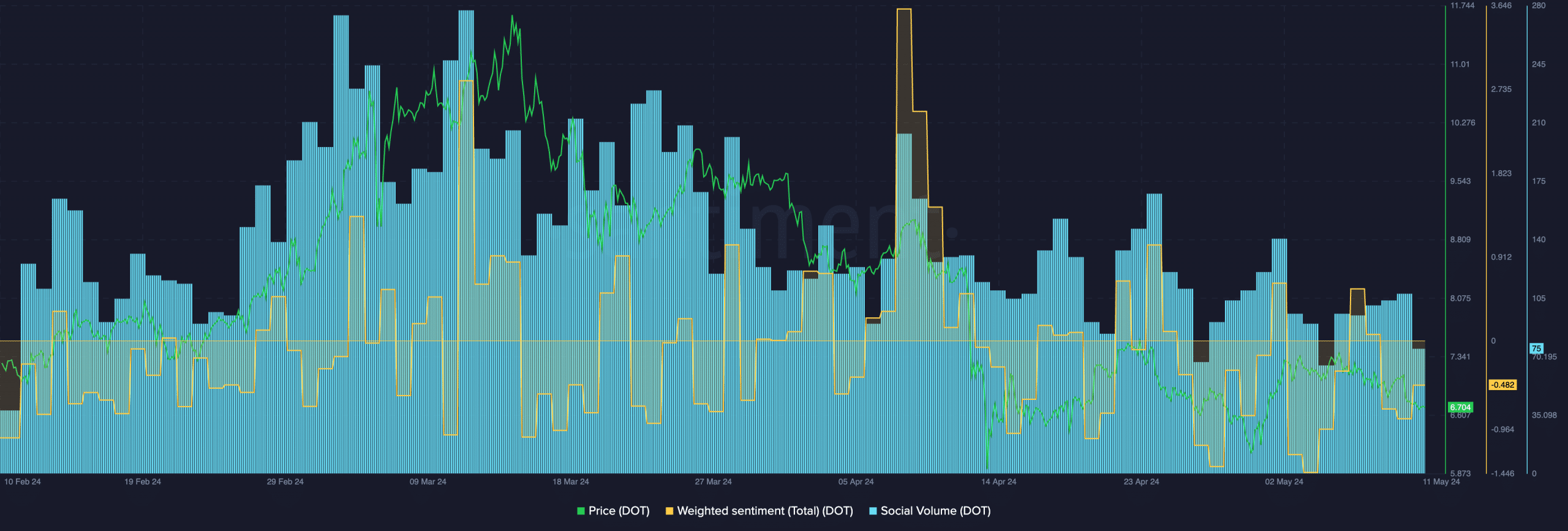

- The social activity of the Polkadot network has decreased significantly in the past few days.

- Overall activity on the network also decreased.

Dotted [DOT] It was one of the L1s that didn’t see as much growth as its counterparts. One reason for this is Polkadot’s declining popularity across social media platforms.

Word on the street

AMBCrypto’s analysis of Santiment data revealed that Polkadot’s social volume has decreased significantly. Furthermore, weighted sentiment around DOT has declined meaningfully.

Source: Santiment

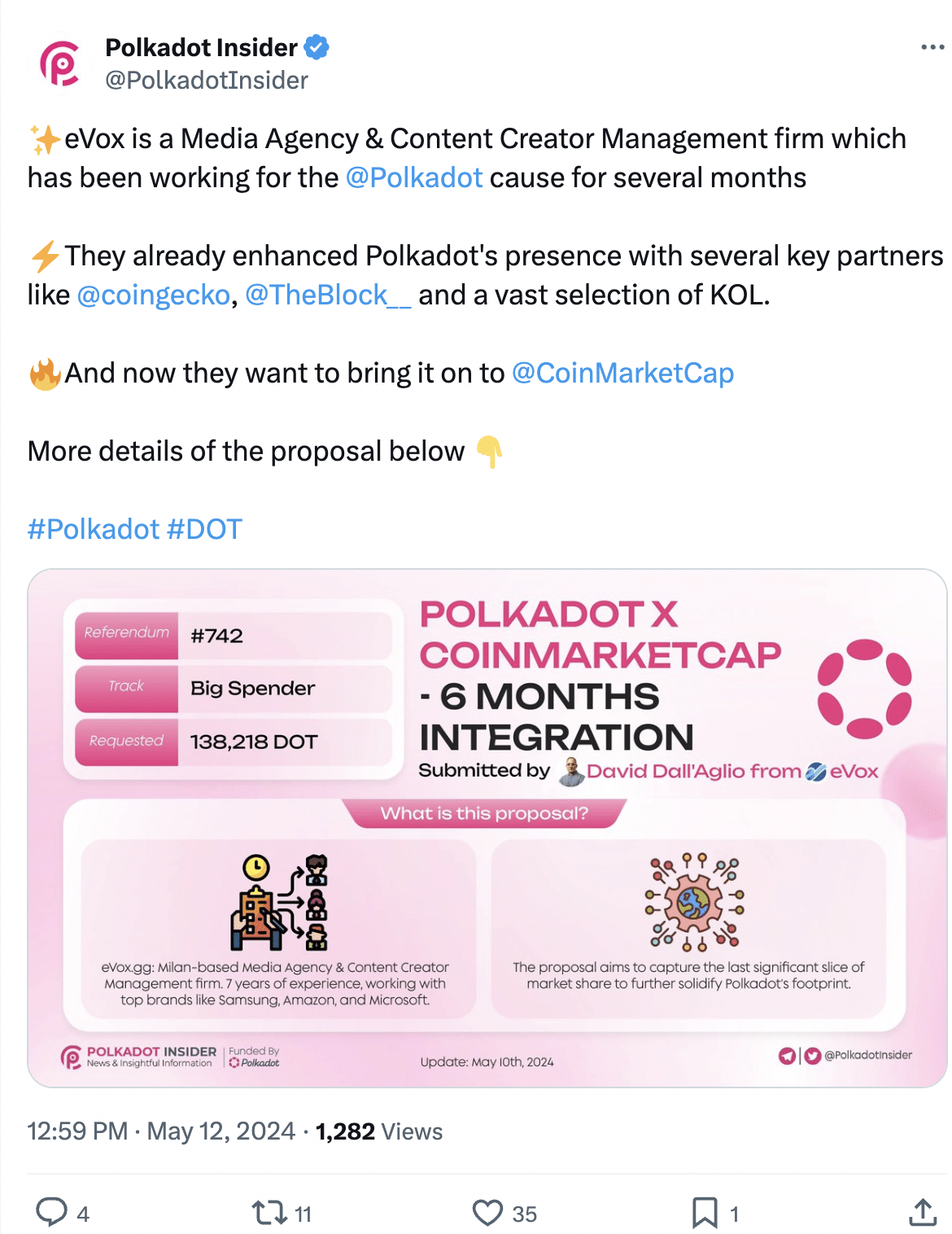

However, Polkadot is actively collaborating with a media agency to raise awareness of the network.

eVox, a media agency and creator management company, has dedicated several months to promoting Polkadot’s cause.

Nowadays, they aim to expand these outreach efforts to include CoinMarketCap.

Source: X

It remains to be seen whether Polkadot’s efforts to improve its popularity can yield positive results in the long term.

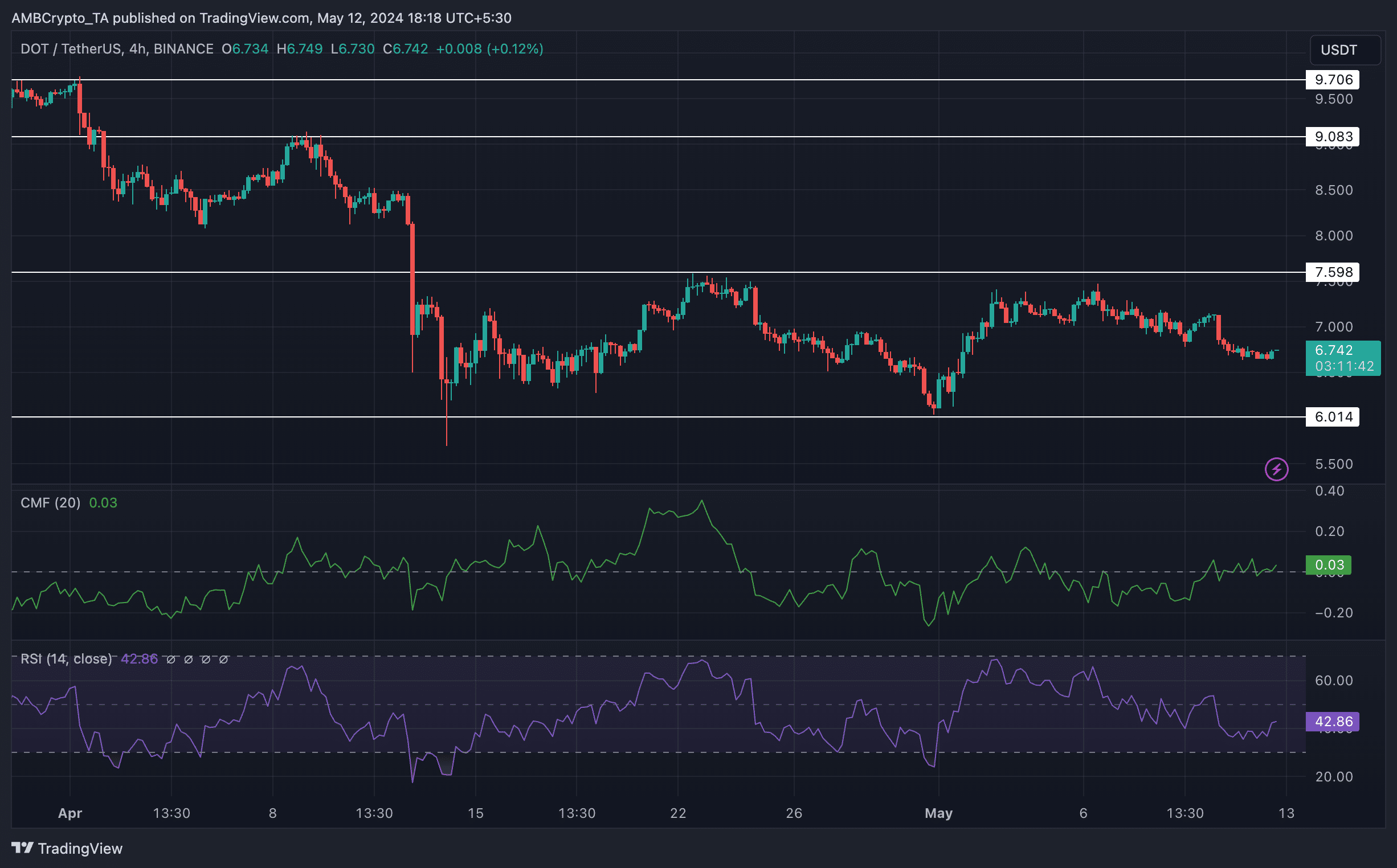

Consider the price

DOT hasn’t done well in terms of price action either. Since April 1, its price has decreased by 27.96%. During this period, DOT displayed several lower lows and lower lows, indicating a downtrend.

Moreover, the CMF (Chaikin Money Flow) of DOT grew slightly, which means that there may be a slight increase in money flow for DOT in the future.

However, the RSI fell to 42, indicating that the bullish momentum has decreased significantly. DOT will need to retest the $7,598 level several times before it can begin its journey higher.

Source: Trading Offer

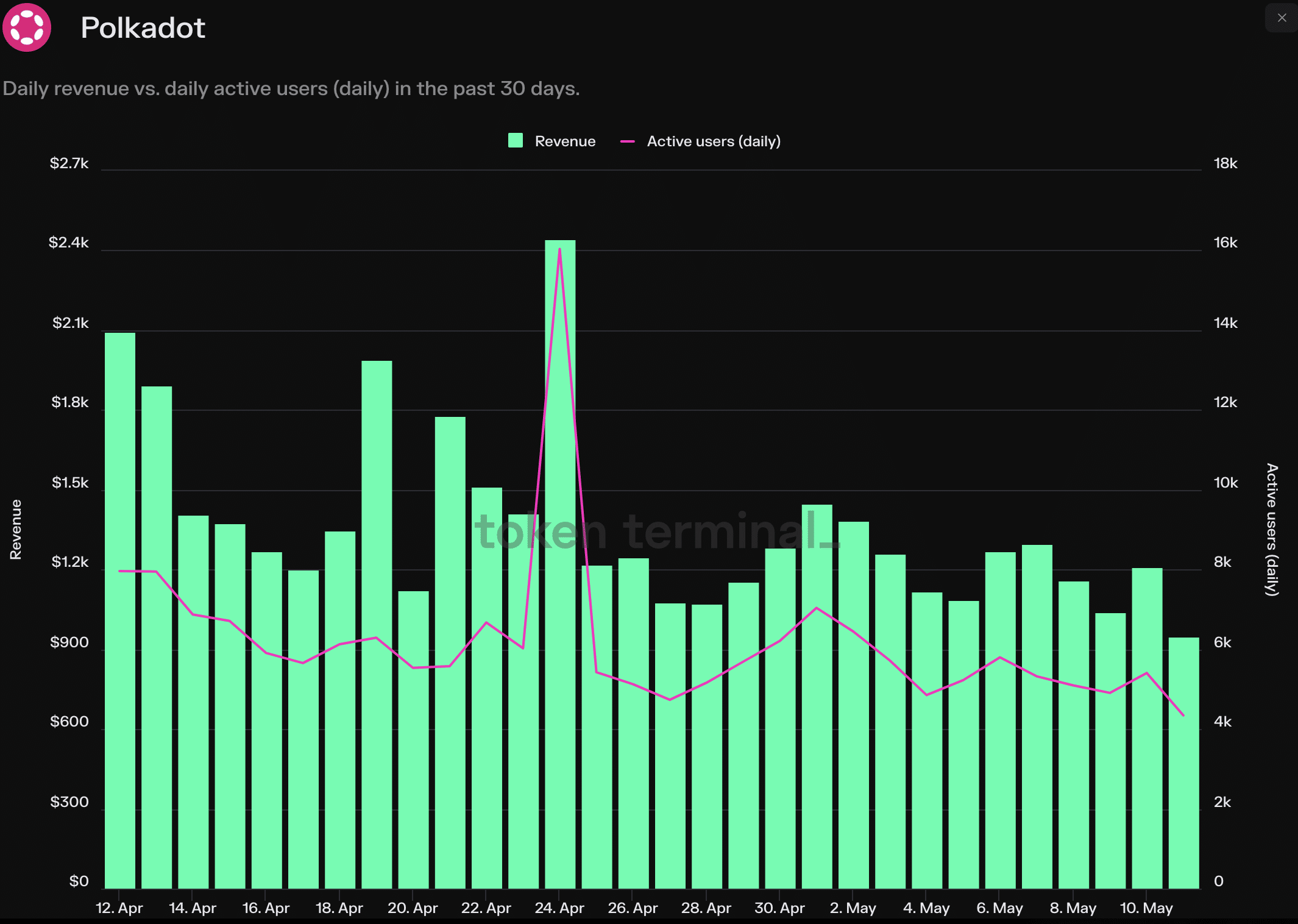

Speaking of the state of protocol, the situation looked absolutely dire. The number of active users on the Polkadot network has decreased significantly over the past 30 days.

Revenue generated by the network also decreased during this period.

Read Polkadot [DOT] Price forecasts 2024-25

These factors suggest that not only was DOT not doing well in terms of price and social activity, but the overall strength of its ecosystem was also declining.

It may be difficult for DOT to recover if things continue like this.

Source: Token Station

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings