(Bloomberg) — Jerome Powell's comments next week will be closely analyzed by investors for any clues about how long the Fed is willing to wait before cutting interest rates.

Most read from Bloomberg

The last time the US central bank chief spoke, he noted that policymakers were likely to keep borrowing costs high for longer than previously expected, citing a lack of further progress in lowering inflation and continued strength in the labor market.

The latest price data, which showed stubborn core inflation, combined with expectations of a strong employment report on Friday, are unlikely to prompt the Fed chief to change his tune.

Powell will speak to reporters after the Fed's interest rate decision on Wednesday, when the central bank is widely expected to keep borrowing costs at their highest level in more than two decades. Expectations of interest rate cuts have been pushed back further until 2024, and investors are now betting on at most two cuts by the end of the year.

The week will conclude with the monthly jobs report, which provides a fresh look at the state of the US labor market. Economists see non-farm job growth falling to a strong pace in April amid stable, low unemployment.

What Bloomberg Economics says:

“We expect Powell to make a hawkish pivot. At the very least, he would likely signal that the average FOMC participant now expects 'fewer' cuts this year. In a more hawkish direction, he could hint at the possibility of no cuts — or even It indicates that a rate hike may be on the table, but not the current baseline.

—Anna Wong, Stuart Ball, Elisa Wenger, and Estelle Au, economists. For the full analysis, click here

We'll also get updates on the closely watched quarterly employment cost measure, as well as monthly numbers on job openings and manufacturing.

Looking north, Canada's February GDP data may show a slight boost to the economy, giving the Bank of Canada options as it considers when to shift to an easier policy.

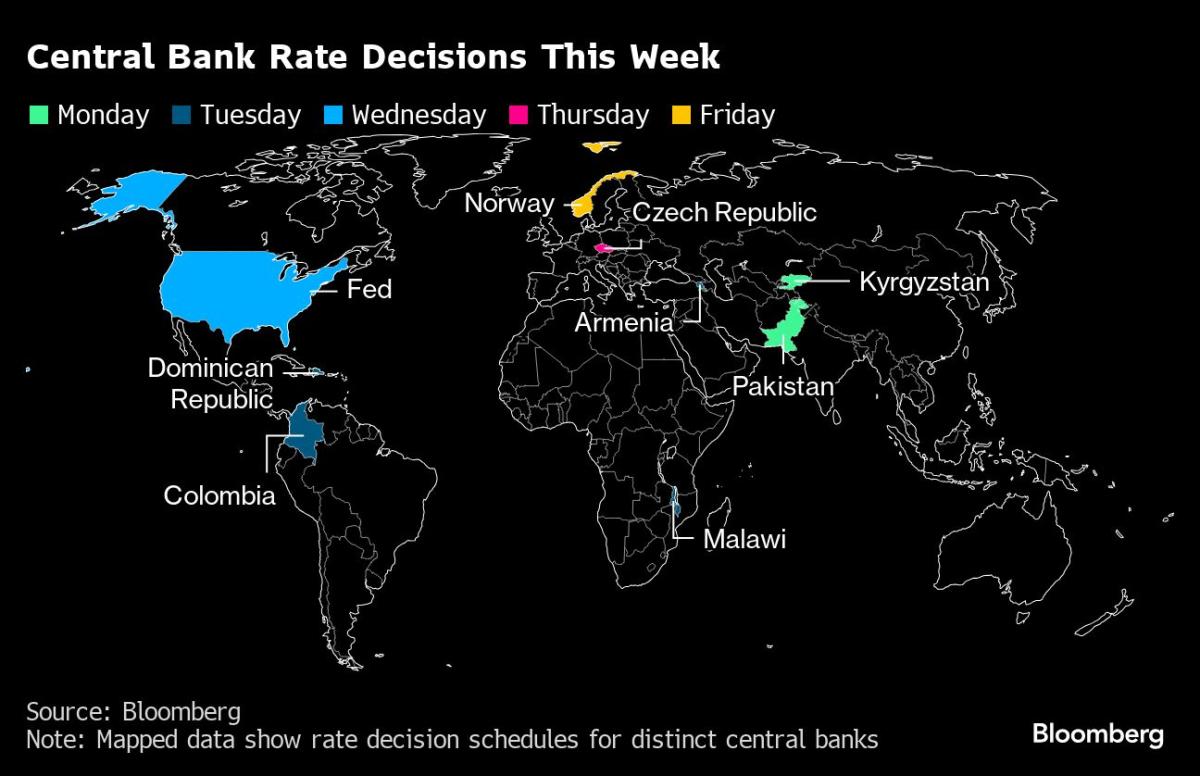

Elsewhere, euro zone data may show that inflation has stopped slowing and the economy is starting to grow again, while Chinese surveys point to the strength of the expansion there. Central banks from Norway to Colombia will set interest rates, while the Paris-based Organization for Economic Cooperation and Development will issue new global forecasts on Thursday.

Click here to see what happened last week. Below is a summary of what will happen in the global economy.

Asia

China highlights prospects for building on economic expansion in the first quarter with the release of official PMI data on Tuesday. The report will indicate whether manufacturing activity expanded for a second month in April.

There may be some seasonal weakness resulting from fewer work days, but the overall trend likely points to a continued recovery, according to Bloomberg Economics. The Caixin index is scheduled to be released on the same day, hovering above the 50 threshold that separates expansion from contraction for five months.

Global trade will be in the spotlight as Australia, South Korea, Thailand, Sri Lanka and Vietnam release trade figures throughout the week.

Japan gets a big batch of data on Tuesday that is expected to show industrial production rebounding in March, with retail sales and the unemployment rate also released.

South Korea's consumer inflation data on Thursday is expected to show price growth slowing slightly while remaining above the Bank of Korea's target, giving the central bank additional incentive to postpone any policy pivot.

Meanwhile, Thai Prime Minister Sritha Thavisin has appointed capital markets veteran Pichai Chunhavagira as the country's new finance minister in an appointment that could ease tensions between the prime minister and the central bank over monetary policy.

Europe, Middle East, Africa

In the euro zone, data may show that the inflation slowdown stopped in April for the first time this year. Consumer prices are likely to rise 2.4% from a year earlier, consistent with March results, amid rising energy costs.

A basic measure that excludes such volatile elements may provide reassurance to officials that the travel trend remains downward, although national figures may reveal some discrepancy. Germany and Spain, which are scheduled to publish their data on Monday, may see faster inflation.

The Eurozone report will be released on Tuesday with the latest GDP figures. Economists believe the region may have returned to growth at a minimum of 0.1% in the first quarter after the shallow recession it suffered in late 2023.

As with inflation, Tuesday's numbers may mask mixed results across the region. To get a taste of this, investors will likely keep a close eye on growth data in Ireland on Monday, which has a history of volatility.

Overall, the reports may be consistent with European Central Bank President Christine Lagarde's observation this month that the economy is weak and facing “bumps in the road” in the inflation path.

Switzerland will release consumer price data on Thursday which could show inflation remaining well below the central bank's 2% target.

The next day in Türkiye, investors will monitor the progress of slowing consumer price growth.

Most markets see Turkey's inflation rate continuing to accelerate from 68.5% in March to around 75% in the coming months, despite nearly a year of strong interest rate increases. Until the price rise slows, bond investors are unlikely to rush into the lira debt market, a key target of the Turkish government.

Three critical decisions are made across the wider region:

-

On Tuesday, officials in Malawi may be persuaded to raise the key interest rate again to rein in inflation, which is likely to remain high due to crop damage due to adverse weather conditions.

-

The Czech Central Bank is set to unveil its latest decision on Thursday, with policymakers expected to cut borrowing costs by 50 basis points.

-

The next day, Norges Bank may keep its deposit rate on hold after the Norwegian economy developed better than expected, even as inflation slowed faster than expected. Investors will be watching for any evidence of whether policymakers are becoming more cautious about starting to cut borrowing costs in the fall.

latin america

Mexico's rapid first-quarter production data is likely to show that the economy suffered a slight contraction in the three months through December. Analysts agree that growth will slow for a third year in 2023, to approximately 2.4% from 3.2% in 2023.

Brazil will publish a number of reports, including a broader measure of inflation, a survey of central bank expectations, the current account, industrial production and the national unemployment rate.

Since last June, the unemployment rate in Latin America's largest economy has fallen below 8%, which many Brazil observers view as a non-accelerating inflation rate of unemployment in the economy.

Chile releases a slew of indicators for March, including retail sales, unemployment, industrial production, manufacturing, copper production and GDP numbers. Stronger-than-expected growth and higher inflation prompted the central bank to slow the pace of monetary easing earlier this month.

In Peru, an April inflation report in Lima, the country's huge capital, may show that prices have finally returned to the 1% to 3% tolerance range, while still above the 2% target.

The Colombian central bank is widely expected to expand its easing cycle with a second successive half-percentage-point cut that would bring the key interest rate down to 11.75% amid a steady process of lowering inflation. BanRep will also publish its quarterly inflation report, update growth and inflation forecasts, as well as provide revised monetary policy forecasts.

-With assistance from Ott Omelas, Robert Jameson, Laura Dillon Kane, Vince Juhl, Patrick Donahue, Brian Fowler, Monique Vanek, and Paul Wallace.

(Updates with new Thai Finance Minister in Asia section)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

More Stories

3M Surges Most in 36 Years as New CEO Boosts Earnings Outlook

Tesla Robotaxi is now set to be revealed on October 10, and Elon hints at ‘something else’

Elon Musk Claims Tesla Will Start Using Humanoid Robots Next Year | Elon Musk