The following is from a recent issue of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these and other on-chain Bitcoin market insights straight to your inbox, subscribe now.

Bitcoin continues to act like a high-risk beta asset similar to most of the overvalued tech sector. With the spread of Russia’s announcement of military intervention in the financial markets, US stock markets reached a decline of -3% in the overnight session, with Bitcoin also dropped to $34,300, before bottoming out and then rebounding strongly to $40K in a major short squeeze..

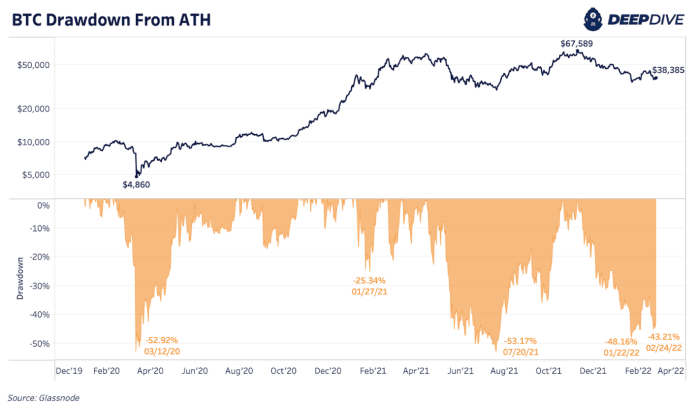

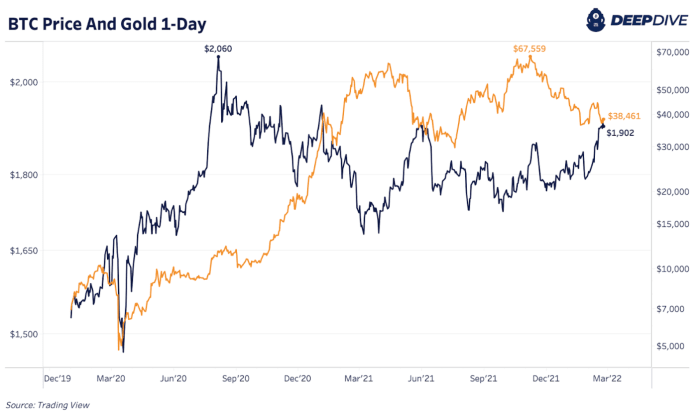

At the time of writing, bitcoin is down 43% from its November highs, and 12% from its lows late last night. At the close of the day, the Nasdaq closed 3.4% hanging in the green in the daily session, as risky assets traded as if maximum fear and uncertainty were priced in shortly after the declarations of war. Gold initially jumped to a one-year high, touching $1,744 an ounce before dropping sharply, in a reversal pattern from the US stock markets and bitcoin.

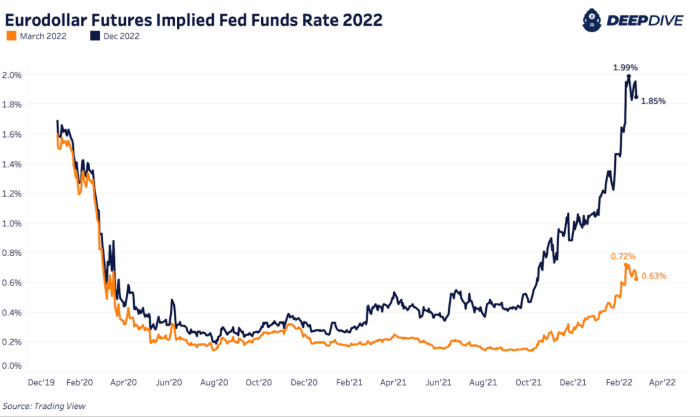

As a result of the conflict, markets have quickly priced in the Fed’s low interest rate increases for 2022. Looking at the eurodollar futures market, the implied fed funds rate is now down more than 10 basis points for March and slightly higher for the rest of the period. general.

A development that will be important to watch is if the Federal Reserve rolls back its monetary tightening schedule due to the outbreak of war in Ukraine. If history sets a precedent, this may well be the case as central banks cherish the chance to shrug off policy mistakes and continue to tone down the markets.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings