The widespread losses from the cryptocurrency crash are broader among black investors.

A quarter of black American investors owned cryptocurrency at the start of the year, compared to just 15 percent of white investors, according to exploratory study By Ariel Investments and Charles Schwab. Black Americans were twice as likely to buy cryptocurrencies as their first investment.

The value of those investments has plummeted. Total market value of Cryptocurrency It fell to less than $1 trillion from more than $3.2 trillion last year. The drop in digital assets comes along with a bear market in US stocks.

Black Americans’ greater exposure to cryptocurrencies has left them more vulnerable to financial downturns, even as their families, on average, own less wealth.

The allure of wealth building, amplified through marketing, has drawn many black investors into cryptocurrencies. dollar price Bitcoin It rose 9,300 per cent in the five years to its peak in November.

Jefferson Noel, 27, said he first got exposed to cryptocurrency in January 2019 when he accidentally invested $5 in bitcoin while using App Cash, a payment service.

“I had no idea what it was, and I don’t even remember doing it,” he said.

By last May, his unintended investment was worth $70. The astronomical gain inspired him to take a friend’s advice to pour $20,000 of his savings into other cryptocurrencies, such as Dogecoin, into traditional investments like index funds.

“[Black Americans] Noel said. “As far as I can tell, the black community sees cryptocurrency as a way to even get into the playing field and get into the game before other gatekeepers get involved.”

But he is now rethinking that decision. Ongoing losses have wiped out more than 20 percent of his crypto investment. He’s looking for mutual funds on his uncle’s advice, but he’s still buying more cryptocurrency.

Historically, black investors have tended to be conservative, investing more of their money in lower-risk assets such as insurance and savings bonds. According to an Ariel Schwab survey, black Americans have less confidence in the stock market and financial institutions than white Americans. Separate studies have linked their concerns to decades of discrimination in the financial system.

Gatali Bellanton, author of a personal finance curriculum geared toward young black Americans called Kids Who Bank, sees cryptocurrencies as a way to offset wealth-building opportunities that have not historically been available in the housing and stock markets.

“We don’t like being left behind when it comes to new technology,” she said.

The promise of cryptocurrencies as a wealth builder has been bolstered by celebrity endorsements, sponsorships, and advertisements.

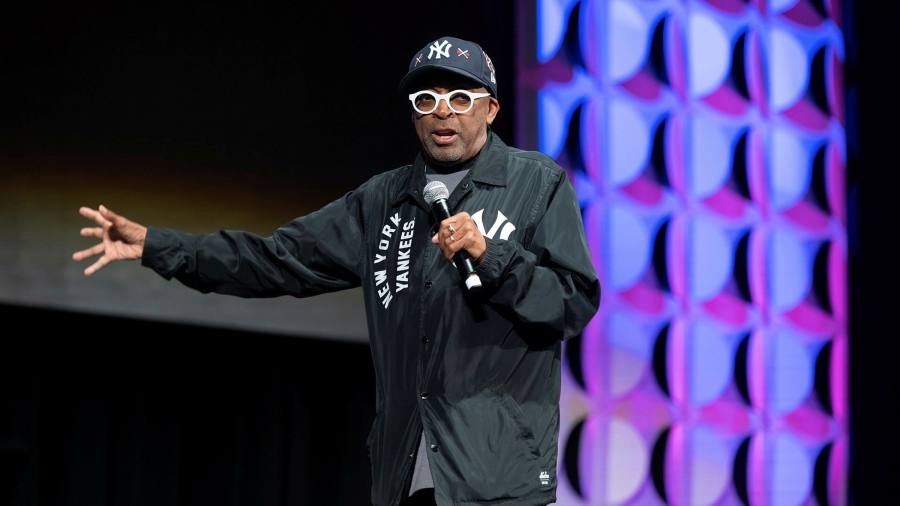

Prominent black Americans, including musicians Jay-Z and Snoop Dogg, boxer Floyd Mayweather, actor Jamie Foxx, and filmmaker Spike Lee, have promoted cryptocurrency in their communities.

Lee appeared in commercials for the crypto ATM operator Coin Cloud last year, saying that “old money won’t pick us up; it drives us down” and “systematically oppresses,” while digital assets are “positive and inclusive.”

Last month, Jay-Z announced a partnership with former Twitter CEO Jack Dorsey to launch a “Bitcoin Academy” literacy program at the Brooklyn public housing complex where he grew up.

These celebrities have faced heavy criticism for getting paid to sell high-risk investments to people who may not have the resources to face the vagaries of cryptocurrency.

“98 percent of these cryptocurrencies are not designed to do anything other than extract money from people’s bank accounts,” said Najah Roberts, a former financial advisor and founder of the Crypto Blockchain Plug Education Center.

“This is not a ‘get-rich-quick’,” Roberts added. “There are huge targeted ads targeting our community.”

It’s not about advertising but the prospect of financial freedom, the lack of minimum mutual investment for mutual funds, and the feeling that distributed ledgers on the blockchain are more transparent than the big banks that attract first-time investors, Bellanton said.

“The reason that minorities at a higher rate than others are embracing crypto is precisely because if you are not already rich, it is cheaper to send [USD Coin, a stablecoin asset] Instead of sending a wire, Brian Brooks, CEO of Bitfury blockchain, said at the Aspen Ideas Festival last month. “It’s only cheaper. The whole system is cheaper and faster. It doesn’t have all these entry barriers as you can only have it if you are really rich.”

Despite the risk of losses, many black investors continue to invest in the market. Dennis McKinley, 41, was buying the dip in exchange for the advice of his financial advisor. He said his cryptocurrencies now make up nearly 30 percent of his total portfolio, along with stocks.

“Young black Americans have now reached a point where we have a measure of freedom to have the opportunity to invest in alternative strategies besides just real estate,” said McKinley, a small business owner in Atlanta. “I think it’s important to learn and get out there.”

More Stories

3M Surges Most in 36 Years as New CEO Boosts Earnings Outlook

Tesla Robotaxi is now set to be revealed on October 10, and Elon hints at ‘something else’

Elon Musk Claims Tesla Will Start Using Humanoid Robots Next Year | Elon Musk