- Bitcoin whales have been hoarding large amounts of Bitcoin amid market volatility.

- Mining revenues have fallen, putting significant selling pressure on cryptocurrencies.

Bitcoin [BTC]The Bitcoin price crash has sent shockwaves through the cryptocurrency markets as a whole. However, while many traders in the market have suffered heavy losses, some traders have benefited from the cryptocurrency’s recent correction.

Whales buy the dip

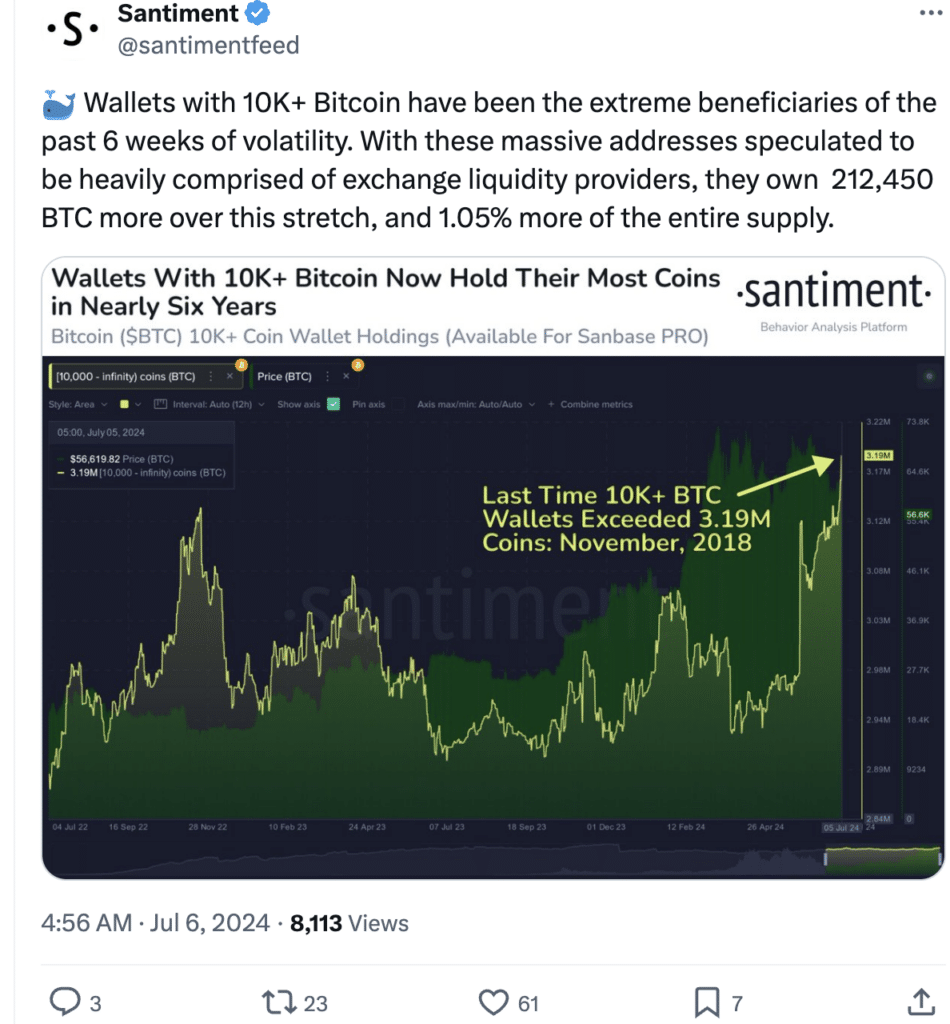

Wallets holding more than 10,000 BTC have been major beneficiaries of the recent market volatility. These large addresses, believed to be primarily owned by liquidity providers on the exchange, have significantly increased their holdings over the past six weeks. By some estimates, these addresses have accumulated an additional 212,450 BTC, representing a 1.05% increase in their share of the total BTC supply.

The actions of these large wallets can be seen as a sign of confidence in Bitcoin’s long-term potential. This positive sentiment could attract other investors to the market, further boosting the price. This could also help Bitcoin regain its previous highs and potentially help it reach $60,000, if there is no additional selling pressure.

However, this is a double-edged sword. If whales continue to accumulate large amounts of Bitcoin, it could affect Bitcoin’s centralization. These whale addresses will have a lot of power and could manipulate Bitcoin prices, depending on their behavior. This could put individual investors at risk, especially when these whales decide to sell their holdings.

Source:X

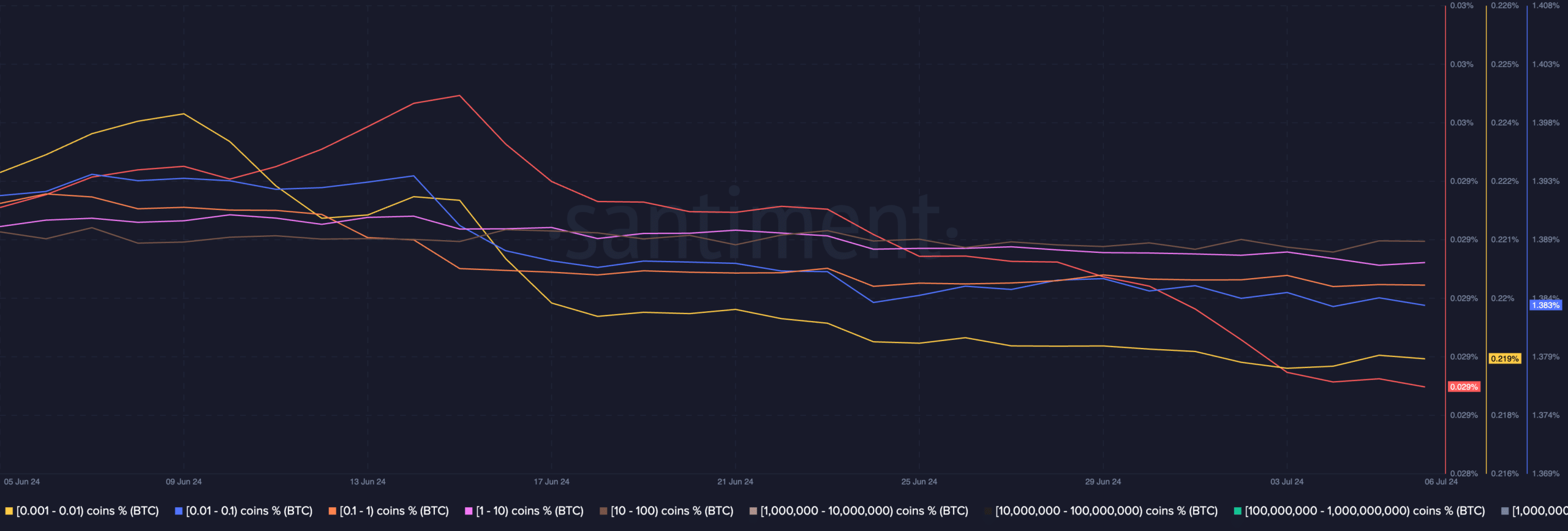

Another worrying factor is the fact that individual investors have not shown the same level of enthusiasm as the whales.

AMBCrypto’s analysis of Santiment data revealed that the number of retail addresses in the 0.1 BTC to 1 BTC range showed no interest in buying BTC. If this continues in the long term, it could lead to increased centralization and leave retail investors at the mercy of whale addresses.

Source: Santiment

How do miners survive?

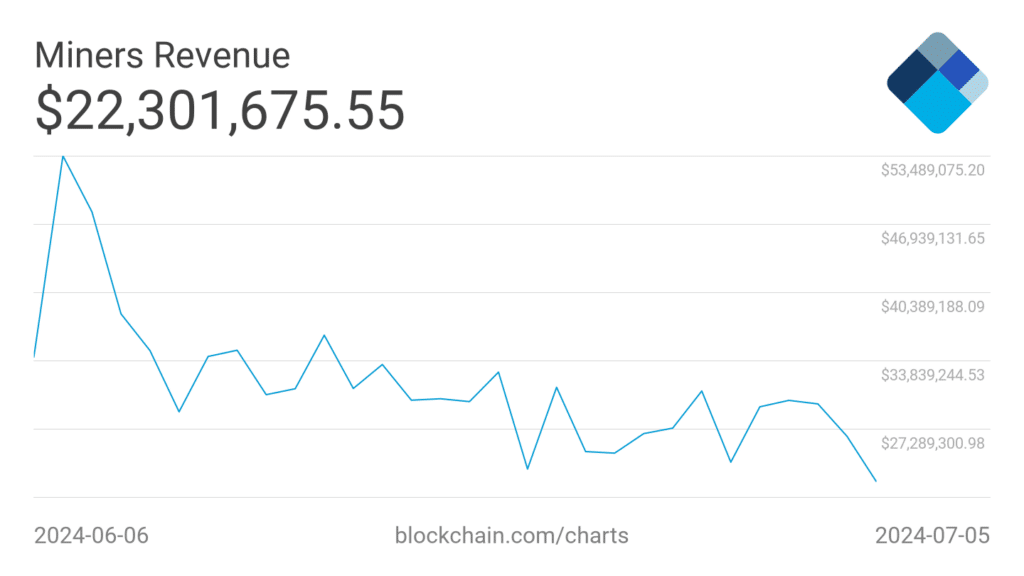

While whale interest may temporarily support the Bitcoin price, struggling miners may exacerbate selling pressure. Miners’ daily revenues have dropped significantly in recent days, highlighting their financial pressures. This drop in revenue may prompt miners to sell their Bitcoin holdings to cover operating costs, putting downward pressure on the price.

Read about Bitcoin [BTC] Price forecast 2024-2025

At the time of writing, Bitcoin was trading at $56,741.70, up 2.8% in the last 24 hours. Despite its tepid recovery, the cryptocurrency’s volume has fallen by more than 37% over the period.

If this holds true over the next week or so, it will be difficult for BTC to break the $60k level on the charts.

Source: Blockchain

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings