The UK bond and currency markets have been in turmoil since Finance Minister Kwasi Koarting announced his “mini-budget” on Friday.

Olly Scarf | Getty Images News | Getty Images

LONDON – British lenders Virgin Money, Halifax and Skipton Building Society have withdrawn some mortgage deals for clients after turmoil in British bond markets.

Virgin Money and the Skipton Building Society have temporarily halted mortgage offerings to new customers, while Halifax – owned by Lloyds Banking Group – plans to discontinue any fee-paying mortgage products where low interest rates are usually offered.

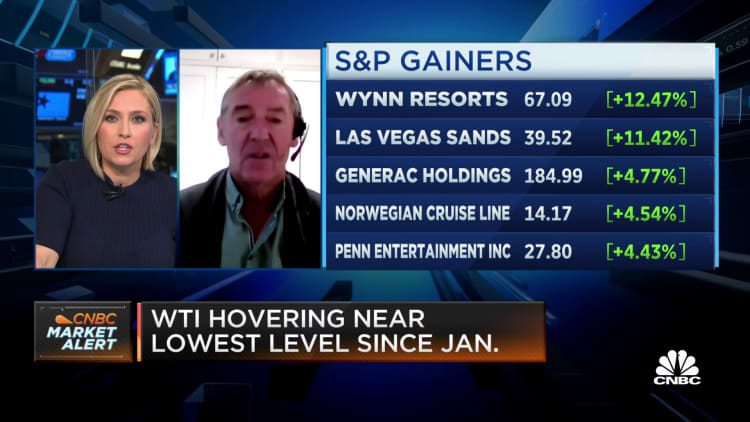

Related investment news

A Virgin Money spokesperson said this was due to “market conditions”, while Halifax attributed the move to “significant changes in mortgage market rates”.

The Skipton Building Society said it has paused its products in order to “re-price them following the market response over recent days.”

British bond and currency markets have been in turmoil since Finance Minister Kwasi Koarting announced his “mini-budget” on Friday, which included deep tax cuts and a push toward “slashing economies”. The yield on British 10-year Treasuries rose to levels not seen since 2008 on Monday, while the yield on British 10-year bonds rose to levels not seen since 2008. British pound dropped to a level Lowest level against the dollar.

Inflation fears were accelerated by market moves, suggesting that the Bank of England will have to continue raising interest rates to fight rising prices. The central bank said that He wouldn’t shy away from this as he aims to bring inflation back to 2%. He was watching developments closely.

Markets have begun pricing in raising the base rate to 6% for next year, from currently 2.25%, sparking concerns among mortgage lenders and borrowers.

“The average offered rate for a two-year fixed rate is likely to rise to about 6% early next year, if the MPC [Monetary Policy Committee] Bank interest rates will increase as quickly as markets expect, 400 basis points higher than two years earlier, Samuel Tombs, chief UK economist at Pantheon Macro Economics and colleague Gabriella Dickens, UK’s chief economist, said in a research note.

“Families refinancing a two-year mortgage in the first half of next year will see their monthly payments rise to around £1,490 early next year, from £863 when they took out the mortgage two years ago.”

Changing market conditions have caused some lenders to change their product offerings.

Sarah Coles, a senior personal finance analyst at Hargreaves Lansdown commented in a research note.

The developments not only mean that mortgage rates will rise, but that borrowers are also likely to have fewer options. A string of smaller lenders have reportedly already halted sales of mortgage products over the past few months due to interest rate pressures, narrowing the market.

This problem will only be exacerbated by large lenders suspending products, said Rob Gill, managing director at Altura Mortgage Finance.

“With borrowers set to take a hit in significantly higher mortgage costs, the curtailment of choice caused by the large lenders withdrawing from the market will only exacerbate the situation,” he said.

“We’ve seen smaller lenders pull out of the market fairly regularly in recent months as they struggle to adjust to higher interest rates. However, the shift to larger lenders like Virgin Money and Halifax is significant and a major mortgage concern. borrowers”.

More Stories

Journalists convicted in Hong Kong sedition case

Stand News: Hong Kong journalists convicted of sedition in case critics say highlights erosion of press freedom

Shark decapitates teen off Jamaica coast