- ORDI, Stacks and Kaspa were the biggest winners this week.

- Beam, Celestia, and Lido DAO topped the list of losers this week.

Like ORDI [ORDI]heaps [STX]And a gainer [KAS] BIM stock was the biggest gainer during the week [BEAM]Celestia [TIA]And Lido Dao [LDO] It topped the other side of the chart.

Biggest winners

Orde [ORDI]

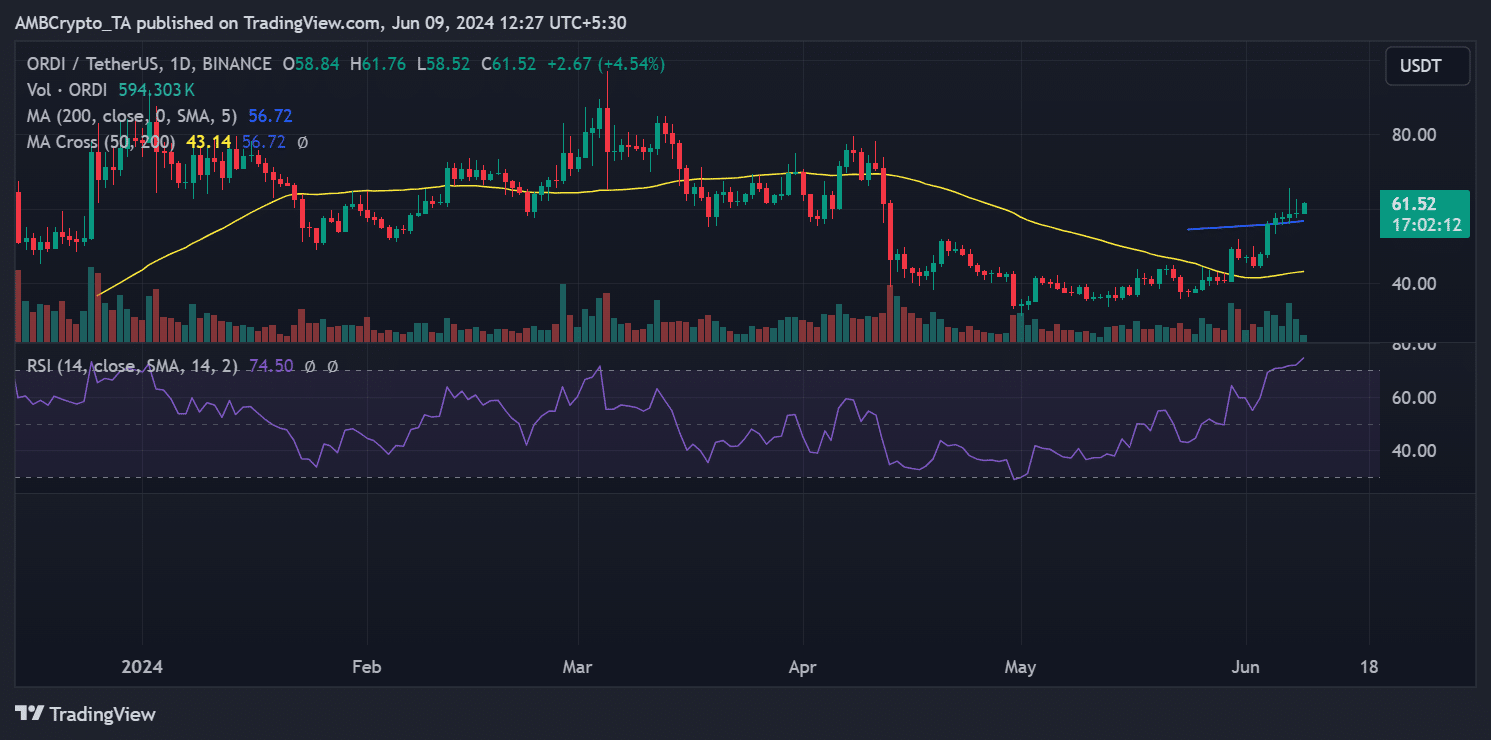

Daily analysis of ORDI’s price trend revealed interesting positive trends.

Although ORDI’s positive trend started on the second day of the week, it has seen consistent upward trends since the initial price increase.

The week began with a 4.56% decline, taking ORDI’s price from around $47.50 to around $45.00. However, this setback was quickly overcome as the asset began a steady upward climb.

The chart revealed two significant price movements that ignited ORDI’s uptrend. On June 3rd, ORDI saw a rise of over 6%, bringing its price back into the $47 range.

The next day, it saw a staggering 17% increase, pushing its price above $55.

By the end of the week, ORDI was trading at around $59.

Source: Trading View

According to data from CoinMarketCapORDI was the biggest gainer this week, posting an impressive increase of over 25%.

At the time of writing, ORDI is trading an additional 4% higher, bringing its price to over $61. Its market value reached approximately $1.3 billion.

However, trading volume decreased by about 30%, reaching about $314 million.

Heaps [STX]

according to CoinMarketCapSTX posted the second-highest gains this week, with an impressive increase of over 22.5% in the past seven days.

AMBCrypto analysis showed that Stacks started the week on a negative note, trading at around $1.80. However, as of June 3, it has gained momentum and has seen consistent upward trends.

The chart indicated that STX reached a high of around $2.48 at some point during the week. By the end of the week, it was trading at around $2.24.

As of this writing, STX is up slightly to around $2.27.

Additionally, data indicated that the Stacks market was valued at approximately $3.3 billion at the time of writing, although it has declined over the past 24 hours.

Trading volume also decreased by more than 50% over the past 24 hours, reaching approximately $145 million.

Kasba [KAS]

AMBCrypto analysis of KAS revealed that it started the week at around $0.14, and began its upward trend on the first day.

The chart showed that KAS continued to rise, reaching the $0.19 range at one point during the week. However, it has since declined, and by the end of the week, it was trading at around $0.16.

Despite its decline, Coin Market Cap Data showed that Kaspa (KAS) was the third biggest gainer during the week, up more than 15%. As of this writing, it is still trading around the $0.16 price range.

The data also indicated that its market value reached about $3.8 billion, although it decreased by more than 5%.

Likewise, trading volume saw a significant decline of over 40% over the past 24 hours, reaching around $67 million.

Biggest losers

Firmness [BEAM]

AMBCrypto’s look at the BEAM price chart revealed no positive trends. BEAM started the week at around $0.27 and saw successive declines throughout the week.

By the end of the week, its price had dropped to around $0.22. according to CoinMarketCapBEAM stock was the biggest loser this week, declining by about 20.8%.

As of this writing, BEAM is trading at around $0.23 with a market cap of around $1.1 billion, which is down over 3%.

Trading volume fell by more than 40%, settling at approximately $13.8 million.

Celestia [TIA]

Celestia was closer to the Earth than to the stars. According to AMBCrypto analysis, TIA started the week on a positive note, trading at around $11.46.

However, it saw subsequent declines, falling to around $9.10 by the end of the week.

according to CoinMarketCap According to the data, this decline puts TIA as the second biggest loser for the week, with a loss of more than 20% in value over the past seven days.

As of this writing, TIA is still trading in the $9.10 price range. Its market value fell by more than 6% over the past 24 hours, to about $1.7 billion.

In addition, trading volume fell by about 50%, settling at about $75 million.

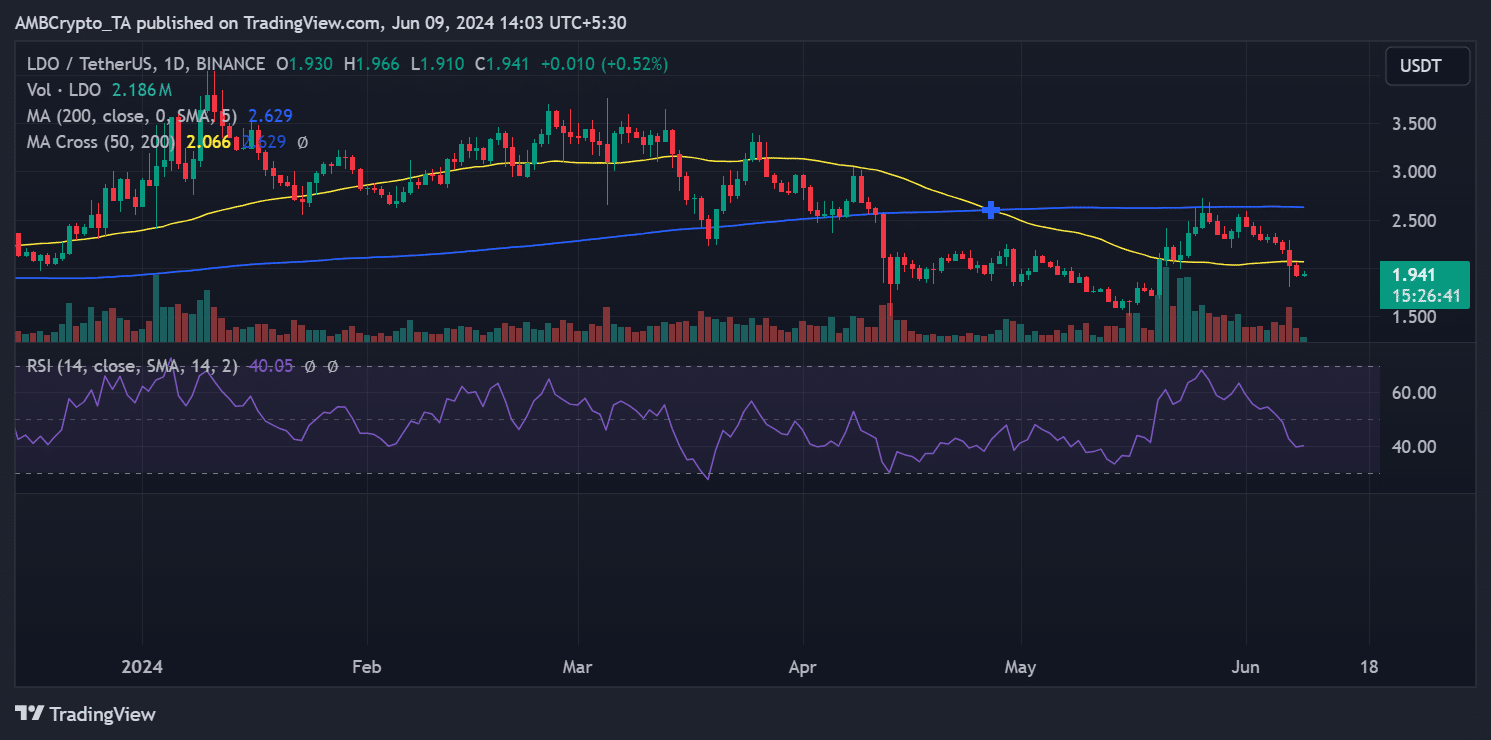

Lido Dao [LDO]

Lido DAO, according to its daily time frame, started the week at around $2.30. The graph indicated that it began with a decline of 3.56%, and continued throughout the week.

By June 7th, LDO dropped to around $2.00, breaking the support line (yellow line). At the end of the week, it was trading at around $1.90 after a 4.8% decline, and is now trading below the support level.

LDO decline It also pushed the Relative Strength Index (RSI) to 40, indicating a strong downtrend. According to CoinMarketCap, LDO saw the third largest loss this week, with a decline of over 19%.

Source: Trading View

Its market value fell by more than 5% over the past 24 hours, to about $1.7 billion. Its trading volume fell by more than 20%, reaching about $143 million at press time.

Conclusion

Here’s the weekly summary of the biggest gainers and losers. It is important to take into account the volatile nature of the market, as prices can change quickly.

Therefore, it is best to do your own research (DYOR) before making any investment decisions.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings