Changing the rule will help Singapore better compete with rival malls

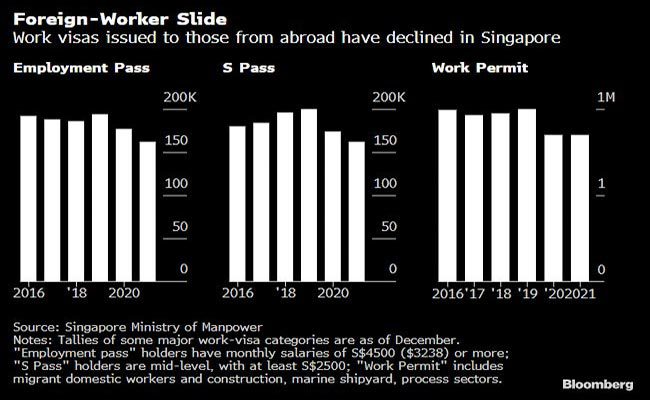

Singapore is reforming visa rules to attract foreign workers and ease labor market restrictions that are contributing to wage and price pressures.

The new rules will allow foreigners who earn at least 30,000 Singapore dollars (21,431 US dollars) a month to secure a five-year work permit, with a condition that their dependents are allowed to look for work, according to the Ministry of Manpower. Exceptional candidates in the fields of sports, arts, sciences and academia who do not meet the salary criteria are also eligible for a long-term visa under the so-called Experience and External Networks (ONE) which will come into effect on January 1.

“Both companies and talent are looking for safe and stable places to invest, live and work in. Singapore is a place like this,” Manpower Minister Tan Si Ling told reporters on Monday. “So it’s time to take advantage of this opportunity to cement Singapore’s position as a global talent hub.”

The announcement is the latest in a series of decisions this year aimed at tackling a still-tight labor market, as well as attracting international business to advance the city-state’s ambitions as a global financial hub, after a pandemic-era slump in white-collar workers from abroad. Many parts of the economy have seen wage increases this year to attract talent, fueling fears that the wage escalation and its costs will add to core inflation that touched a 14-year high and force the central bank to tighten monetary policy further.

From September 1 next year, Singapore plans to exempt jobs, similar to those held by the top 10% of Employment Permit holders, from the need to advertise them locally before hiring foreigners under a system called the Fair Thinking Framework. The duration of FCF announcements, where applicable, will be halved to 14 days, the ministry said, adding that the processing time for all EP applications will be reduced to 10 working days from the current maximum of three weeks.

The rule change will help the city-state better compete with rival business hubs such as Hong Kong and the United Arab Emirates and catch up with Australia and the United Kingdom, which have similar global talent visas. More than 700 finance professionals moved to Singapore from Hong Kong last year, according to recruitment firm Robert Walters.

The United Arab Emirates this year made it easier for expats to work without employer sponsorship, as well as switching to the weekend from Saturday to Sunday to align the country with global markets in its quest to win more business, with Dubai positioning itself as a major digital currency hub.

Singapore has had to contend with particularly tough labor market dilemmas as the nation grapples with Covid and the need to recharge sectors such as hospitality and food and beverage that have suffered disproportionately amid social mobility restrictions that were recently lifted.

The main measure that measures the imbalance between demand and supply for workers rose earlier this year to the highest level since 1998. This trend is a risk to productivity in the economy, which officials expect to grow 3%-4% this year, is narrower. from the 3%-5% seen before – a pace that will be among the slowest in Southeast Asia.

Minister Tan said the country is seeing an easing of labor market tightness, adding that the supply of labor in manufacturing and construction, among others, has almost returned to pre-Covid levels.

The problems lie at the higher end of the income ladder – where Singapore wants to attract the best global talent especially in the next generation, tech-heavy industry – as well as the lower end. The government has drawn criticism during the pandemic that treatment and broader policies for migrant workers primarily employed in the construction industry need to be restarted.

“This is an era when talent makes all the difference in a nation’s success,” Prime Minister Lee Hsien Loong said in his National Day address on August 21. “We need to focus on attracting and retaining the best talent, in the same way we focus on attracting and retaining investments.”

(This story has not been edited by the NDTV crew and is automatically generated from a shared feed.)

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings