- Worldcoin has seen high capital inflows in recent months, causing the price to drop by 81%.

- Prices are expected to start rising by 9%-10% on August 19.

Worldcoin [WLD] The price of WLD has been in a strong downtrend lately, a trend that has yet to slow down. A report earlier this month highlighted that Alameda still holds 24 million WLD tokens.

This has raised concerns about future selling pressure.

The big price losses are nowhere near over. What are the next price targets, and when should bulls consider re-entering long positions?

$1.7 is a confluence of resistance

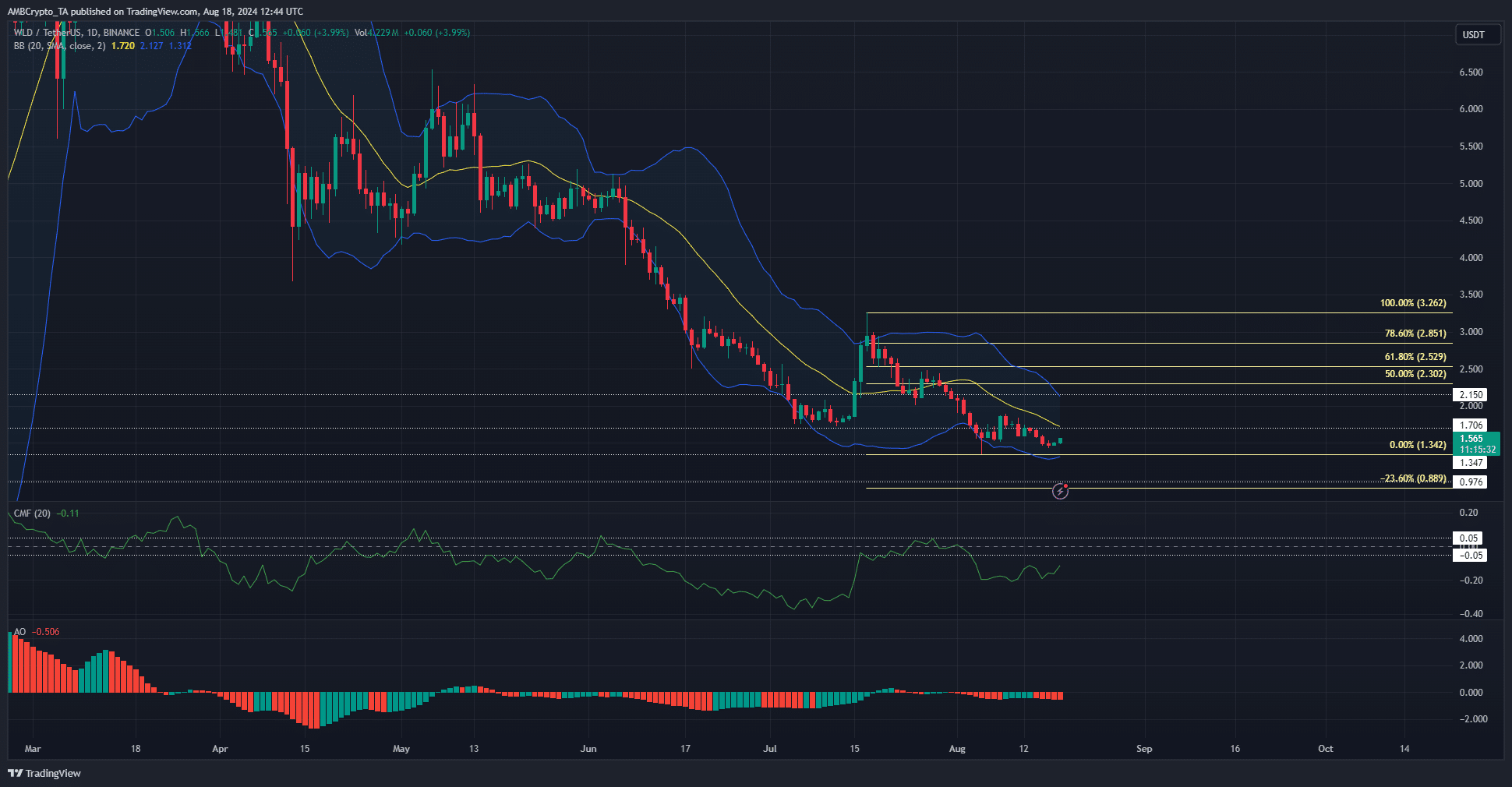

Source: WLD/USDT on TradingView

The price was below the 20-day moving average to indicate bearish momentum. This moving average also aligned with the $1.7 level which acted as support in early July.

The Awesome Oscillator also reflected the bearish momentum.

The central market index was more negative and has not remained above +0.05 for several days since March.

The continued outflow of capital from the market saw Worldcoin’s value drop from $8.3 to $1,565 in less than five months, a drop of 81%.

The 23.6% Fibonacci extension level at $0.89 is the next downside target, although a price bounce to $1.7 and $2.15 is possible before that.

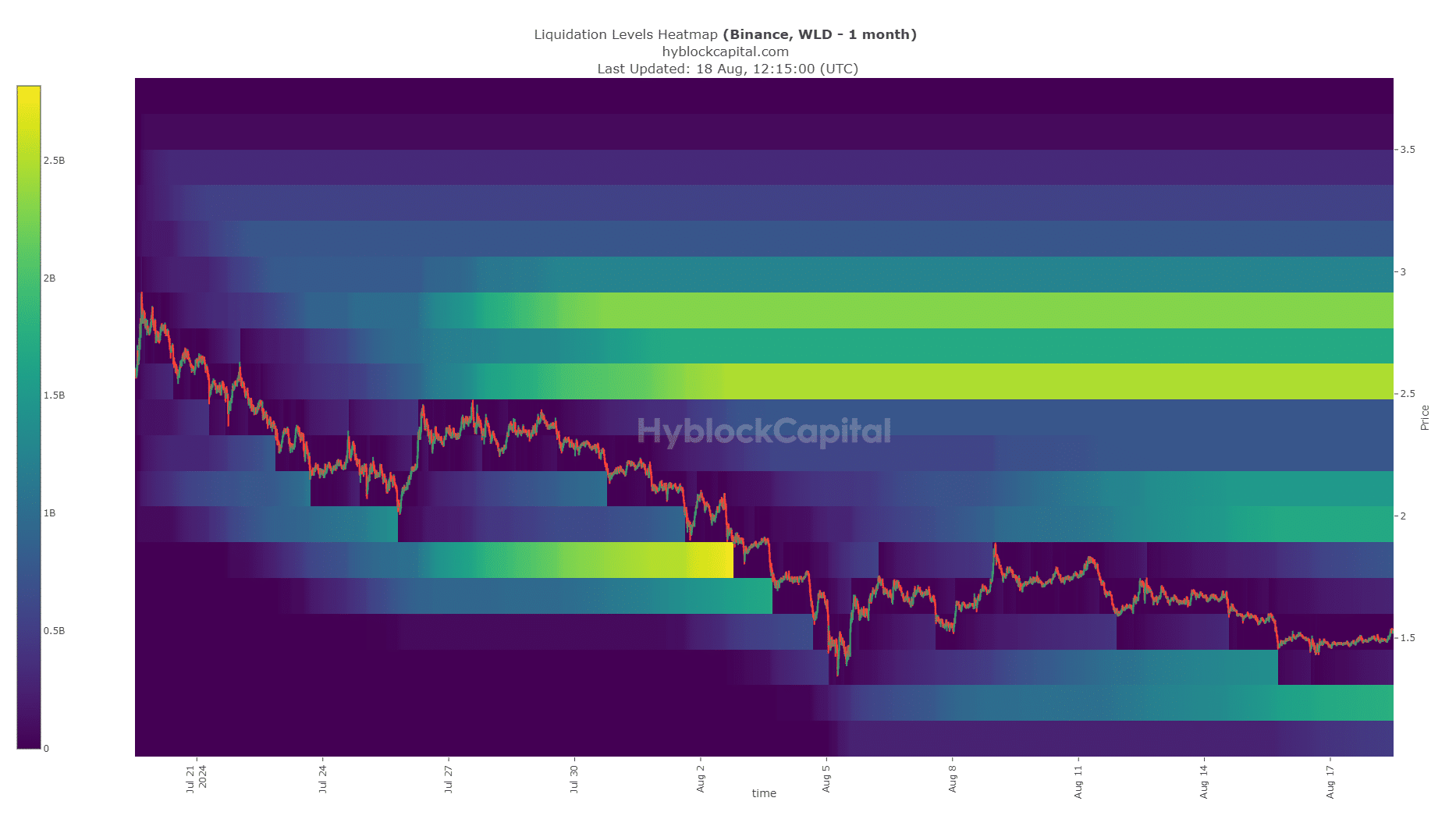

Evidence of Worldcoin’s Liquidity Level

The $1.96 to $2.11 level was a significant liquidity pool above the current market price. Further south, the $1.22 level was an area where a bullish reversal for Worldcoin could occur.

Technical indicators are strongly bearish, suggesting that a move towards the $1.22 level is most likely. Such a move could be preceded by a short-term price recovery.

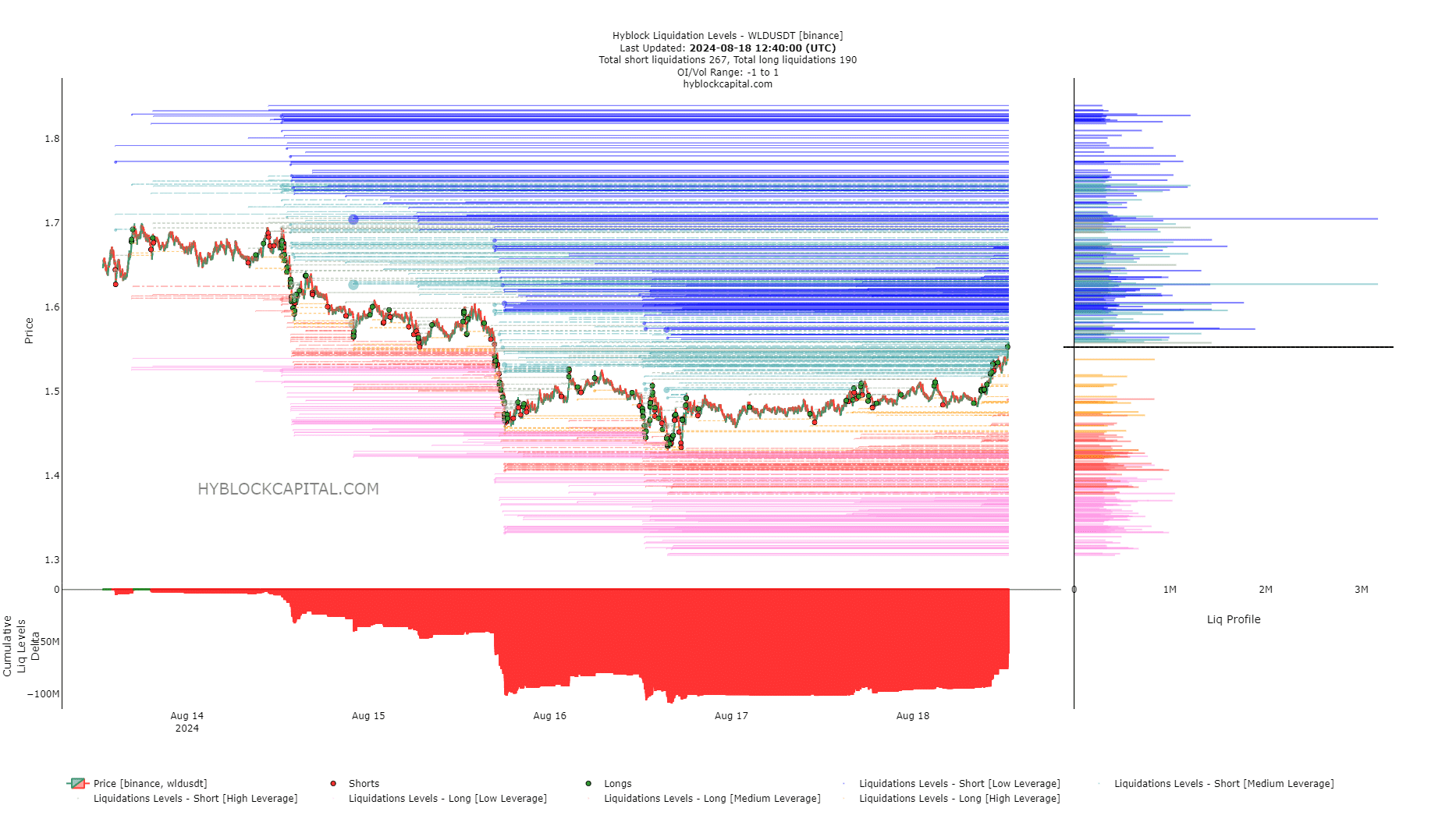

Whether it’s real or not, here’s the market cap of WLD in terms of BTC

The delta of the liquidity levels was very negative, indicating that Worldcoin is likely to rise but not certain to reach equilibrium. The largest liquidity pool costs were at $1.62 and $1.7.

Therefore, short traders can wait for a bounce to these levels before considering short selling and taking profits around the $1.22 area.

Disclaimer: The information provided does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings