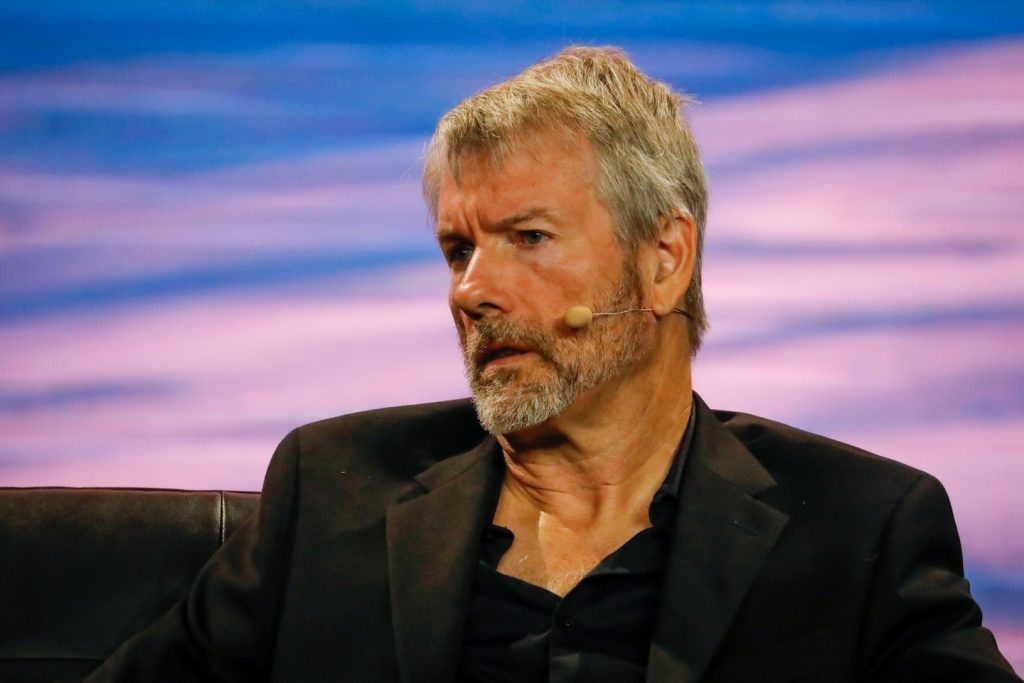

The lawsuit22 in D.C. Supreme Court, says Saylor has claimed for years to be a resident of low-tax jurisdictions despite living in a 7,000-square-foot penthouse on the waterfront in Georgetown. The complaint also alleges that MicroStrategy, despite knowing that Saylor was a resident of Washington, D.C., conspired with the scheme “instead of accurately reporting his address to local and federal tax authorities and properly withholding county taxes.” Both Saylor and MicroStrategy released statements on Wednesday, denying the allegations in the lawsuit.

The complaint alleges that Saylor purchased the Georgetown property in 2005 prior to purchasing two adjoining penthouses, merging them into a single residence that Saylor calls “Treegate,” and also purchased a penthouse unit in Adams Morgan. Beginning in 2012, according to the complaint, Saylor bought a house in Miami Beach, obtained a driver’s license in Florida and registered to vote there despite living in the capital. , despite posts on social media over the years suggesting he lived in Washington and considered it his home.

“Since at least 2012, Saylor has bragged to his confidants of his successful plan to create the illusion of Florida residency in order to evade county personal income taxes,” the complaint reads. The lawsuit alleges that MicroStrategy defrauded through an agreement to list Saylor’s residence on federal tax forms as his Florida home, despite knowing he lived in the capital, “actively helping Saylor avoid his obligation to pay county taxes.” (Florida does not have a state individual income tax.)

In his statement, Saylor said he bought the Miami Beach home a decade ago after moving from Virginia.

“Although MicroStrategy is based in Virginia, Florida is where I live, vote, and report for jury duties, and it is the focus of my personal and family life,” he wrote. Colombia, and we look forward to a fair resolution in the courts.”

Saylor founded MicroStrategy in 1998 and served as its CEO until earlier this month when the publicly traded company announced that he would take on a new role as its CEO. On August 2 new version Announcing the change of leadership, MicroStrategy said that Saylor will also remain chairman of its board.

MicroStrategy, in its own statement, denied the allegations and vowed to “vigorously defend against such abuse”.

“The case is a personal tax matter involving Mr. Saylor,” the statement said. “The Company was not responsible for his day-to-day affairs and did not supervise his individual tax responsibilities. Nor did the Company conspire with Mr. Saylor to absolve him of his personal tax responsibilities.”

Racine’s office said the lawsuit was filed with the city recently expanded The False Claims Act, which the Metropolitan Council amended last year to include tax-related issues, incentivizes whistleblowers to identify tax fraud. Racine said the law also enables the court to impose a penalty of up to three times the amount of tax evaded, and that between unpaid income taxes and other penalties his office is seeking to recover from Saylor and MicroStrategy, the damages in the case could be more than $100 million.

The lawsuit is based on a similar complaint filed against Saylor by a whistleblower in DC’s Supreme Court last year, which was not sealed Wednesday. Racine’s office said it independently investigated allegations of tax fraud and intervened in the whistleblower complaint, filing its own lawsuit against Saylor and MicroStrategy.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings