- Bitcoin formed a smaller band within the range.

- Bullish sentiment has weakened considerably, and selling pressure may soon take over.

Bitcoin [BTC] It continued to trade between $73K and $60.7K, forming a range.

In a previous analysis, AMBCrypto reported that the bulls need to defend the $64.5K support area to push above the $66K resistance level.

This did not happen, instead, we saw a rejection at $67K and a move to $62.8K. This development came at a time when whale activity and ETF flows were slowing.

Therefore, the argument for continued consolidation in the short term was valid.

The bigger picture metrics that fueled BTC's growth have declined

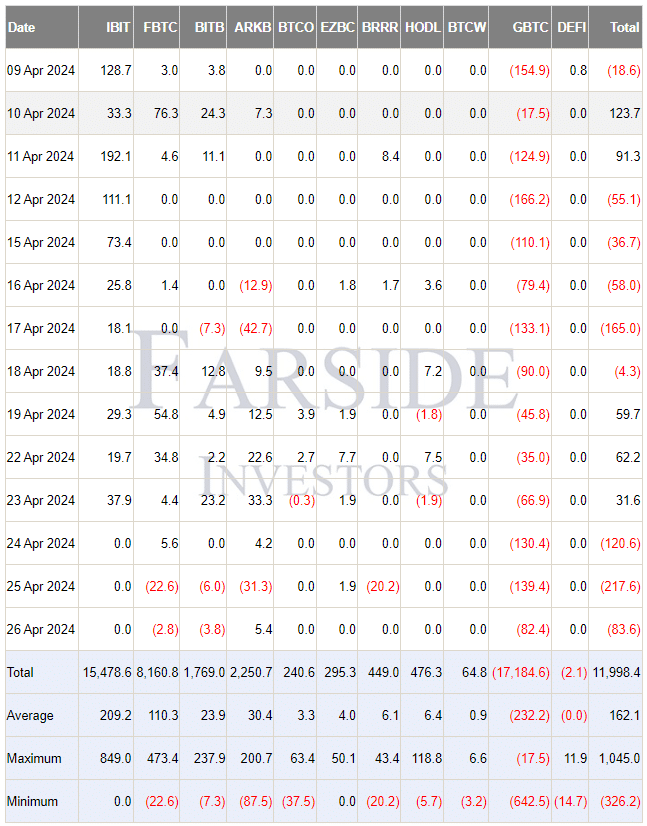

in Share on X (formerly Twitter), Cryptocurrency Analyst Panda whale He noted that Bitcoin ETF flows were negative for the third day in a row on Friday, April 26.

Blackrock's ETF IBIT saw a third day of zero inflows after receiving the largest inflows earlier this month.

source: Persian investors

The lack of demand shows up here. Only the Grayscale Bitcoin ETF (GBTC) has seen consistent outflows, but others like ARKB joined it on April 25.

This was a reflection of the lack of bullish conviction after the halving.

source: Ali_charts on X

Cryptocurrency analyst Ali Martinez brought up another solution Interesting factor In conversation. The number of whale transactions has decreased since mid-March.

Bitcoin price also lost its upward momentum in the higher time frame over the past month.

What do futures markets reveal about Bitcoin market sentiment?

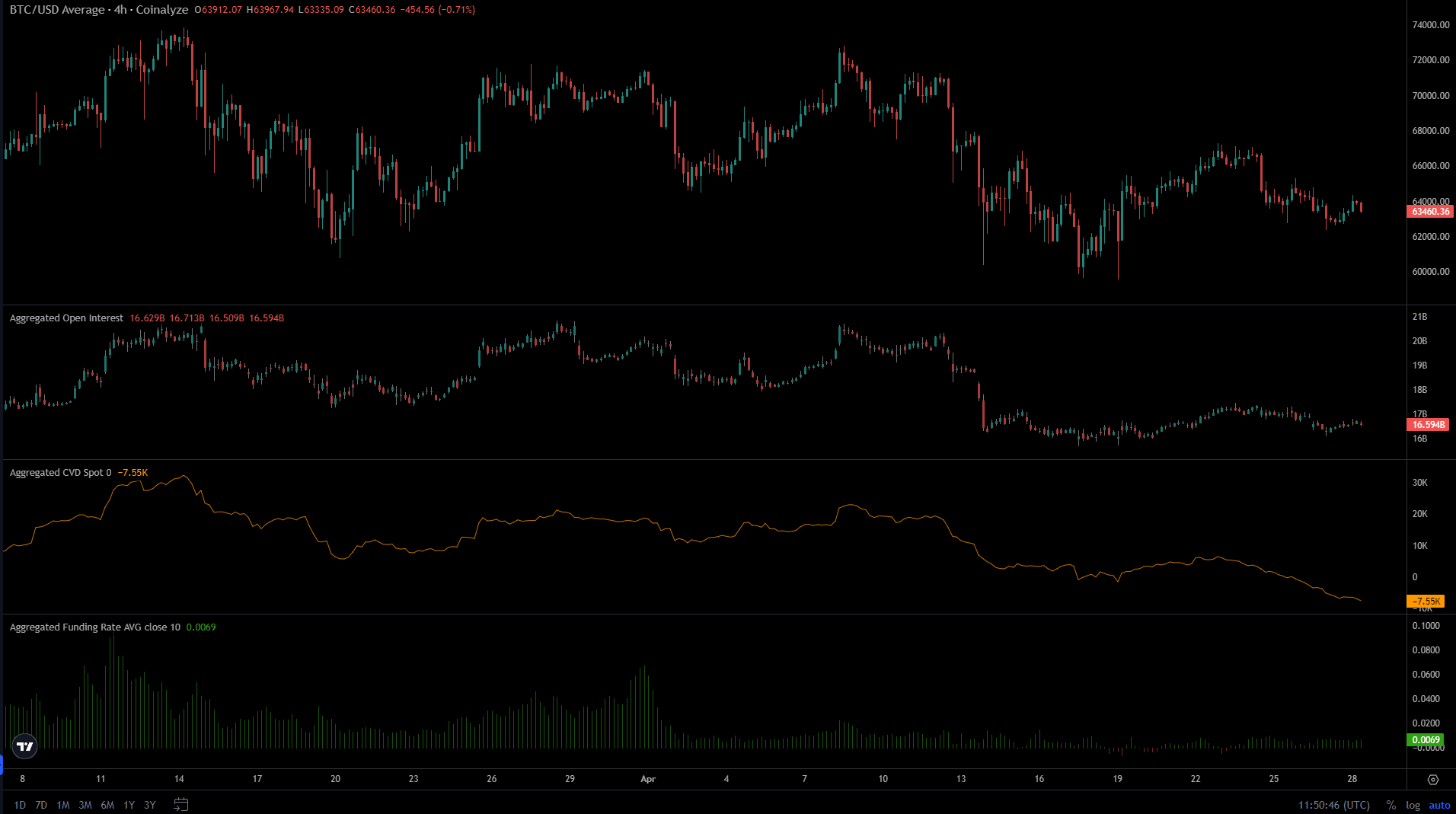

source: Currency analysis

Open interest in Bitcoin has been waning since April 10. This came alongside prices falling below $70,000, which took Bitcoin to $60,000 and highlighted bearish sentiment. Speculators were unwilling to buy.

The financing rate, which was very positive in March, was just above zero in April, once again showing speculators' hesitation.

The spot CVD rate increased from March 20 to April 10. This means that buyers were present in the spot market at the time, giving the price a reason to try to rise above $70,000.

For the past three weeks, it has been on a relentless downward trend. Therefore, it was likely that we would see BTC trend lower, or stay within the range.

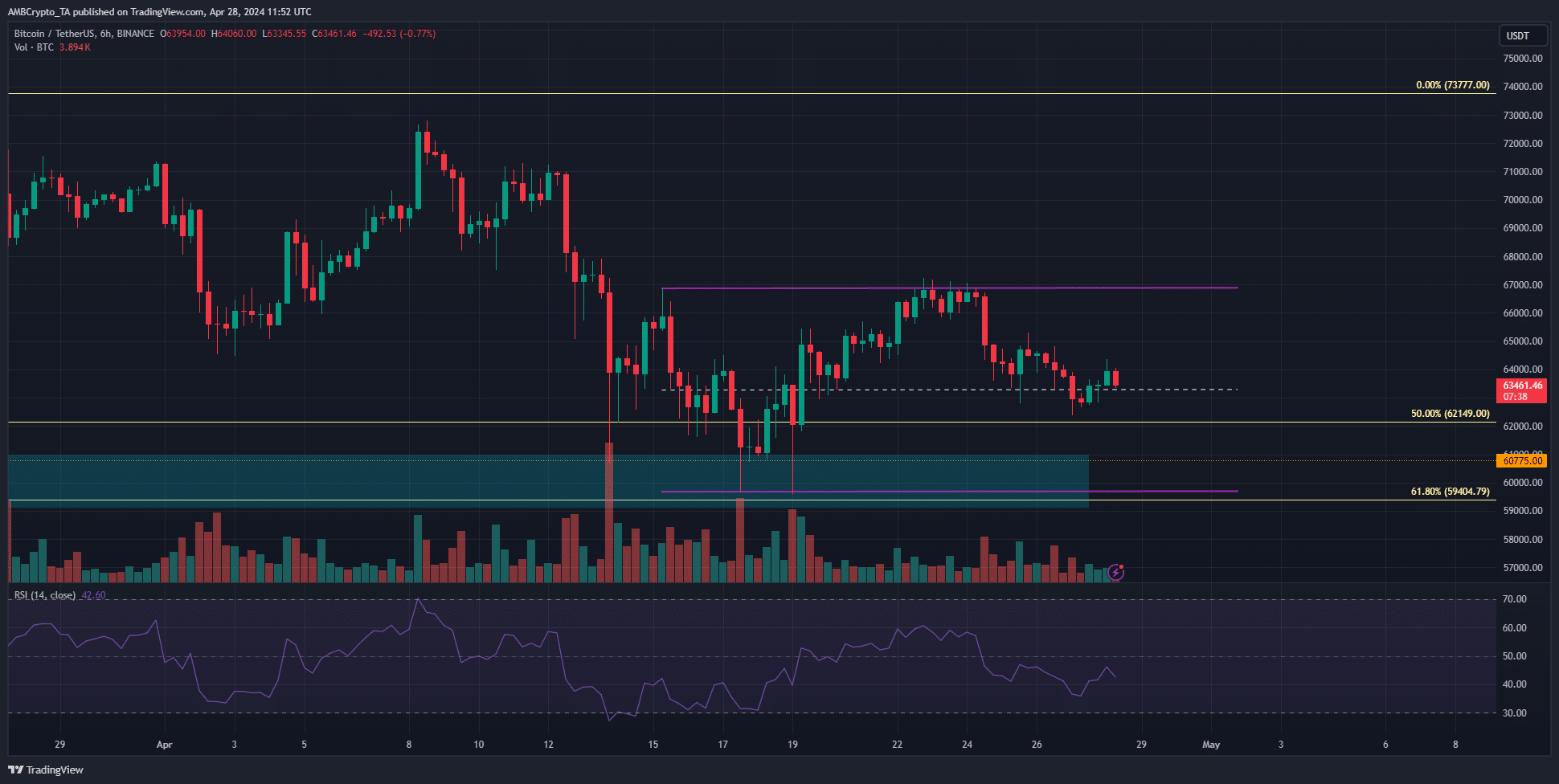

Source: BTC/USDT on TradingView

A short-term range is observed between $66.9K and $59.7K (purple). This was at the lower end of the $60k-$73k range that BTC was already trading in.

Is your wallet green? Check out our Bitcoin Profit Calculator

The mid-range mark at $63.3K was broken over the weekend, and we could see another drop to $60K later this week.

The RSI on the 6-hour chart was below the neutral 50 level and indicated downward momentum. With less demand, it seemed likely that we would see another contraction soon.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings