- Trading volume increased, while exchange inflows doubled compared to outflows

- If SHIB rebounds, it may face resistance at $0.000025

Shiba Inu [SHIB] It is possible that the price is set to post another pullback, despite the 103% surge in volume. At the time of writing, SHIB stands at $0.000024 on the charts, after the altcoin’s value fell by more than 4.8% over the past 24 hours.

The decrease in price plus the increase in volume, together, is evidence that selling pressure was high. However, apart from these, AMBCrypto also found other metrics that indicate that the price may fall further on the charts.

Is SHIB overvalued right now?

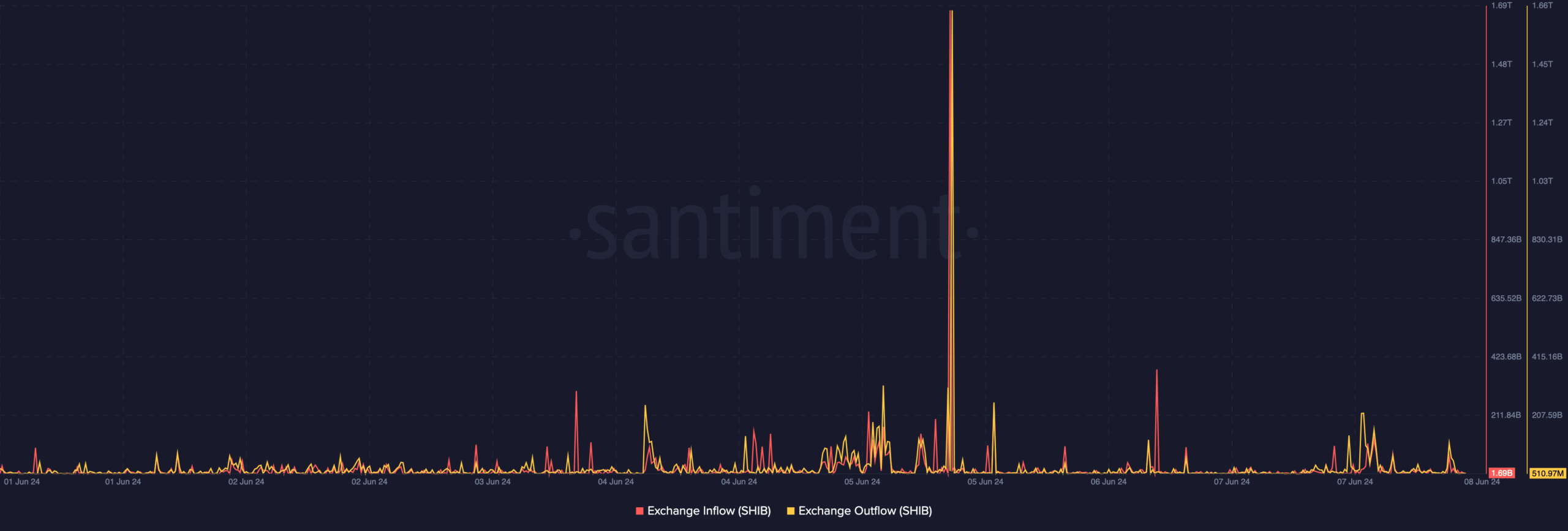

For starters, it is worth considering exchange flows. At press time, data from Santiment revealed that exchange outflows from the Shiba Inu network reached 510.97 million. This metric tracks the number of tokens moving off exchanges.

Most often, exchange outflows indicate that the owners are not ready to sell soon. On the other hand, exchange flows doubled, reaching 1.69 billion. Unlike outflows, this metric measures the number of tokens sent to exchanges.

Source: Santiment

So, difference This indicates that there are more participants willing to part with their SHIB tokens. If this trend continues, the price of the token could drop to $0.000020.

This is, in contrast to speculation that SHIB may be on its way higher after whales were bought in large numbers. While an uptrend may still occur, the Shiba Inu’s value may decline first.

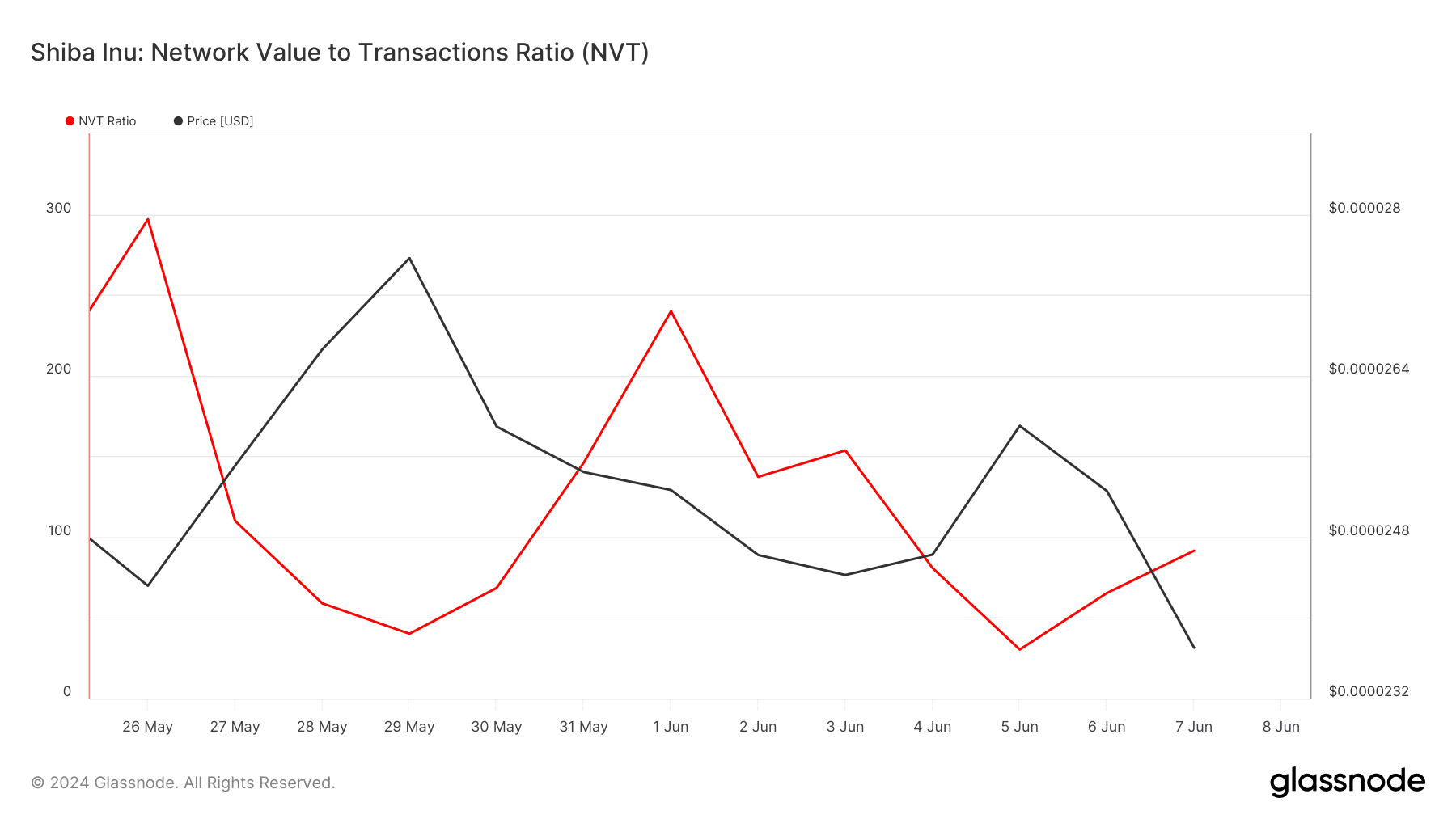

Additionally, AMBCrypto looked at the Network Value to Transaction (NVT) ratio, and noted that it has started to rise again.

A decrease in the NVT ratio indicates that the volume of transactions is growing faster than the market value of the project. This is a sign that investor sentiment is bullish and the price may rise.

However, the NVT ratio on the Shiba Inu grid at press time was 91.56. This suggests that the value of the network was relatively high, and investor sentiment was bearish.

From the graph below, it can be seen that there is an increase in the percentage synchronization With low price. As such, the expected decline for SHIB may be correct.

Source: Glassnode

A sell wall puts the token in trouble

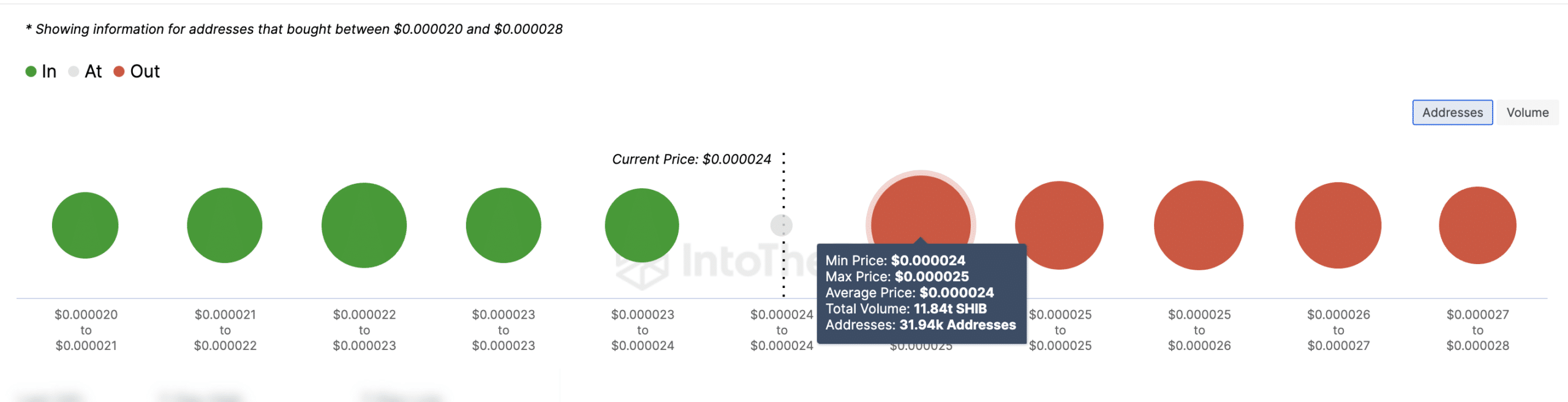

However, if buying pressure picks up on the charts, SHIB could head towards $0.000025. A look at the money in/out index revealed that 31,940 addresses purchased a total of 11.84 trillion tokens between $0.000024 and $0.000025.

This large group of titles was losing money. As such, this area could be… resistance for the token due to the large number of potential short positions on the chain.

Therefore, the price rise may not confirm the validity of the SHIB rise. Alternatively, some token holders can pull the price back as a lot of profit taking may occur at once.

Source: IntoTheBlock

According to the above indicators, SHIB could be looking at a drop to $0.000022. In a very bearish case, the value of the cryptocurrency may fall to $0.000020 as well.

Realistic or not, this is SHIB’s market capitalization in terms of DOGE

However, traders need to pay attention to what is happening in the broader market. For example, if Bitcoin [BTC] Price rebounds, SHIB’s bearish forecast may be invalidated.

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

Shares of AI chip giant Nvidia fall despite record $30 billion in sales

Nasdaq falls as investors await Nvidia earnings