(Bloomberg) – In the days after the outbreak of the Ukraine War, the collapse of the ruble was a powerful symbol of Russia’s new financial isolation.

Most Read From Bloomberg

International sanctions against Vladimir Putin’s regime drove it to a record low of 121.5 rubles per dollar, evoking memories of the blow it suffered during the 1998 Russian financial crisis.

Things sounded so dire that US President Joe Biden said the ruble had been reduced to “a rubble.”

Now, though, she certainly didn’t. The ruble rose again to where it was before Putin’s invasion of Ukraine, to continue its recent rally to a strong level of 74.2625 to the dollar in early Moscow trading on Thursday.

What has become clear is that, despite the incredibly broad package of sanctions on the Russian government and its oligarchs, and the exodus of foreign companies, the measures will be largely toothless if foreigners continue to consume Russian oil and natural gas – propping up the ruble by hoarding it. Putin’s coffers.

Read: Japan won’t ban Russian coal imports, Mainichi says

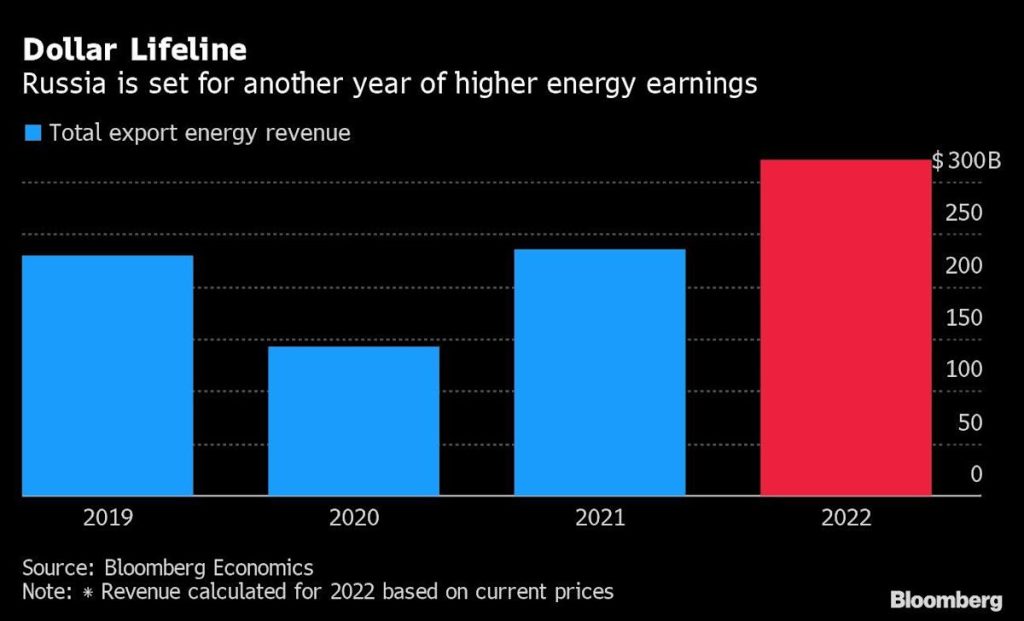

Even with Russia remaining mostly isolated from the global economy, Bloomberg Economics expects the country to earn nearly $321 billion from energy exports this year, up more than a third from 2021.

The rapid recovery of the ruble gave Putin a major victory in Russia, where many people focus on the currency’s swings and tumbles, even as his military falters in Ukraine and anger grows around the world over the atrocities he has committed.

For politicians, it’s a good PR tool by saying that sanctions have no effect. “It will help limit the impact of inflation,” said Guillaume Tresca, senior emerging markets analyst at Generali Insurance Asset Management.

In the history of post-Soviet Russia, the exchange rate of the ruble against the dollar was the economic indicator that Russians were most interested in. The rate was broadcast by exchange booths popping up in every town and city, indicating the currency’s collapse with hyperinflation in the early 1990s. The ruble fell again after Russia stumbled in 1998.

Once that chaos subsided, the government deleted the three zeros. Then, during the 2008 crisis, the authorities spent billions of dollars to slow the currency’s decline, in part to avoid creating panic among the population and provoking a bank run in the country. Governor Elvira Nabiulina decided to take a risk in 2014 when sanctions against the annexation of Crimea and declining oil pushed her to switch the currency to free-floating.

In response to this year’s sanctions, Russia has enacted capital controls that also appear to bolster the ruble. This includes freezing assets held by non-resident investors, and telling Russian companies to convert 80% of the foreign currency they hold into rubles.

This has some observers questioning the importance of the ruble’s recovery to pre-invasion levels – which is also happening amid the lightest trading volume in a decade. “It is not a free-floating currency given all the measures that the authorities have imposed,” Tresca said. US Treasury Secretary Janet Yellen said essentially the same thing on Wednesday when testifying before Congress, warning against sending deeper messages about sanctions than the ruble’s rebound.

However, it is hard to ignore the lifeline other countries are throwing at Putin by buying oil and gas for his country. Doing so gives Russia a current account surplus – the economic term for exporting more than it imports, which tends to raise the country’s currency – and undermines the attempt to inflict sanctions on Russia.

“The current account surplus should in fact be another source of stability for the ruble,” said Brendan McKenna, strategist at Wells Fargo Securities LLC. “If energy prices remain high and major importers of Russian energy and goods continue to buy, the current account should remain in surplus.”

Russia has managed to stabilize domestic markets and even avoid a messy foreign debt default — at least for the time being. This means that if the coalition of governments that oppose Putin wants to damage the ruble again, it will most likely have to change course. Just this week, the US Treasury blocked dollar debt payments from Russian accounts in US banks, in a bid to get Russia to drain or default on its domestic dollar reserves.

“As the Russian economy and financial sector adjust to a new balance of capital controls, managed prices, and economic self-sufficiency, it is not surprising that some domestic markets are stabilizing,” said Elena Rybakova and Benjamin Helgenstock, economists at the Institute of International Finance. . “Sanctions have become a moving target and will require adjustments over time to remain effective.”

They pointed to the possibility of further tightening of financial sanctions, and perhaps even the disconnection of additional Russian institutions from SWIFT, the communications system used by banks to move money around the world.

Putin had to change his war strategy in Ukraine, moving troops away from Kyiv after failing to occupy the capital. Research firm Tellimer Ltd. Of confidence in market rallies amid negotiations to end the war in Ukraine.

Don’t buy peace rallies,” said Paul Domjan, Tellimer’s senior shareholder analyst. Investors should be very cautious about market rallies following the news regarding the peace talks. There will be many false dawns as the world valiantly strives to end this war.”

(price for updates in the fourth paragraph)

Most Read From Bloomberg Businessweek

© Bloomberg LP 2022

More Stories

Jasper Fire: Latest map after wildfires erupt in Jasper National Park, Alberta

SNCF: French high-speed trains disrupted by ‘coordinated sabotage’ ahead of Paris Olympics opening ceremony

Macron Responds to Left-Wing Efforts to Rule France – Politico