down 83 percent from the same week a year earlier.

He said home sales are down 13 percent year-on-year so far Salma Heib, chief economist at CoreLogic, a real estate data analytics company. “Further increases in mortgage rates, above 6 percent, over a 30-year fixed rate mortgage will exacerbate affordability challenges,” she said.

Ms Hebb said home price growth has also slowed, but the current “recalibration” is a positive result of higher rates. “All of these were the intended consequences of tightening financial conditions and implying better housing markets going forward,” she said.

There can be other ripple effects. As home sales decline, more people will continue to rent, which can lead to higher rental costs.

“Rising rents are taking a toll on consumer price inflation,” said Mr. Yun of the National Association of Realtors. “In a sense, in the short term at least, raising interest rates will increase inflation.

And if higher rates cause more homeowners to stay home — unwilling to swap affordable mortgages for more expensive ones — the home stock could shrink even further. “Only by significantly increasing the supply of homes, both apartments and property, will home prices and rents come under control,” Yoon added.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings