- XRP price has increased by more than 10% in the past 24 hours.

- Metrics revealed that buying pressure on the token was high.

XRP‘s The performance over the past 24 hours has been remarkable, with its value rising by double digits. In fact, the recent price surge has allowed the token to break above a critical resistance level, which could lead to another price surge in the coming days.

Therefore, it is worth looking at whether the metrics support the case for a continued rise.

XRP is pumping

Recently, the famous cryptocurrency analyst World Of Charts shared tweet Highlighting an interesting development. Accordingly, a bullish falling wedge pattern has emerged on the token’s price chart. The token has been consolidating within the pattern after reaching its highs in March.

The price of XRP has increased by more than 18% in the past seven days. In the last 24 hours alone, the token’s value has increased by more than 10%. At the time of writing, XRP is trading at $0.5144 with a market cap of over $28 billion, making it the seventh-largest cryptocurrency.

Thanks to the above-mentioned price action, the coin has managed to break out of this bullish pattern. If the coin continues to test the pattern, investors may see an increase of more than 50% in the value of XRP in the coming days.

What do the metrics say?

AMBCrypto’s analysis of Santiment data revealed that buying pressure on the token was high. And that seems to be the case, as its trading flows have also increased sharply.

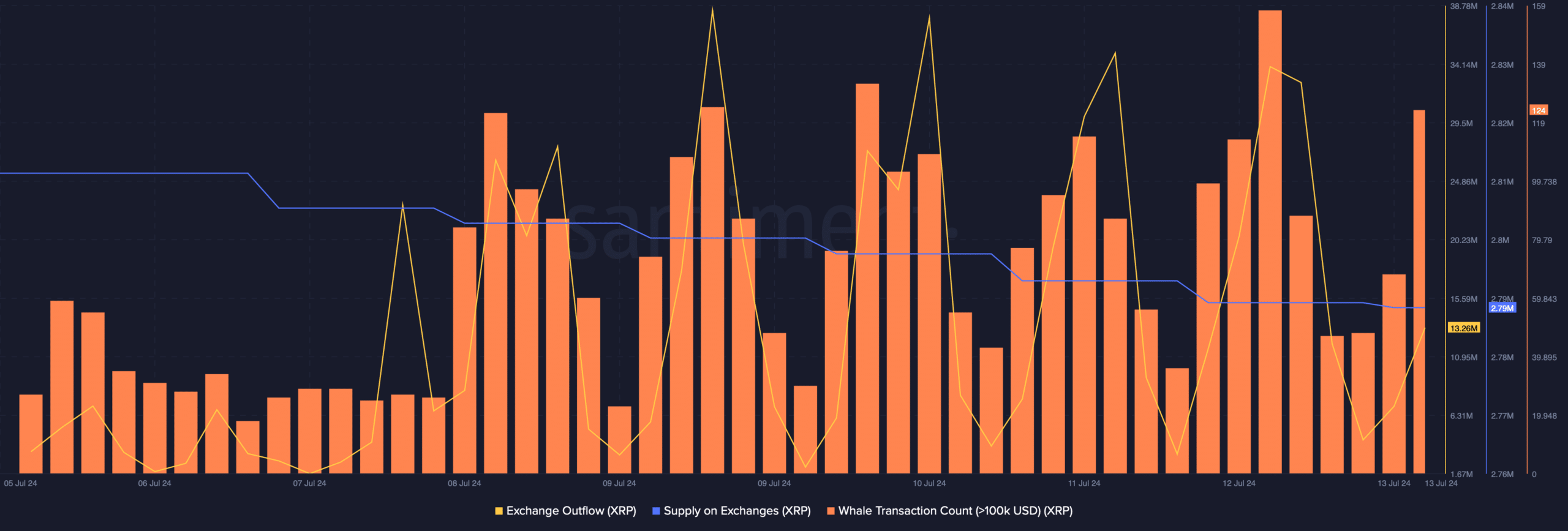

Buying pressure on XRP has been proven to be high with the supply of it on exchanges declining, meaning investors are now hoarding more tokens. Whale activity around XRP has also been high – evidenced by the high number of whale transactions.

Source: Santiment

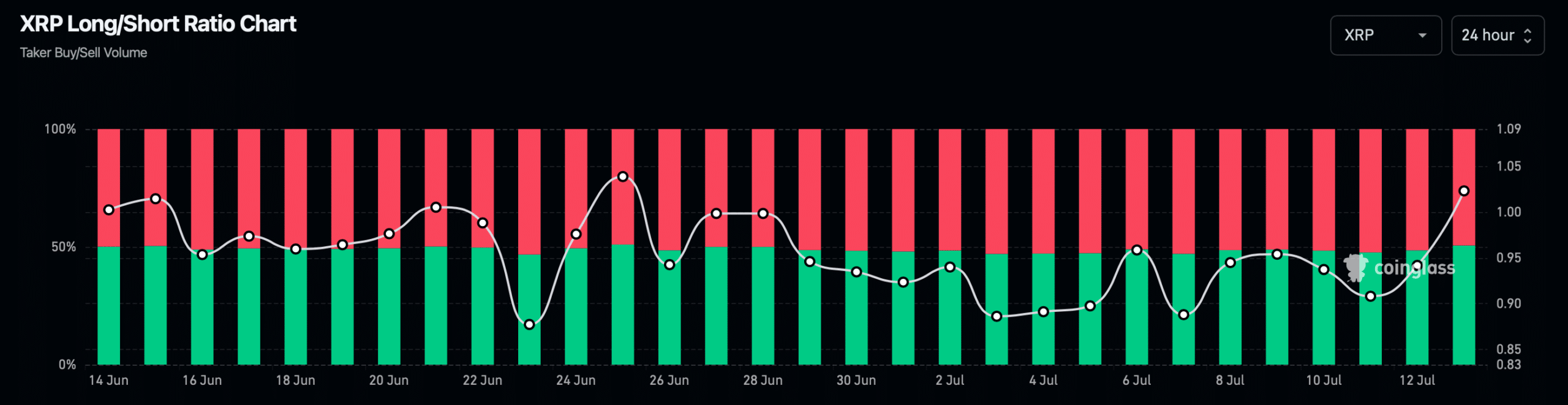

A look at Coinglass Data It also revealed that the open interest in the token has risen, along with its price. Generally, a rise in the metric indicates that the chances of the current price trend continuing are high.

In addition, the buy-sell ratio has increased. Simply put, there are more long positions in the market than short positions – a sign of rising bullish sentiment.

Source: Coinglass

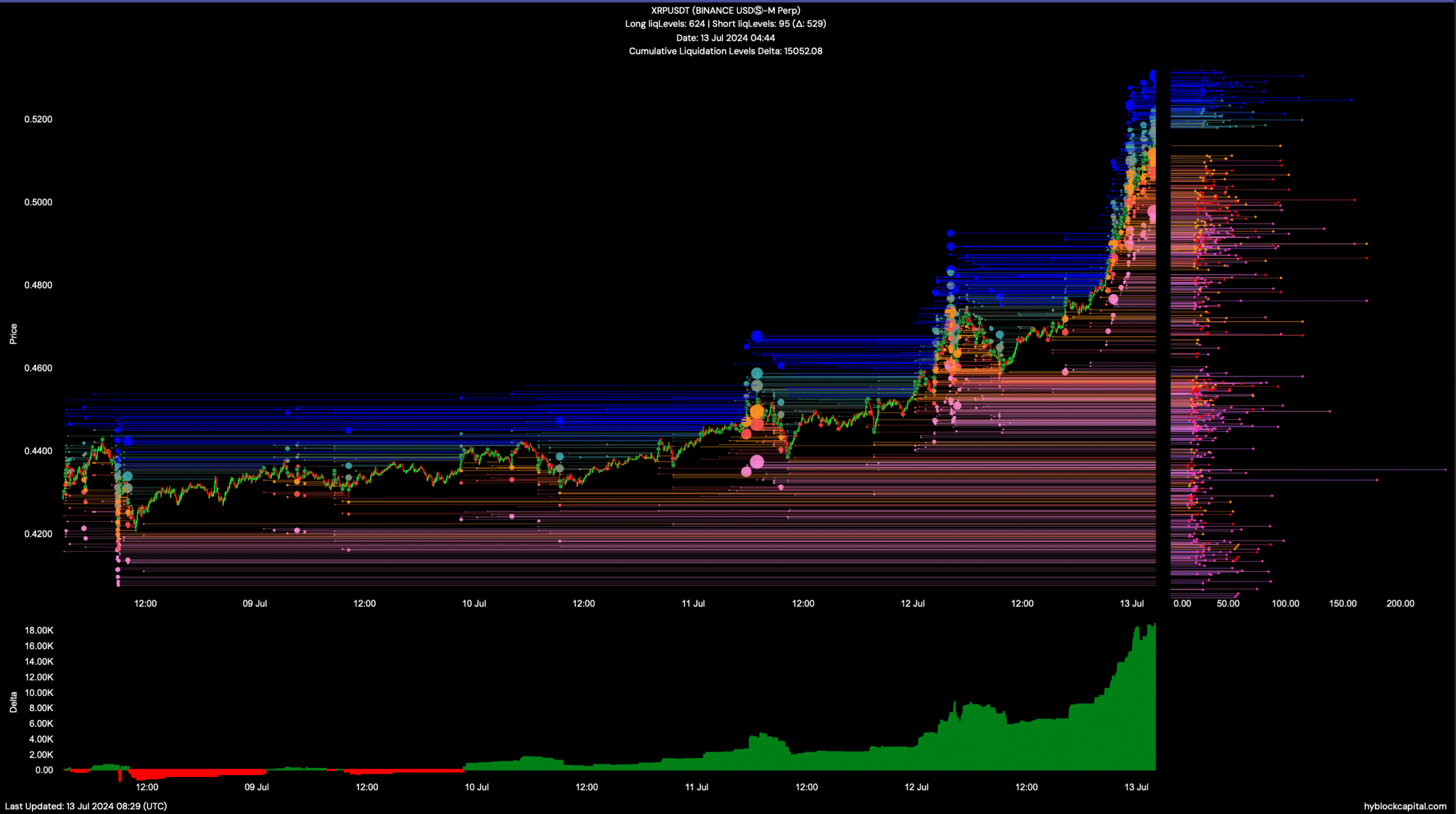

Conversely, a look at Hyblock Capital data reveals that the delta of XRP’s cumulative liquidation level has increased significantly.

This massive rise may indicate a potential market top, which may be followed by a price correction on the charts soon.

Source: Hyblock Capital

Realistic or not, here you go. XRP Market Cap in BTC

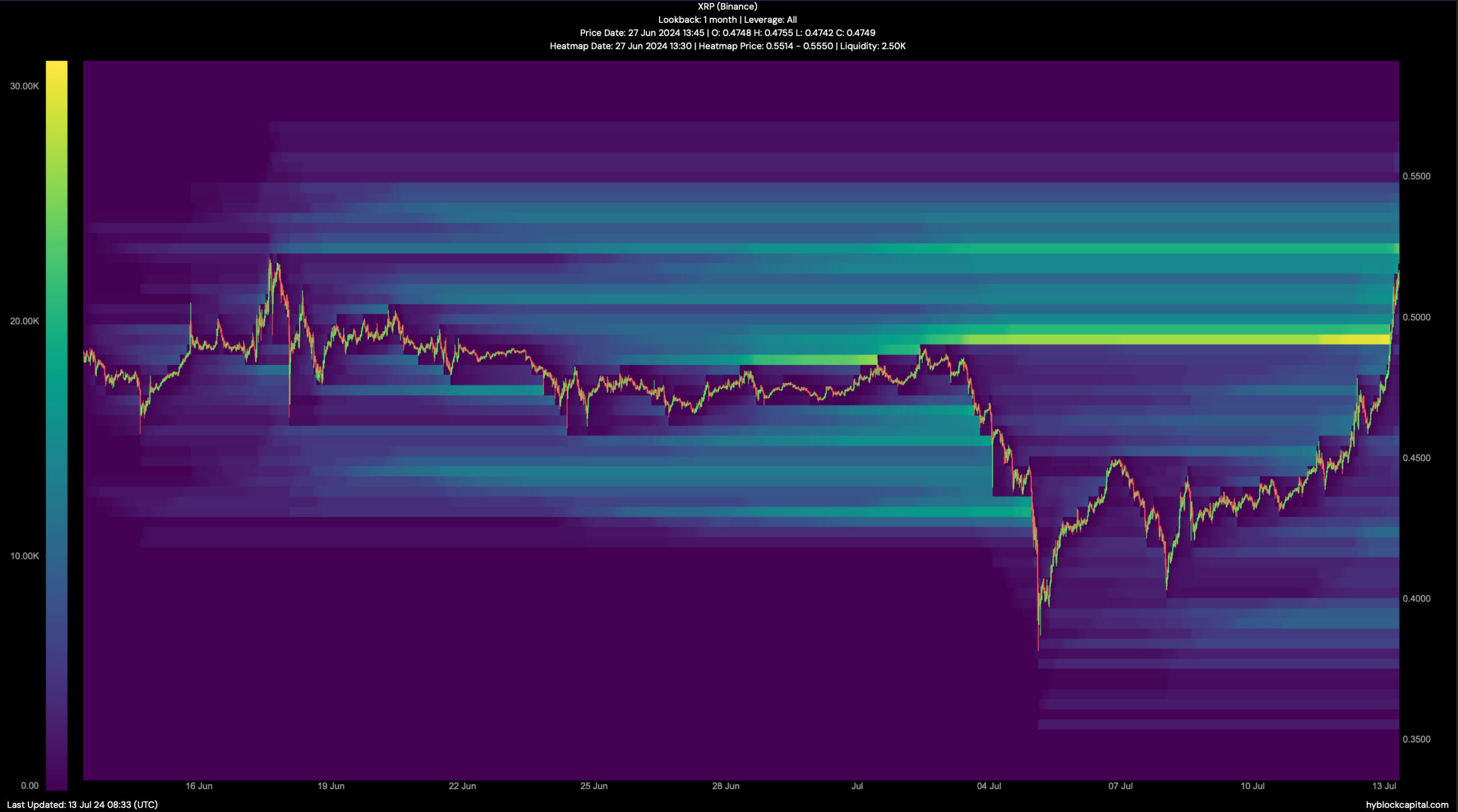

Finally, AMBCrypto examined the heatmap of the token’s liquidation to look for potential support and resistance areas for the token. We found that the token’s liquidation will rise to around $0.526.

High liquidation often leads to price corrections. However, if bears take control of the market, the token price may drop to $0.42.

Source: Hyblock Capital

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings