(Bloomberg) — European stocks rose, tracking gains in Asia, as investors awaited U.S. price data that could offer guidance on the Federal Reserve’s policy path.

Most Read from Bloomberg

The Stoxx Europe 600 index rose 0.3% at the open, led by financial services and banks. U.S. stock index futures rose after a quiet day on Wall Street. Asian shares rose, recovering from last week’s rout, supported by a gain in Japan.

Sterling rose after data showed the UK unemployment rate fell unexpectedly in the second quarter, raising doubts about the pace of monetary policy easing by the Bank of England. U.S. Treasuries and the dollar were steady.

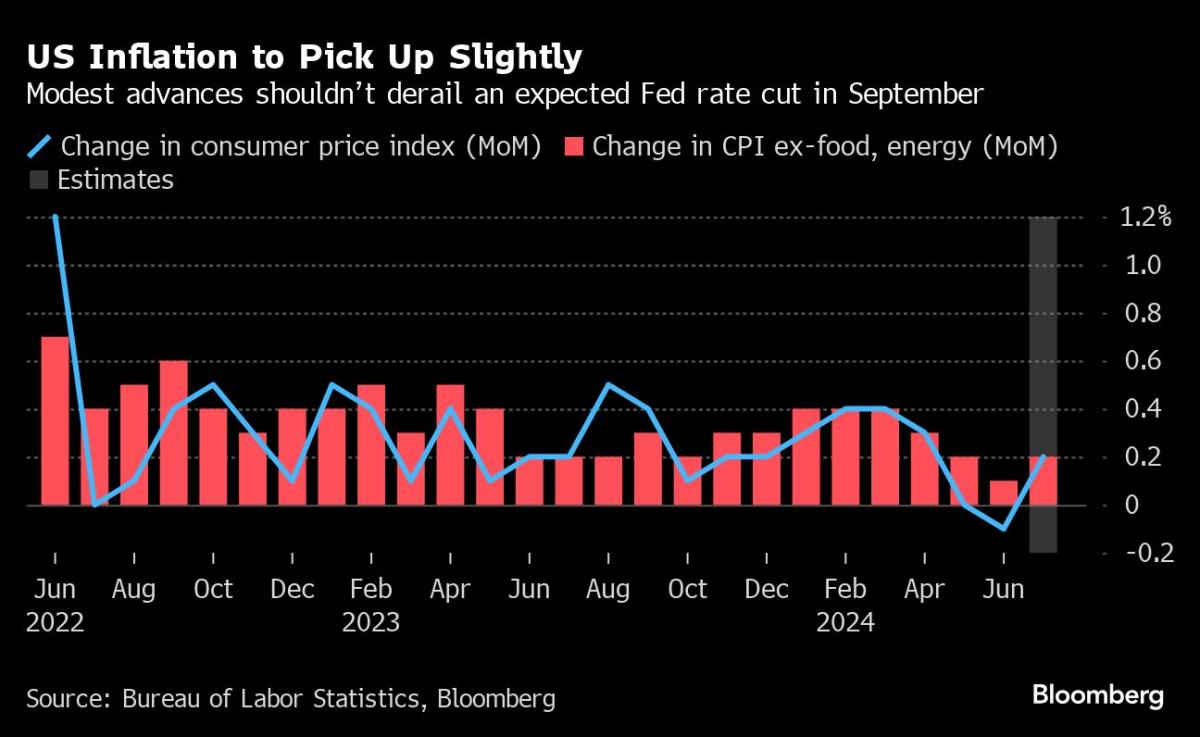

After last week’s turmoil, markets are now focused on Wednesday’s US CPI to see whether the Fed will act more freely or more cautiously to ensure a soft landing for the economy. The recent surge in crude oil prices is also highlighting producer price figures due later on Tuesday as a sign of inflationary risks from pipelines.

“The first wave of carry trades on the yen should be complete by now, and investors are now focused on US inflation and retail sales data to gauge the chances of a soft landing. Risk sentiment has improved,” said Linda Lam, head of financial advisory North Asia at Union Bancaire Privé.

Japanese stocks rose after a holiday, as a weaker yen supported exporters. The MSCI Asia-Pacific index rose about 1%. That erased losses from last week’s slide, when a risk-off move sent indexes around the world tumbling and the U.S. volatility index topped 65 at one point, compared with an average of about 19.5.

“The market’s reaction to last week’s rise in the volatility index reflects a reassessment of the situation rather than just US data points or a deconstruction of yen yields,” said Billy Leung, investment strategist at GlobalX Management in Sydney. “However, it is important to be cautious in reading short-term moves in Asia, given signs of foreign outflows and reduced liquidity.”

Brent crude held near Monday’s $82 level as the United States sees an Iranian attack on Israel as increasingly likely. Fitch Ratings cut Israel’s sovereign debt by one notch and kept the credit outlook negative as the military conflict drags on the country’s finances. Treasury bonds held gains on Monday.

Elsewhere in Asia, regulators in China’s Jiangxi province have told commercial banks not to settle their purchases of government bonds, taking some of the most drastic measures yet to cool a market rally that has alarmed Beijing.

The crackdown is starting to have an impact on corporate debt markets, with the average yield on one-year yuan-denominated corporate bonds with an AA rating — typically considered junk debt in the domestic market — seeing its biggest jump since December 2022.

Main events this week:

-

German ZEW survey forecast, Tuesday

-

US Producer Price Index, Tuesday

-

Fed’s Raphael Boucek speaks Tuesday

-

Eurozone GDP, Industrial Production, Wednesday

-

US CPI, Wednesday

-

China housing prices, retail sales, industrial production, Thursday

-

US Initial Jobless Claims, Retail Sales, Industrial Production, Thursday

-

Alberto Musallam and Patrick Harker speak on Thursday.

-

U.S. housing starts, University of Michigan consumer confidence index, Friday

-

Federal Reserve Board Member Austin Goolsbee speaks Friday

Some key movements in the markets:

Stocks

-

The Stoxx Europe 600 index was up 0.3% by 8:18 a.m. London time.

-

S&P 500 futures rose 0.5%.

-

Nasdaq 100 futures rose 0.8%.

-

Dow Jones Industrial Average futures rose 0.3%.

-

The MSCI Asia Pacific Index rose 1.1%.

-

The MSCI Emerging Markets Index saw little change.

Currencies

-

The Bloomberg Dollar Index was little changed.

-

The euro was little changed at $1.0929.

-

The Japanese yen fell 0.5% to 147.90 yen per dollar.

-

The offshore yuan was little changed at 7.1760 per dollar.

-

The pound rose 0.2% to $1.2800.

Cryptocurrencies

-

Bitcoin rose 1% to $59,433.28

-

Ether fell 0.8% to $2,659.39.

Bonds

-

The yield on the 10-year US Treasury note rose one basis point to 3.91%.

-

The yield on the 10-year German bond was little changed at 2.23%.

-

The yield on 10-year British bonds rose one basis point to 3.93%.

Goods

-

Brent crude fell 0.5% to $81.91 a barrel.

-

Spot gold fell 0.4 percent to $2,462.42 an ounce.

This story was produced with the help of Bloomberg Automation.

–With the assistance of Jason Scott.

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings