After excluding the more volatile food and energy prices, the core PCE index rose 4.6% from a year ago, the lowest annual increase since October 2021.

“What we saw today was a pullback from the surprise big rally in July, where inflation is now back to where it was in May,” said Scott Brave, chief consumer spending economist at Morning Consult. “And that’s still more than 6%. It’s still too high for the Fed, for sure.”

“While the lower inflation readings for July are welcome, the improvement in one month is well below what the committee will need to see before we can be confident that inflation will abate,” Powell said. “We are purposefully moving our policy position to a level that is restrictive enough to bring inflation back to 2%.”

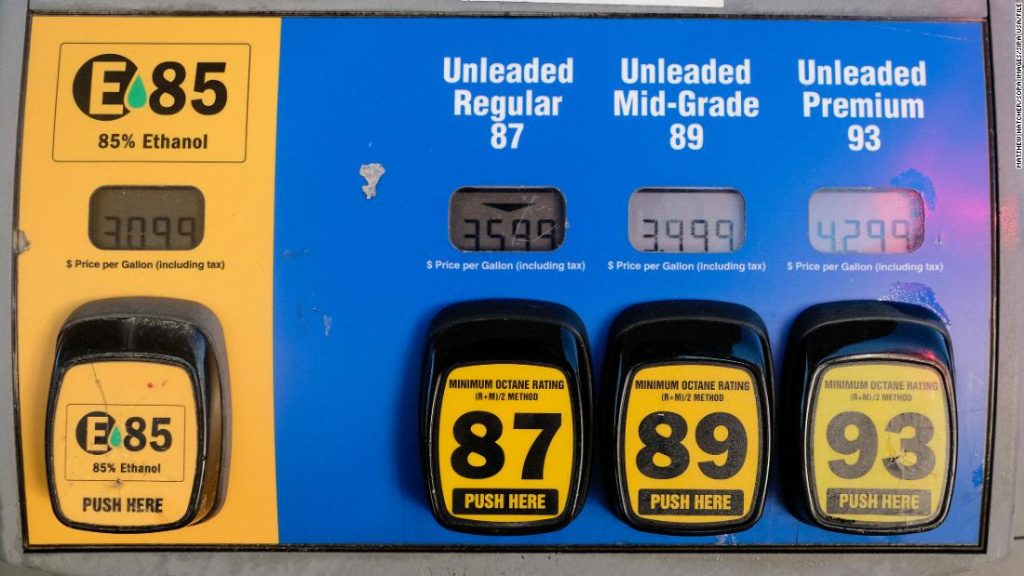

The latest BEA data reflects this decline. In June, energy prices were up 43.4% from the same period last year. Last month, that annual increase was 34.4%.

While US consumers received a welcome reprieve at the pump in July, Brave said, inflation remains uncomfortable — especially for low- and middle-income Americans.

“The pressure is increasing over time here on family budgets,” he said. “And real income, inflation-adjusted incomes, are still really not rising strongly. That puts pressure on us and forces us to make tough decisions.”

The personal savings rate as a percentage of disposable income remained at 5% – its lowest position in more than 13 years.

Real personal disposable income rose 0.3% from June, but remained down 3.7% year over year, according to BEA data. Consumer spending also rose slightly, rising 0.2% in the month, adjusted for inflation.

While much of the current influx of spending has been in services — where people are now able to vacation and dine in restaurants after becoming limited during the pandemic — some July dollars went into permanent good categories like cars, furnishings and recreational equipment.

Wells Fargo economists Tim Quinlan and Shannon Serry wrote in a note published Friday that strength in this type of spending is likely to decline in the coming months.

“We are still not looking at spending on durable goods to drive consumption forward,” they wrote. “The cost of financing these expensive items is set to rise as the Federal Reserve raises interest rates.”

More Stories

3M Surges Most in 36 Years as New CEO Boosts Earnings Outlook

Tesla Robotaxi is now set to be revealed on October 10, and Elon hints at ‘something else’

Elon Musk Claims Tesla Will Start Using Humanoid Robots Next Year | Elon Musk