(Bloomberg) — The Taiwanese semiconductor maker delivered a better-than-expected revenue outlook and stuck to its plans to spend up to $32 billion in 2024, supporting expectations of sustained growth in demand for artificial intelligence.

Most read from Bloomberg

These expectations came after the first quarterly increase in profits in a year, after strong demand for artificial intelligence revived growth in Asia's largest company. Major chip maker Nvidia Corp. and Apple Inc. Revenue ranged from $19.6 billion to $20.4 billion in the June quarter, beating estimates by $19.1 billion.

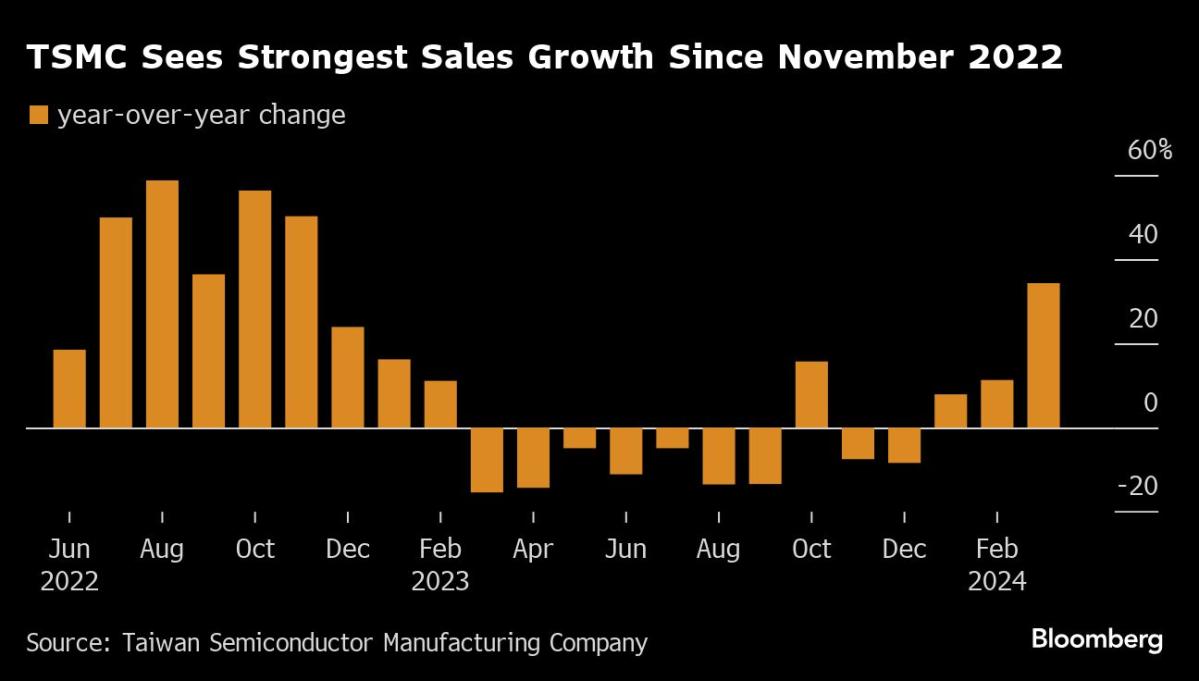

These forecasts may help calm some investors who worry that demand for artificial intelligence will not hold up, or that the smartphone recovery may be longer in the future. Just last week, TSMC revealed the fastest sales growth since 2022, suggesting that demand for chips that accelerate the development of artificial intelligence is starting to offset the fallout from the decline in the smartphone market. Apple, which accounted for about a quarter of TSMC's revenue in 2023, started the year with a deep decline in iPhone sales.

Inside TSMC Chairman Leo's short but influential reign: Tim Culpin

However, TSMC CEO CC Wei said the company is reviewing its 2024 semiconductor market growth forecast — excluding memory chips — to about 10%, from above that number. He also trimmed his growth forecast for the foundry sector, which is led by TSMC. But it clung to expectations of spending between $28 billion and $32 billion on expanding and modernizing capabilities this year.

“Looking at 2024 as a whole, macroeconomic and geopolitical uncertainties remain, which may impact consumer sentiment and end-market demand,” Wei told analysts on a conference call.

For a live blog on TSMC's earnings, click here.

TSMC continues to expect revenue growth of at least 20% this year as the broader semiconductor market recovers, although uncertainty remains given global macroeconomic volatility. Leading supplier ASML Holding NV – the only supplier of the world's most advanced chipmaking machines – reported a 22% loss in first-quarter bookings on Wednesday.

The Taiwanese chipmaker said it will begin mass production of next-generation 2-nanometer chips in the fourth quarter of 2025, executives said, narrowing its timeframe from next year overall. Wei added that TSMC's auto business will decline this year, versus previous expectations of an increase, without going into details.

TSMC has gained about $340 billion in market value since its October 2022 low, riding on bets that it will become one of the clear winners of the global boom in artificial intelligence development. On Thursday, it posted a better-than-expected 9% increase in net income to NT$225.5 billion ($7 billion) for the March quarter.

The earthquake that rocked Taiwan this month damaged some chips used in chip production, causing gross margins to decline by about 50 basis points, or 0.5 percentage point, in the June quarter, executives said.

Read more: TSMC says quake damaged some chips, resulting in small profits

In the long term, investors expect AI-focused chips to gradually account for a larger share of revenue. TSMC's AI revenue is growing at a rate of 50% annually, the company said in January.

However, some investors have warned that the current level of demand for AI chips is not sustainable in the long term. Others remain concerned given the uncertainty looming over the Taiwan Strait – the narrow body of water between China and the island it considers part of its territory.

“The demand is very high, very high, and we will do our best to increase our ability to alleviate the shortage,” Wei said of the demand for AI. “Maybe it won't be enough this year, but next year we'll try hard.”

–With assistance from Gao Yuan, Mayumi Negishi, Phil Heiskanen, and Cindy Wang.

(Updates with capex and CEO comments from second paragraph)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings